US refiners facing tough times for another year

US refiners have weathered choppy seas this yearand it doesn't look like smooth sailing ahead for quite awhile.

The odds are that refining margins will continue to remain under pressure for some months to comeperhaps not seeing relief until the start of next year's summer driving season.

Overall product stocks in the US have finally begun to slip back to historical normal levels after an aggressive round of run cuts by refiners, noted Lehman Bros. analyst Paul Cheng in a Sept. 23 research note.

He contends that, with the likelihood of Iraq-centered tensions in oil markets continuing, " . . . refiners' profitability will likely continue to be hurt over the next 2-3 quarters in light of the persistently high war premium in crude oil prices which refiners are unable to fully pass through to consumers.

Cheng also cites the recent record run in US gasoline imports continuing into next year, given the weak global economy.

US products demand

The surge in US gasoline imports is masking what is otherwise a pretty robust market for gasoline in the US.

As London-based Centre for Global Energy Studies noted in a recent analysis, gasoline demand in the US had reached record highs this year even before the start of the summer driving season. As early as February, US gasoline demand was showing year-on-year growth of almost 2%. Up to the end of July, the 4-week average for gasoline consumption in the US was a record 9.04 million b/d.

That kind of demand strength, coupled with a surge in in gasoline prices much earlier than usual this year, has pulled in a record volume of gasoline imports into the USjumping to more than 1 million b/d during the late summer. So despite the strength in demand, the high level of gasoline imports has kept supplies ample in the US, with stocks remaining within the normal level of forward demand cover for the peak season.

Unfortunately for refiners, there is another side to the coin of robustness in gasoline demand. Much of the surge in gasoline demand can be attributed to the increased levels of driving in response that followed the aversion to flying after the Sept. 11, 2001, terrorist attacks on the US. Jet fuel demand in the US plummeted 10% in the first half of this year from the same time a year ago. While air travel has picked up a bit in recent months, the economic slowdown has helped keep a lid on the terrorism-spawned decline. Consequently, the forecast is for business travel not to recover to 2000 levels before next year.

Distillate demand has remained weak, showing a year-on-year slide of 6.5% in the first half, according to CGES. Contributors here were the economic slowdown and warmer-than normal weather.

Outlook

With the end of the gasoline season drawing near, refiners must turn their attention again to the outlook for distillates.

Unfortunately, that outlook is not promising. Distillate stocks in the US are 9% above normal, despite a fairly strong drawdown in recent weeks.

Demand is likely to improve on the strength of economic recovery, even if the consensus now is that said recovery won't be as robust as had been projected earlier in the year. If temperatures this coming winter remain close to normal, that will also bolster the distillate demand outlook.

But even with improving demand, the ever-present prospect of ample supplies abroad available for import, coupled with continuing high crude prices, will keep pressure on US refiners' margins.

All of this is occurring at a time when a number of refineries may be coming up for sale or closure. The prospect of having to fund capital projects spawned by new environmental regulations amid sagging cash flow has some refiners taking a long hard look at whether or not to saddle themselves with hitherto unacceptable levels of debt.

And there has been a flurry of refining assets hitting the auction block because of recent megamergers.

Put these together, and we have the prospect of a dramatic change in US refinery ownership coming just ahead of regulatory changes (sulfur cuts, ethanol mandate, a ban on methyl tertiary butyl ether) that will have the end result of spiking gasoline prices amid fewer competitors.

But refining margins mainly will be, well, marginal, until then.

OGJ Hotline Market Pulse

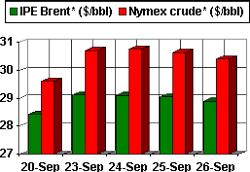

Latest Prices as of Sept. 27, 2002

null

null

Nymex unleaded

null

Nymex heating oil

null

IPE gas oil

null

Nymex natural gas

null

NOTE: Because of holidays, lack of data availability, or rescheduling of chart publication, prices shown may not always reflect the immediate preceding 5 days.

*Futures price, next month delivery. #Spot price. @New contract