Is the stage being set for another scary standoff between Russia and OPEC over production cuts? Sure.

The bigger question is whether any potential market share war that might result from this scenario will come before US military action against Iraq this year. That will determine the extent of a price collapse, if one occurs this year.

The loss of Iraqi oil supplies in the months to come seems increasingly likely with every passing day. At the same time, the stars are aligning for excess market supplies in the second quarter. The upshot may very well be an oil price that both producers and consumers can live with while the global economy slowly recovers this year. The downside, of course, is worsening hostilities in the Middle East and what that may portend for the US-led campaign against terrorism.

Export cuts fizzle

It's pretty clear that Russia's pledge to cut crude oil exports by 150,000 in the first quarter is shaping up to be a hollow gesture-–a bone tossed to OPEC that lets the group cut its own output without losing face.

Even at that, OPEC's own pledges to cut output beginning in January have proven a bit thin.

London-based Centre for Global Energy Studies notes that there's always been a great deal of uncertainty over the Russian pledge to cut exports, mainly because the starting point against which the cut was to be measured was never clearly defined–whether it was against actual exports in the third or fourth quarters of last year or the scheduled level of exports in the fourth quarter. But that may be moot, says CGES, because by any benchmark, Russia's oil exports cut failed to materialize last month. In fact, Russia's crude exports have continued to rise, rising 50,000 b/d in January from fourth quarter 2001 levels.

Depending on which benchmark is used, Russia's underperformance against pledged cuts was 137,000-263,000 b/d in January.

Even with this non-OPEC "quotabusting," Russian oil companies still chafe against export constraints and have fed much of their oil into the domestic sector. This in turn, says CGES, has dominoed into a miniglut of refined products on the domestic market. Consequently, Russia's exports of refined products spiked up in January (also helped by strong weather-related demand). And the prospects are good for still further rises in exports this month and next, CGES notes. Sharp cuts are expected in export taxes on key products, coming on the heels of a crude oil export tax.

"With a 60% reduction in the crude oil export tax at the beginning of February, it appears unlikely that Russia will make any serious attempt to curb its oil exports in line with its pledge to OPEC," CGES said. "If pipeline exports to Europe remain unchanged from January, the February loading schedules for ports handling Russian crude suggest that Russia's crude oil exports could rise even further in February, reaching nearly 2.7 million b/d.

OPEC's Moscow visit

The situation with Russian exports, of course, has caught OPEC's attention. According to various press reports, plans call for OPEC Sec. Gen. Alí Rodríguez and OPEC Pres. Rilwany Lukman will visit Moscow on Mar. 11–4 days before the next scheduled OPEC ministerial meeting to gain "clarification" on Russia's commitment to cuts in oil exports.

The two OPEC leaders will try to encourage Moscow to extend the country's pledged 150,000 b/d cut in crude exports beyond the first quarter–the limit the Russians initially imposed–to the first half. President Vladimir Putin has already indicated that's not likely.

Meanwhile, OPEC's own recent track record on compliance has not been sterling, either. OPEC's own monthly market report showed the group was over quota by 453,000 b/d in December, and early reports are that much of this cheating continued in January.

According to Lisa Rothenberg, senior analyst at Energy Security Analysis Inc., Wakefield, Mass., "This will all be a buildup to the spring, when Russian crude exports will really pick up, just at the time when global product demand is at its weakest between the heating and the driving season."

And that means another showdown with OPEC, which will have to either give up market share or fight for it with the new big kid on the block.

But springtime also means the mandated review of sanctions against Iraq under an accord between the US and Russia that allowed the UN-brokered oil-for-aid oil sales to proceed last December. That may well prove to be the Bush administration's opportunity to set its anti-Saddam campaign into motion.

And then the threat of market share war disappears under the shadow of a real war.

OGJ Hotline Market Pulse

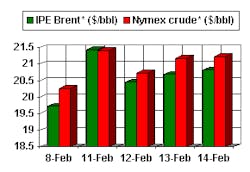

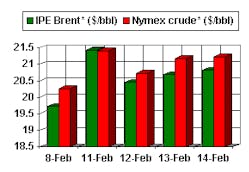

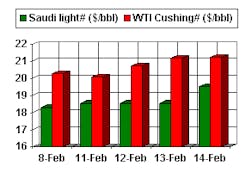

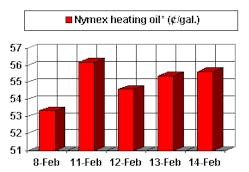

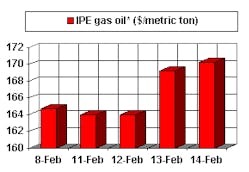

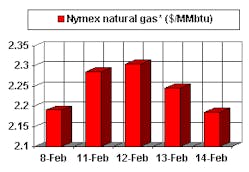

Latest Prices as of Feb. 15, 2002

null

null

Nymex unleaded

null

Nymex heating oil

null

IPE Gas oil

null

Nymex natural gas

null

NOTE: Because of holidays, lack of data availability, or rescheduling of chart publication, prices shown may not always reflect the immediate preceding 5 days.

*Futures price, next month delivery. #Spot price.