Just as oil markets are going to relive 1991 in the weeks to come, anyone who remembers the US natural gas market of the 2000-01 winter may feel a sense of d

According to the latest natural gas storage capacity projections by Energy Security Analysis Inc., US storage levels at the end of the winter heating season could drop to as low as 19%.

That's the same bullish level seen in spring 2001, notes the Boston-based consulting group.

"Over the last 2 months, stormy and frigid weather in the central and eastern parts of the country have significantly increased residential and commercial gas-heating demand, as well as electric heating demand that is fueled by gas-fired power generation," said ESAI analyst Kristin Domanski.

Adding to the pull on gas stores is a rise in industrial demand in the so-called Producing Region of the countrymainly from refiners and petrochemical producers.

2001 redux?

Remember what happened in the winter of 2000-01, when gas prices spiked to $10/MMbtu, owing to depleted storage levels and slumping deliverability amid a sharp, weather-related jump in demand?

Later that year, gas prices nosedived from those highs. Demand destruction and a blistering pace of injection into storage were the culprits. Another major contributor was a surge in fuel switching. While oil prices were relatively strong at the time, on a btu basis, they were lower than gas prices at their peak.

This time around, there are noteworthy differences. The oil supply-demand situation is the tightest it's been in decades, and it's poised to worsen at least for at least a few months under the best-case scenarios involving Iraq and Venezuela. So the urge to switch from gas to oil will remain tempered.

While there was some evidence of fuel switching in December, the recent spike in oil prices to the mid-$30s/bbl has deflated that push.

Demand for gas this summer likely will be stronger as well. The lack of snowfall and resulting spring runoff in the US Northwest this winter will mean a shortfall in hydropower supply to meeting expected cooling demand. This in turn will spur increased demand for gas-fired power generation.

Different for deliverability

Most important, however, is the outlook for deliverability, and it's a good deal more bullish for gas prices now than in 2001. The jump in gas prices in 2000-01 spawned a flurry in gas drilling, propelling the Baker Hughes Inc. weekly active rotary rig count to almost 1,300 that summer. The resulting increase in natural gas production, coupled with sagging demand amid cool summer weather, yanked gas prices out of the stratosphere and plunged them back to $2/MMbtu.

Many of those gas wells drilled in 2000-01 were predicated on a presumption that gas prices would remain near $4/MMbtu for the year. Yet even though that presumption triggered a great deal of drilling, the resulting rise in US gas production was marginal. Since then, US gas production has lagged badly. Merrill Lynch analysts on Feb. 14 said that a group of US companies accounting for 40% of US gas output reported a drop in production in fourth quarter 2002 of 3.4% vs. the third quarter and 7.8% year-on-year.

With so many forecasts calling for gas prices topping $4/MMbtu again this year, would there not then be another flurry in opportunistic gas drilling? That is not likely to happen to anything close to the extent it did in 2001. In 2001, the rig count started out the year above 1,100 and remained above 1,000 until mid-autumn. In 2003, the rig count has yet to hit 900. There is a palpable reluctance among operators this year to jack up drilling budgets. That's a response to an overall economic and geopolitical climate that offers an unprecedented level of anxiety and uncertainty.

So while the rig count is climbing in response to higher gas prices, it isn't likely to resemble the runup in 2001.

While the gas market fundamentals remain bullish, an oil market scenario that could range from $40+/bbl to a bust in a matter of months makes it impossible to project producer cash flow levels or to gauge the potential for fuel switching this year.

That leaves the weather and storage. The outlook is for continued strong heating-related gas demand and thus little relief for storage heading into the summer demand season.

So reluctance by producers today ensures tight markets the rest of the year. That $4+/MMbtu forecast might just hold up this year.

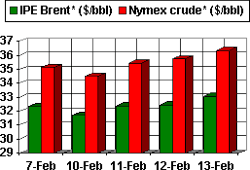

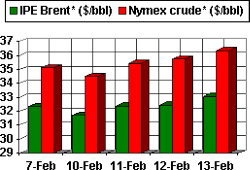

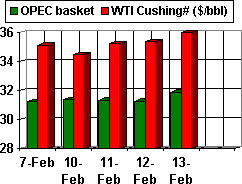

OGJ Hotline Market Pulse

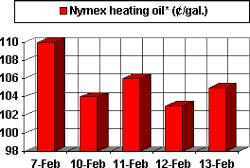

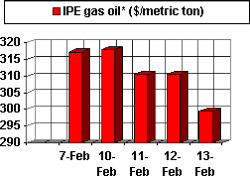

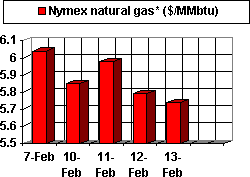

Latest Prices as of Feb. 14, 2003

null

null

Nymex unleaded

null

Nymex heating oil

null

IPE gas oil

null

Nymex natural gas

null

NOTE: Because of holidays, lack of data availability, or rescheduling of chart publication, prices shown may not always reflect the immediate preceding 5 days.

*Futures price, next month delivery. #Spot price. @New contract