null

The strong likelihood that war will erupt in Iraq in the coming weeks warrants fresh analysis of how the oil market will respond to a US-led invasion.

Michael C. Lynch, formerly of DRI-WEFA Inc. and now heading up a new consulting company, Strategic Energy & Economic Research Inc., Winchester, Mass., has outlined some invasion-related scenarios and their respective oil price impacts:

-- Saddam Hussein will try to destroy most of the Iraqi oil fields. Loss of capacity is projected at anywhere from 400,000 b/d to 100%, with the price impacts at $5-15/bbl.

-- Oil prices will not drop at the war's outset, as in 1991. Then, supplies already had been removed by Iraq's invasion of Kuwait, and the uncertainty over possible additional supply outages kept prices propped up; when the uncertainty was removed, they fell instantly. This time, the uncertainty may persist a week or more.

-- Prices also will be kept high as nations move to use strategic stocks only in the event of a physical shortage, not as a price suppressant. Excessive hoarding could exacerbate this situation, as could Saudi concerns over a surge in production creating an inventory overhang later, causing the kingdom to hesitate over hiking output.

-- Oil prices won't slip below $30/bbl until the third or fourth quarter. After an initial surge above $40/bbl, release of strategic stocks will cap that spike.

-- Iraqi production will be easier to restore to recent levels (2.5 million b/d) than some people presume.

On that last point, Lynch said, "I'm assuming three levels of reconstruction: repair of war damage (taking it to about 2.5 million b/d); then recovery from lack of maintenance, about another 0.5-0.7 million b/d. This might require a little more planning, and the (US) military might not want to pass out contractsinstead, letting a (United Nations) council. . .sign off on it.

"Beyond that, though, you're talking new contracts (and dealing with the old ones with French, Russian, Chinese, etc., companies)which is where the nightmare begins (who controls what field, split of revenues between Kurds and Baghdad, etc.).

In sum, assuming a mid-March invasion, Lynch sees the loss of Iraqi production largely offset by releases of strategic stocks. That means oil prices climbing to an average $37-38/bbl for March, staying in the mid-$30s/bbl until around August-September, and sliding to around $27/bbl by December.

That jibes with some other forecasts making the rounds. Merrill Lynch Global Securities Research & Economics Group on Mar. 5 projected West Texas Intermediate at $33-41/bbl during the coming 30 days and $27-33/bbl for the subsequent 60-90 days.

Saudi, OPEC moves

Of course, much of the uncertainty surrounding oil markets these days centers on lingering questions over what Saudi Arabia and the rest of the Organization of Petroleum Exporting Countries will do in the event of an invasion.

One thing is pretty certain: OPEC will disregard quotas and produce all out until after the dust settles a bit in Iraqor pending release of strategic stocks.

What worries Saudi Arabia in particular is that huge volumes of added OPEC crude will be on the water, in transit to markets, just as governments allow release of strategic stocks when they see Iraqi fields are ablaze.

That may be what's behind the Saudis' recent assertion that they won't produce above 9.2 million b/d (only about 500,000 b/d more than current production), according to some press reports. While the kingdom's productive capacity is 10.5 million b/d, the difference in those two numbers represents a sizable investment and weeks or months of ramp-up. Hence the hesitation.

Meanwhile, the numbers coming out of Venezuela are all over the map. Depending on the source providing the data, that beleaguered country's oil production is anywhere from a little over 1 million b/d to a little over 2 million b/d and headed back to a prestrike level of 3.2 million b/d by the end of this month.

Excluding Iraq, OPEC is now producing a little under 25 million b/d. Stocks are perilously low. Merrill Lynch sees the call on OPEC oil rising to over 28 million b/d in the fourth quarter.

If the high prices themselves don't squeeze that demand for OPEC oil a great deal more, it's hard to see the supply numbers adding up to anything other than $30+/bbl for most of the rest of this year.

(Author's e-mail: [email protected])

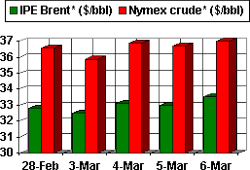

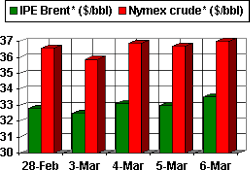

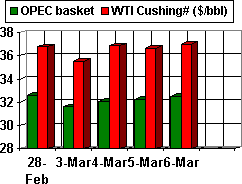

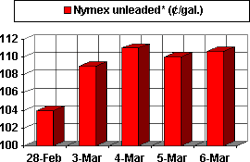

OGJ Hotline Market Pulse

Latest Prices as of Mar. 7, 2003

null

null

NYMEX unleaded

null

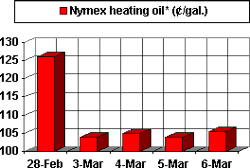

NYMEX heating oil

null

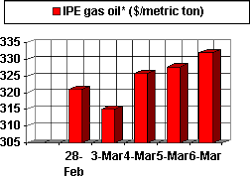

IPE gas oil

null

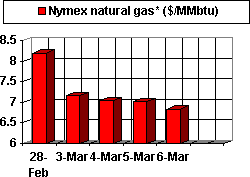

NYMEX natural gas

null