Rebounding oil prices in the wake of Venezuelan President Hugo Chávez's stunning return to power after an abortive 48-hr coup may be a harbinger of things to come this year.

The "countercoup" by Chávez supporters and others alarmed by the speed with which the interim government dismantled not only Chávez's putative legacy but also the existing government infrastructure spawned a reversal in oil prices as well. The expectation that a replacement government would depart from Chávez's fidelity to Venezuela's Organization of Petroleum Exporting Countries production quota had provided a brief counterpoint to the news that Iraq was halting oil exports. Oil traders saw the prospect of a revival of Venezuela's pre-Chávez disdain for OPEC quotas as a depressant element for oil prices. Conversely, the return of Chávez must be seen as a stimulant for oil price gains, the conventional wisdom went.

Well, not so fast, according to Centre for Global Energy Studies.

Immediately after Chávez's ouster on Apr. 12, CGES said the possibility that Venezuela would revert to its policy of flouting its OPEC quota was doubtful.

"First of all," said CGES, "there remains a considerable body of opinion within Venezuela-and not just among Chávez supporters-that believes the policy of pursuing higher oil prices at the cost of lower market share is basically sound and that what was at fault was the way in which the funds were spent."

In addition, CGES contends, Venezuela's leadership would have to remain mindful of the effects of its earlier quota-flouting: contributing to the 1998 oil price collapse and angering a Saudi competitor that could handily win a market share war.

The new government would instead have been wise to honor its existing quota and then wait for OPEC to boost quotas as needed generally at its June 26 ministerial meeting, CGES contended in its Apr. 12 analysis.

OPEC boost needed anyway?

Such a general increase in OPEC quotas and production will, in fact, be needed this summer, according to CGES.

The London think tank contends that supply disruptions such as those posed by Iraq's petulance or Venezuela's chaos are not the biggest threats to the oil market.

"Such supply disruptions, though serious, can be dealt with through the use of strategic stocks and increased output from other producers," CGES said. "The greatest problem for oil markets is OPEC's apparent failure to appreciate that the demand for its oil will rise substantially in the second half of 2002 and that it must raise output ahead of that increase to stabilize the market."

OPEC's relentless efforts to restrain production in order to bolster oil prices in light of weakened demand may create a self-fulfilling prophecy. In the past 18 months, the group has slashed production by 4 million b/d to match its supply to weaker demand. This has created a 1 million b/d "hole" in oil supply that is slowly moving downstream from producers to refiners, claims CGES. Much of this hole has yet to show up in the US because most of the first quarter 2002 stockdraw is still tanker-borne.

Further Middle East supply disruptions will only exacerbate this pending shortfall, says CGES. But its longer-term worry is that OPEC may not react quickly enough to tightening market fundamentals. The result could be a repeat of 2000, where high oil prices halted economic recovery and crimped oil demand growth.

"OPEC cannot directly control oil demand growth, but it can help to create the conditions for growth," CGES said. "However, it can only do this by anticipating the need for its oil at least 1 quarter ahead; it cannot do it by matching output to current demand."

Getting back to Venezuela, if OPEC loosens up its quotas in June, that enables whoever is setting oil policy in Venezuela at the time to allow oil production to expand. This helps appease state oil company Petroleos de Venezuela SA and the oil workers' unions-two of the principal catalysts for the Apr. 12 coup against Chávez-and without running the risk of a market share war with Saudi Arabia that Caracas is sure to lose.

Chávez's own conciliatory first words toward his opponents at PDVSA would augur well for that scenario. If not followed in deed as well as in word, then oil markets will have more to worry about this year than just the loss of Iraqi oil.

Online Apr. 19, 2002; author's e-mail: [email protected].

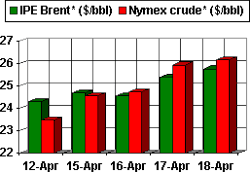

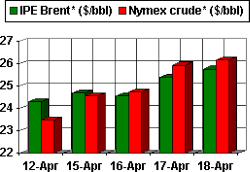

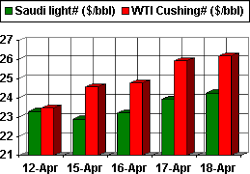

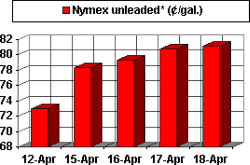

OGJ Hotline Market Pulse

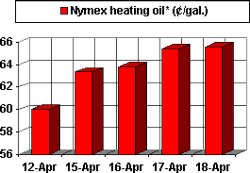

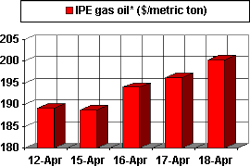

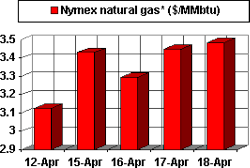

Latest Prices as of Apr. 19, 2002

null

null

Nymex unleaded

null

Nymex heating oil

null

IPE gas oil

null

Nymex natural gas

null