As oil prices hover above $35/bbl and inch towards $40/bbl, the question persists: Is the oil price spike a war premium or a market fundamentals premium?

The answer is important because it points to the longer-term health of oil markets. If the higher price is solely the result of war fears, then it likely will evaporate once the outcome of hostilities in Iraq becomes quickly apparent. That was the case in 1991. Even if there are much larger long-term considerations for a post-Saddam Iraq, a "pure" war premium will disappear as soon as the market is assured of the extent of supply disruptions resulting from military conflict. If Saddam succeeds in staging a "scorched-earth" finale for his swan song (destroying Iraq's oil fields, attacking Kuwaiti facilities, etc.) and/or if concurrent terrorist attacks hit Saudi infrastructure, the market soon will have a sense of how big the supply disruption is and how to gauge any strategic drawdown response. Oil prices might still be fairly high, but at least those prices will reflect the actual volume of supply disrupted. In this sense, the war premium is really a "fear-of-the-unknown" premium.

As Centre for Global Energy Studies put it in the London think tank's latest monthly oil report, "The optimistic scenario of a short conflict in Iraq, lasting just a few weeks and entailing little or no damage to the country's oil infrastructure, combined with the timely release of oil from strategic stocks, should help to ease oil prices."

CGES contends that, with Venezuelan oil production back around 1.9 million b/d by the end of February, ". . . it ought to be possible for (the Organization of Petroleum Exporting Countries) alone to make up for the loss of Iraq's oil exports."

That's the good news. On the downside, the possible loss of Kuwaiti oil resulting from military conflict is a major concern. And, notes CGES, the Saudi government "may think twice before boosting its output in the face of popular opposition to war, while other members of OPEC would have to push production to previously untested levels."

Then, of course, there are the risks of sabotage, renewed violence in Venezuela, and now the specter of Nigerian oil strikes (and perhaps worsening civil strife).

Physical fundamentals

On the other hand, there is plenty to worry about with regard to the physical fundamentals of the market.

OPEC spare capacity available in the short termexcluding Iraq and Venezuelais only 1.5 million b/d more than what those nine OPEC nations are producing today.

Meanwhile, the International Energy Agency has projected an increase in oil demand this year of 1.1 million b/d.

Meanwhile, US crude oil stocks early in February were at their lowest level since 1975 and below the industry's minimum operating level of 270 million bbl. Heating oil stocks are especially low in the blizzard-struck US Northeast. Total oil stocks in the Pacific nations of the Organization for Economic Cooperation and Development in January were 7% below year-ago levels, notes CGES.

And stocks are not likely to rebound quickly even if the crises are resolved soon. The perilous state of stocks today relates directly to a long-term drawdown of stocks that started in earnest in third quarter 2002 and has continued through first quarter 2003.

As UBS Warburg LLC analysts recently noted, "The projected path of OECD industry stocks in first half 2003 is now very similar to the evolution of stocks in first half 2000, when Brent averaged $27/bblit certainly tends to support crude prices at $25/bbl, at least until the end of second quarter 2003, even without a conflict in the Middle East.

To top it all off, the general malaise and uncertainty affecting the global economy is contributing strongly to reluctance by producers to commit to robust capital spending for drilling to take advantage of high oil prices, so there is no appreciable supply response to those high prices. And that situation is mirrored on the gas side as well, so the resulting high gas prices have eliminated any significant relief for heating oil demand via fuel-switching.

So the next time the question arises of whether today's soaring oil prices is the result of a war premium or of a tight physical fundamentals, the answer now seems simple:

Yes.

OGJ Hotline Market Pulse

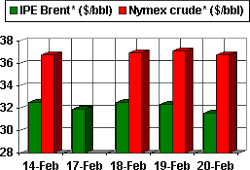

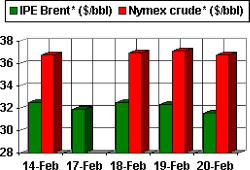

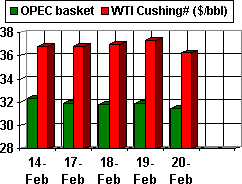

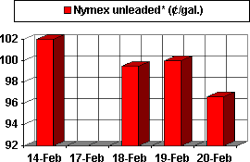

Latest Prices as of Feb. 21, 2003

FOR THE PRESIDENTS' DAY HOLIDAY

null

null

Nymex unleaded

null

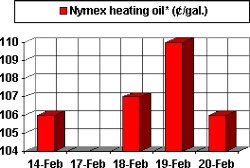

Nymex heating oil

null

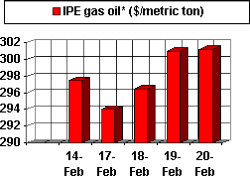

IPE gas oil

null

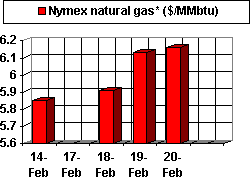

Nymex natural gas

null

NOTE: Because of holidays, lack of data availability, or rescheduling of chart publication, prices shown may not always reflect the immediate preceding 5 days.

*Futures price, next month delivery. #Spot price. @New contract