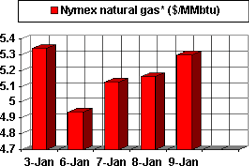

Is 2003 going to be a year of $5/MMbtu natural gas in the US?

The latest developments in oil and natural gas markets seem to be pointing that way, and a number of analysts have already ratcheted up their forecasts for gas prices accordingly. At least one flatly predicts the $5/MMbtu threshold will be sustained as an average price this year.

Supply factors

Well-documented in this space has been the ongoing story about declining wellhead deliverability in the US. There is no disputing the doldrums of 2002: US output of natural gas was at best flat last year vs. 2001. A number of analysts have projected a year-on-year decline in US gas production this year. Raymond James & Associates' Marshall Adkins predicts that slide could be as much as 6% YOY, or 3 bcfd. That underpins his forecasts for gas prices, which have been among the industry's most bullish$4.25/Mcf until the latest projection of $5/MMbtu, about which more later.

The US Energy Information Administration is more bullish than is Adkins on US gas production this year. EIA contends that US gas production was overestimated at 19.42 tcf in 2002; accordingly, its projection of output at 19.45 tcf in 2003 "most likely represents a solid increase from the actual level of production achieved in 2002." EIA thinks that level sufficient to cover incremental demand without "extreme" price pressures and thus pegs 2003 gas prices at $3.90/MMbtu (still up $1/MMbtu on the year).

Adkins and EIA might wish to just split the difference and call it an improvement in the reporting data.

Whichever forecast proves correct, the deliverability side of the equation is not getting enhanced by the current state of drilling in the US. While the gas-directed active rig count rose in December, it remains well below the last high-price period, second half 2001. The paradox of $5 gas and a still-sluggish rig count has taken the market by surprise.

Demand factors

The critical demand factors to consider for natural gas in 2003 are the weather and the potential for fuel-switching.

EIA projects US demand for gas this winter will top last winter's level by 8.7%, on the strength of colder weather and improving industrial demand.

Through the first third of the heating season, temperatures in the US were 5.2% lower than normal and almost 40% lower than last year, according to Adkins. That was tempered by the 20% warmer-than-normal spell in the last week of December. Even with the warm spell, though, Morgan Keegan & Co. Inc., Houston, predicted a 110 bcf draw from storage the week ended Jan. 12. It noted forecasts calling for five weeks of normal (>200) heating degree days remaining this winter and suggested that the YOY storage deficit could reach 700 bcf by early February. That would put storage below 1 tcf at the end of the season, typically low enough to bolster gas prices through the spring "shoulder" months. Storage seems to be on track toward that level, having ended last year 5% below the 5-year average.

Will fuel-switching capability undermine the gas rally in 2003? It's not likely. Prospects are bullish for oil prices this year, given the state of geopolitics today and the recent skill the Organization of Petroleum Exporting Countries has exhibited in fine-tuning supply with demand.

But even if oil prices slumpas they well could for a time with quick denouements to the Venezuelan and Iraqi situations amid the latest surge in supply from OPECthe rush to fuel-switching "may be tempered as low residual fuel oil inventories prop prices regardless of the decline in oil prices."

(Exacerbating the fuel oil stocks dilemma is the prospect of serial outages in Japan's nuclear power plants, spurring demand for fuel oil.)

Adkins goes so far as to suggest this combination of factors sets the stage for a gas supply "crisis" this year, underpinning his new forecast of $5/MMbtu for the year.

Could a belated surge in US gas drilling undermine such a forecast? Morgan Keegan contends that the "promise of continuing high prices, either through a strong economy, a cold winter, or a combination of the two, is what the industry needs to ramp up spending plans into 2003. . . ."

But how many of those postulated gas wells will be deferred by operators opting instead to give their overleveraged balance sheets a much-needed makeover? The cash flow from a sustained $5/MMbtu price for existing gas production sure couldn't hurt. And the memory of 2001's opportunistic drilling boom and subsequent price bust isn't that distant.

OGJ Hotline Market Pulse

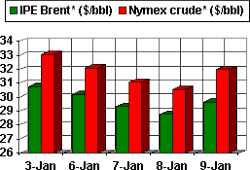

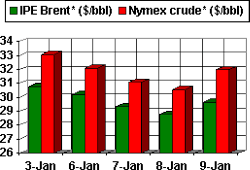

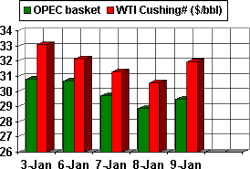

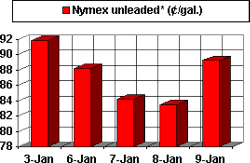

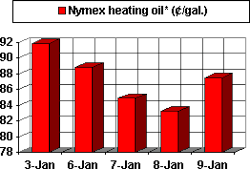

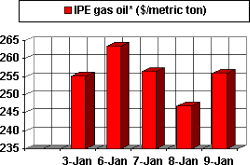

Latest Prices as of Jan. 10, 2003

null

null

Nymex unleaded

null

Nymex heating oil

null

IPE gas oil

null

Nymex natural gas

null

NOTE: Because of holidays, lack of data availability, or rescheduling of chart publication, prices shown may not always reflect the immediate preceding 5 days.

*Futures price, next month delivery. #Spot price. @New contrac