Oil prices look likely to remain high for the rest of the year and well into first quarter 2004.

Demand is robust, thanks to a recovering global economy, led by a resurgent US economy. Global gross domestic product growth, measured year to year, is forecast to jump to 2.8% in the third quarter and 3% in the fourth quarter vs. only 1% in the second quarter, according to J.P. Morgan Securities Inc., New York. Leading this growth are the US and the emerging Asia economies, the J.P. Morgan analysts say.

The economic rebound is fueling an uptick in oil demand, on top of the added increment spurred by an urgent need to replenish inventories not only of crude oil but also gasoline and heating oil. According to the US Energy Information Administration, for the week ended Aug. 15, crude stocks were 31.4 million bbl below average, gasoline stocks were 8.3 million bbl below average, and distillate stocks were 9.1 million bbl below average. The push to rebuild product stocks was blunted with the massive power blackout in the US and Canada that knocked a string of refineries offline, as well as a major products pipeline outage in Arizona. Meanwhile, overall products demand in the US that week was up 1.3%. And more of that products demand is being met by increasing US imports.

Tightening market

The surge of imports has done little to bolster crude oil inventories, though. For the week ended Aug. 15, crude stocks in the US rose only 4 million bbl. As US refiners step up the pace to rebuild gasoline and heating oil stocks, crude imports are pouring into the country at a blistering pace. That pace, nearly 10 million b/d, will have to be maintained consistently through the end of the third quarter in order to build inventories to comfortable levels, says Aaron Brady, senior analyst at Energy Security Analysis Inc., Wakefield, Mass.

Achieving that pace will be exceedingly difficult. The decision by the Organization of Petroleum Exporting Countries in July to maintain the status quo on production quotas, out of concern for a strong ramp-up in Iraqi oil supplies, left the market in a fragile position. Now that it has become increasingly clear that Iraqi oil exports are being hobbled by sabotage to export pipelines and power facilities, even an OPEC decision at its next meeting in September to boost production won't come soon enough to avoid the market from being short in the third quarter. Making the proposition even dicier is uncertainty over Venezuelan and Nigerian supplies because of civil unrest in those countries.

Only Saudi Arabia has sufficient spare capacity to take up some of the slack from the Iraqi supplies that have not materialized. And yet the kingdom thus has shown no interest in taking that step. It will probably take a significant further outage, such as in Venezuela or Nigeria, before the Saudis and the rest of OPEC decide to boost outputand then only to deter the release of strategic oil supplies by consuming governments.

Little relief in sight

Even if OPEC were to hike output at its next meeting, that isn't likely to relieve the tight markets in the US.

"More oil coming onto the market now would probably do little to improve the US crude oil stock position in the short term, since crude oil imports are running close to the capacity of import infrastructure," said Centre for Global Energy Studies in its Aug. 18 monthly oil report.

And the London think tank warns that markets may face further upward pressure from Asia-Pacific refiners that are likely to start their seasonal increase in runs ahead of the coming winter.

"The competition for crude oil from Asian refiners could become particularly strong if they believe that the market is likely to tighten as colder weather approaches and begin to build up stocks ahead of the heating season." CGES said.

So unless the Saudis have a change of heart ahead of the OPEC meeting in late September or the Iraqi security situation dramatically improves soon, the oil market may have to contend with $30/bbl (New York next-month futures) oil prices for the duration.

And if there is any worsening of the supply picture in Iraq, Venezuela, or Nigeria, that duration could extend to second quarter 2004.

(Author's e-mail: [email protected])

Because Oil & Gas Journal does not publish the week of Sept. 1, a new column will not appear in this space until Sept. 5

OGJ HOTLINE MARKET PULSE

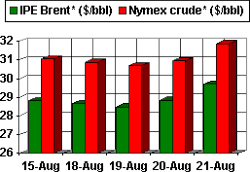

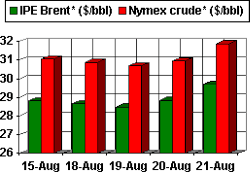

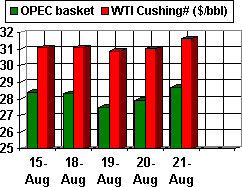

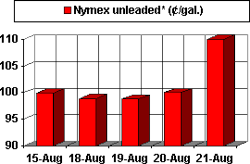

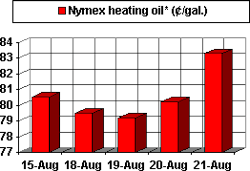

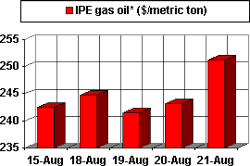

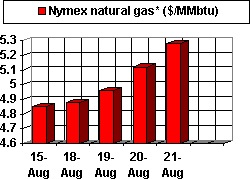

Latest Prices as of Aug. 22, 2003

null

null

null

null

null

null

NOTE: Because of holidays, lack of data availability, or rescheduling of chart publication, prices shown may not always reflect the immediate preceding 5 days.

*Futures price, next month delivery. #Spot price.