Problems with nuclear power plants are proving to be a wild card in the outlook for North American natural gas markets.

That trend echoes a wild card in oil markets within the past year, at the time adding another bullish factor to an oil market already overloaded with them.

Nuclear power plants in Japan in the past year developed cracks and possible leaks in reactors. The resulting string of shutdowns has added as much as 300,000 b/d to Asian oil demand at times in the interim, as utilities switched to residual fuel oil to meet power demand needs in Japan.

US reactor woes

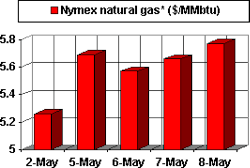

US natural gas futures prices logged their biggest 1-day jump in 3 months May 5 on the heels of a report by the Nuclear Regulatory Commission that two more plants have joined the roster of US nuclear power complexes affected by cracked or leaking reactors.

Cracks or small leaks have been detected in pressurized water reactors in nuclear power plants in Florida, Texas, and South Carolina in recent weeks. Such reactors are found in more than half of the US nuclear power plants; in turn, this type of plant accounts for 10% of US power capacity. In the latest such incident, a South Texas plant is expected to be out of service throughout the summer.

When a similar situation first turned up in Japan, safety concerns prompting a wave of downtime for nuclear plants there meant a surge in fuel switching. For Japan, that meant a switch to resid.

But shortfalls in nuclear or hydro power in the US generally mean a switch to natural gas for dual-fuel-capable utilities.

Gas market impact

It's too early to tell how much of an impact nuclear outages will have on natural gas demand in the US. The scope of the problem and the potential duration of related downtime have yet to be ascertained.

But concerns over the consequent pull on gas demand have been strong enough to push gas futures prices back up low $5s/MMbtu where they had settled at the end of the heating season. Gas storage refill injection had already gotten under way quickly at the start of the shoulder-month stretch before an "afterthought" cold spell in April interrupted. Even at that point, storage levels were already low. The result was an already troubling year-to-year storage deficit plunging to a record 623 bcf Apr. 11. Warmer weather in the weeks that ensued reduced the storage deficit, but it has remained well above below average. For the week ended May 2, storage levels at 821 bcf were 545 bcf below the 5 year average.

However, forecasts of warmer-than-normal weather across much of the South, Southwest, and Midwest US, coupled with historic injection levels and some continuing demand destruction, could leave the year-to-year storage deficit as much as 750-850 bcf by the end of this month, according to UBS Warburg LLC analyst Ron Barone.

Next heating season

The outlook for natural gas storage reaching the traditional comfort level of 3 tcf by the start of the next heating season is iffy at best.

UBS Warburg's Barone estimates that storage injection rates will have to remain at 12 bcfd to reach 3 tcf by Nov. 1. That compares with rates of 8.2 bcfd in 2002 and 9.6 bcfd for the past 9 years-the latter when wellhead deliverability was higher and underlying demand lower.

Is there a good chance deliverability improvements will help the storage injection rate catch up? The outlook isn't promising. While the US count of active rigs drilling for gas has risen, it still remains below the recent high in 2001, when a price-driven opportunistic drilling surge caused a turnaround in a comparable storage deficit situation. In addition, the 2001 drilling surge helped the storage deficit at that time but did little to bolster the overall downward trend in US gas productive capacity.

So if forecasts for a warmer-than-normal summer across much of the US continue to hold, if oil prices hold up enough to stem any fuel-switching tide, and if the nuclear plant problems become more widespread and long-lasting, it will take a lot more demand destruction to keep a $5/MMbtu floor from being a fond memory for gas users this year.

(Online May 12; author's e-mail: [email protected])

OGJ Hotline Market Pulse

Latest Prices as of May 9, 2003

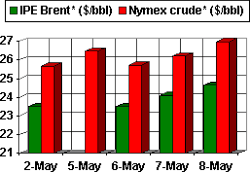

IPE Brent crude and gas oil data for May 5

unavailable because of a public holiday

IPE BRENT/NYMEX CRUDE

null

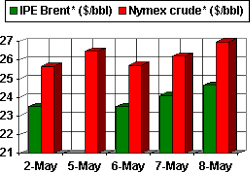

OPEC BASKET/WTI SPOT

null

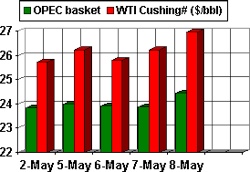

NYMEX UNLEADED

null

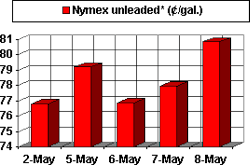

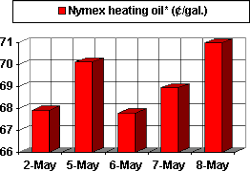

NYMEX HEATING OIL

null

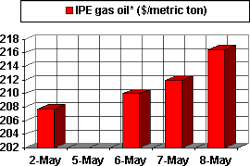

IPE GAS OIL

null

NYMEX NATURAL GAS

null