The "What if?" game on Iraq and the US dominates oil market scenarios at the moment. As discussed in this space last week, there is ample evidence that conflict in Iraq is all but inevitable amid already tight market fundamentals.

But doubts are emerging about the thoroughness of the upcoming inspection regime and the wiggle room that Iraqi President Saddam Hussein may have short of triggering a US-led attack. There have been press reports that Saddam has declared his acquiescence to the return of United Nations weapons inspectors to Iraq to be something of a victory over the US. His rationale, these reports suggest, is that acquiescence under a less-than-rigorous inspection regime is coupled with diplomatic language within the UN Security Council Resolution 1441 that effectively paints the US into a diplomatic cul-de-sac.

In shortif this is an accurate take on the situationit would underscore the likelihood of a long and drawn-out cat-and-mouse game that stops short of inviting hostilities.

"The world can now expect a tortuous period of weapons inspections and destruction, which may possibly drag on well into 2003," said Centre for Global Energy Studies in its November monthly oil report. "Even if a war is averted, UN sanctions on the country's oil exports could remain in place for most, if not all, of next year, with a 'clean bill of health' for Iraq from the weapons inspectors difficult to obtain."

Uncertainties

Even if there is conflict, there are other uncertainties over its scope. Certainly, Iraq's oil exports would be disrupted in the short term in the event of a US-led invasion. And there is little likelihood that Iraq could do much to expand the conflict beyond its borders.

But, as CGES points out, there remains the "most plausible" scenario of a major oil supply disruption being a terrorist attack on a key Persian Gulf export terminal timed to coincide with a US-led attack on Iraq.

Compounding this kind of uncertainty is the head-scratching that persists over the direction of oil demand in the near term and even beyond.

OPEC price threat

Absent a war, says CGES, the Organization of Petroleum Exporting Countries will need to make substantial output cuts to keep oil prices from falling below the floor of its $22-28/bbl official target price range (for a basket of OPEC crudes).

Noting that the price of oil had fallen by $6/bbl from mid-October to mid-November, the London-based think tank said that the OPEC 10 (excluding Iraq) had opted for boosting production in October. With Iraq doubling oil exports to 1.7 million b/d in October, that hiked total OPEC output by 1 million b/d that month.

"Unless Iraq's oil exports collapse again, the rest of OPEC needs to begin curtailing overproduction to prevent further falls in the price in the coming months," CGES said.

The think tank estimates that needed cut (from October's level) at 750,000 b/d this quarter, to an average 24 million b/d.

But should Iraq's exports continue at 1.7 million b/d, then the rest of OPEC will be facing further output cuts in 2003 in order to keep oil prices within the targeted price band, says CGES.

This could be achieved without changing quotas, for OPEC 10 production would need to fall to 22.6 million b/d, still almost 1 million b/d over the current 21.7 million b/d group quota. Without such restraint, oil prices would start to drift down towards the lower end of the OPEC price band by yearend, says CGES. Failure to act immediately, the think tank warns, would then require a cut of 1.5 million b/d in second quarter 2003 just to keep Brent crude at $18.50-20.50/bbl next year.

"OPEC cannot afford to wait for a disruption to Iraq's oil exports to bring the oil market back into balance," CGES said. "The threat of war will linger until Iraq is given a clean bill of health by the UN's weapons inspectors.

"In the meantime, there is too much oil in the market for OPEC to achieve its price target unless, in an uncharacteristic burst of altruism, OPEC accepts that the global economy needs cheaper oil."

Saddam's duplicity. UN weapons inspectors' thoroughness. UN politicking and waffling. Same old song.

But here's an old refrain sung to a new tune: Testing US resolve. Or: Will President George W. Bush care about diplomatic cul-de-sacs?

A correct answer to that question also divines whether there is too much oil on the market now.

OGJ Hotline Market Pulse

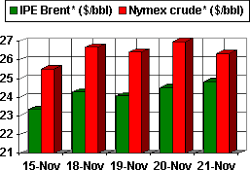

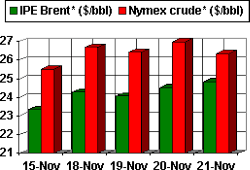

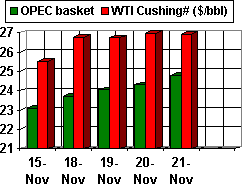

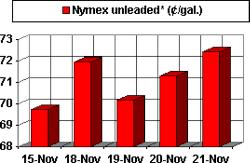

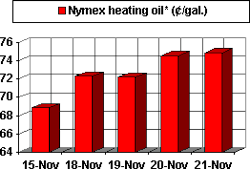

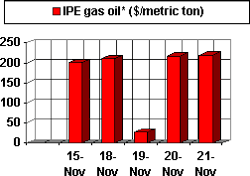

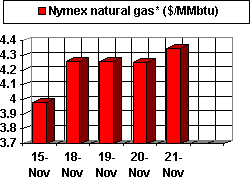

Latest Prices as of Nov. 22, 2002

null

null

Nymex unleaded

null

Nymex heating oil

null

IPE gas oil

null

Nymex natural gas

null

NOTE: Because of holidays, lack of data availability, or rescheduling of chart publication, prices shown may not always reflect the immediate preceding 5 days.

*Futures price, next month delivery. #Spot price. @New contract