The latest meeting of the Organization of Petroleum Exporting Countries ministers proved uneventful, as predicted.

As expected, OPEC rolled over its quotas for another quarter. The ministers shrugged off the decisions of Russia and Norway to abandon their collaborative production restraint.

Also as expected, Venezuelan Energy and Mines Minister Alvaro Silva was elected to fill out the remaining term of OPEC Sec. Gen. Alí Rodríguez Araque—who is stepping down to take over troubled Venezuelan state oil company Petroleos de Venezuela SA.

While predictable, these events were nonetheless significant because of the questions buzzing around them.

OPEC vs. non-OPEC

Shortly before the OPEC meeting, some analysts were noting ominously the refusal of Norway and particularly Russia to not extend their first half production cuts of 150,000 b/d apiece into another quarter. It was suggested that another Moscow-Riyadh showdown was in the offing, a reference to last year's standoff between the world's two biggest oil exporters over market share. That situation weakened oil prices until Moscow blinked and gave the Saudis a face-saving—if negligible in actual supply terms—production "cut" that just happened to match the usual seasonal decline in Russian oil exports.

The recent chumminess between the Bush and Putin administrations over energy supply issues was viewed as further evidence of Russia's attempts to build market share at OPEC's expense. Putin was seen as shrewdly exploiting US impatience with the Saudis over the war on terrorism and Saudi impatience with the US over the Israel-Palestine conflict.

While one shouldn't underestimate the wiliness of a former KGB chief, one also should not underestimate the Saudis' determination to avoid getting caught again in the role of perpetual swing-supplier. It was this steely resolve that made the Russians blink last December; there is no reason to assume it has dissipated. The case could even be made for Saudi Arabia's own latent strategem: using a Russian market share grab as a pretext for a market share grab of its own. This also could be seen as a friendly gesture to the US and its allies in the war on terrorism-accompanied, of course, by the Saudis' own recent initiatives in that regard. It need not last long enough to do real damage to the market-the Saudis' own budget could not withstand a sustained collapse in oil prices. But it might be enough to bring the Russians permanently into the fold of solidarity on supporting prices while allowing for reasonable demand growth-just as the Saudis worked out with Mexico and Venezuela several years ago-not to mention the diplomatic points scored with the West.

Questions over Venezuela

In the weeks before the OPEC meeting, analysts also were buzzing over hints from Venezuela that it might be returning to its old quota-busting ways. Reports were circulating that Caracas might elect to boost its oil output by as much as 300,000-400,000 b/d this year, flouting its quota.

But upon closer examination, this is an old question now come to light: whether the new synthetic crudes emerging from the Orinoco oil belt heavy oil megaprojects should be counted against Venezuela's quota. Boston-based Energy Security Analysis Inc. contends that most of the targeted increase must be attributed to these syncrudes.

"It may suit OPEC's interests to ignore an increase (by Venezuela) and avoid a showdown that could have a decidedly negative impact on compliance with the current production and its potential extension into the third quarter," said ESAI Managing Director Sarah Emerson.

It also must be noted that Silva is known to be a price hawk and thus now is ideally placed to shepherd said avoidance.

Complacent or smart?

It wasn't long ago that analysts were pressing the panic button about second half oil demand and calling on OPEC to start ramping up production now to avoid a price spike later this year.

Meanwhile, US gasoline demand is rising sharply vs. last year, and OPEC Pres. Rilwanu Lukman notes that a weakened US dollar is helping to stimulate oil demand at a time when economic recovery still remains a bit skittish. And while market physical supply fundamentals loosen up, a lingering "crisis premium" nevertheless adds a cushion of a few extra dollars to the OPEC basket price.

So OPEC stands pat on current official quotas while shrugging off non-OPEC output increases and turning a blind eye to proliferating reports of cheating within its own ranks.

Now does that sound complacent—or just smart?

OGJ Hotline Market Pulse

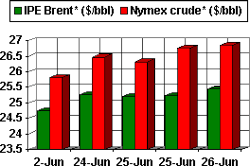

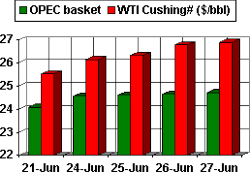

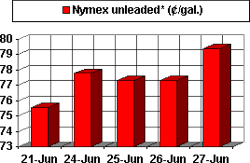

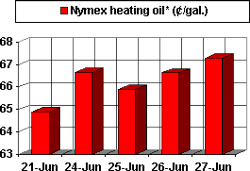

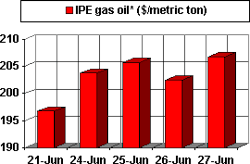

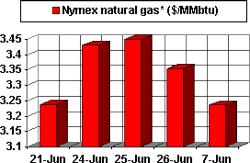

Latest Prices as of June 28, 2002

OGJ Hotline Market Pulse has ceased tracking the price of Saudi light crude oil and replaced it with the average daily price of the OPEC basket of crudes, in light of the latter's greater importance to OPEC strategy and thus to oil markets.

null

null

Nymex unleaded

null

Nymex heating oil

null

IPE gas oil

null

Nymex natural gas

null

NOTE: Because of holidays, lack of data availability, or rescheduling of chart publication, prices shown may not always reflect the immediate preceding 5 days.

*Futures price, next month delivery. #Spot price. @New contract