So far this year, oil markets are worrying more about languishing demand and increased stock levels than they are about OPEC and non-OPEC production cuts.

In other words, traders are taking an "I'll believe it when I see it" stance towards the pledges by OPEC and non-OPEC oil exporters to cut nearly 2 million b/d of production while they wallow in bearish data reports.

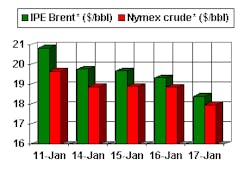

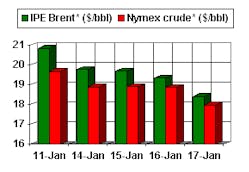

That sort of attitude prevailing is what has contributed to NYMEX futures crude yesterday sliding below $18/bbl for the first time in 2 years. Is it warranted? Well, yes and no.

Given the scope of bearish data on inventories and demand recently being released, the best face to put on it is that the agreement between OPEC and non-OPEC oil exporters was the oil market equivalent of the little Dutch boy with his finger in the dike. All that could be hoped for was stemming the tide toward another full-blown market collapse.

Energy Security Analysis Inc., for one, thinks that OPEC did, in fact, need to take action to prevent a price collapse from happening-it just overreached.

ESAI notes that oil prices "are often shaped by developments on the margin of the market."

OPEC, however, is not concerned with marginal developments but instead sees a baseload problem, says the Boston consultant: the growth in non-OPEC production absorbing all of this year's growth in demand-and then some.

As a result, instead of choosing a marginal solution, OPEC has opted for a "full-bore realignment" of supply and demand.

This is in keeping with market concerns that the global economic slowdown will sharply curtail oil demand growth.

However, ESAI thinks that OPEC has overreached with the new production accord.

"If OPEC initially makes good on the production cut, crude supplies will be depleted, and prices will be headed to the $25/bbl OPEC basket target easily by midyear. As prices rise, the pressure to cheat, however, will become unbearable, attenuating the price increase at a lower level.

"In short, the spare capacity OPEC is creating is far too heavy a burden to carry if prices are rising and non-OPEC output is taking market share."

But if OPEC does not make good on its production cut at the outset, then the group will be faced with having to awkwardly put a good face on poor discipline, ESAI contends: "The biggest fallout from this would be a commensurate loss of discipline in non-OPEC countries. As discipline deteriorates among all producers, the $25 OPEC basket price target is out of reach."

In ESAI's view, OPEC has yet to figure out that the long-term sustainable crude oil price is not above $25/bbl, but above $20/bbl: "OPEC would have been better off making a marginal adjustment. It would have been credible, effective, and have a greater chance of enduring."

Saudi view

If OPEC is overreaching, then what was behind the decision to make a "full-bore realignment" of supply and demand vs. the marginal adjustment of which ESAI speaks?

Could it be an unrealistic expectation of where oil prices could settle in the near term because of Saudi budget pressures? Because Saudi Arabia is the main driver of OPEC quota decisions these days, it is logical to turn to the kingdom for an analysis of what its desired oil price should be.

Centre for Global Energy Studies notes an extraordinarily high dependence on oil for its budget needs: Oil revenues account for almost 80% of the country's fiscal budget.

"To have fully covered in 2001 its fiscal expenditure of $68 billion less the income it received from nonoil activities, Saudi Arabia needed an OPEC basket price of $27.70/bbl with its oil production at 8 million b/d," CGES said. "Since the OPEC basket price [was] unlikely to average more than $23/bbl [in 2001], one can readily understand how Saudi Arabia posted a $6.7 billion budget deficit for 2001.

"The kingdom evidently has a problem with the expenditure rather than the revenue side, for its spending increased by 19% over last year, whereas its oil revenues stayed the same."

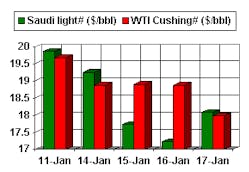

In light of that kind of overspending, the Saudis slashed their budget by 20% for 2002 while allowing for a 30% decline in revenues, according to the London think tank. That leaves the kingdom with a $12 billion budget deficit this year. To meet Saudi Arabia's 2002 revenue target, CGES estimates the kingdom would need an OPEC basket price of $16-20/bbl (add a couple of bucks for WTI or Brent) with oil output of 7.1-8.5 million b/d. But to balance its budget next year requires a price of $21-26/bbl at the same output range.

CGES contends that a 1 million b/d of actual output cuts from OPEC in the first half would balance the Saudi budget. But falling short of that would leave Brent at $18/bbl and the Saudis with its projected $12 billion deficit.

That pretty much jibes with what Saudi Oil Minister Ali al-Naimi told Middle East Economic Survey during OPEC's Dec. 28 meeting that produced the pledged cuts. Al-Naimi told MEES a price collapse to less than $18-19/bbl would "impact OPEC's revenues negatively."

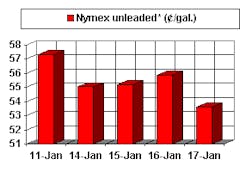

The Saudi minister also told MEES that it is wrong to focus on price bands now and that the focus should be on restoring a supply-demand balance. That means implementing at least half of the pledged production cuts from OPEC and non-OPEC combined and hoping for a pickup in demand to boost the stock draw. Sometime in the next few weeks, the signs of compliance will be clearer, as will evidence of declining stocks. This week's $18/bbl probably represents a brief nadir for oil prices, although the likelihood of quotabreaking in OPEC in tandem with seasonal slackness in the second quarter will keep oil prices from venturing very far into the $20s/bbl before the summer driving season.

The Saudi-Russian showdown may have been a trip to the edge of the price abyss after all. If so, there remains largely upside price risk in the form of a suspension of Iraqi oil exports. It is becoming increasingly apparent, judging from statements emanating from Washington, DC, that a US-Iraq showdown in the continuing campaign against terrorism is just a question of when, not if.

A disruption of Iraqi supplies probably would be just what the Saudis need to balance their budget this year, without the kingdom looking like it engineered an oil price spike amid global recession.

null

null

null

null

null

null

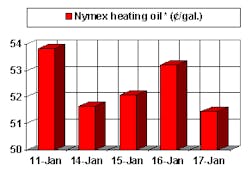

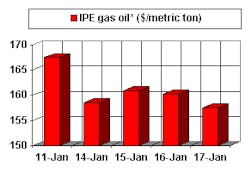

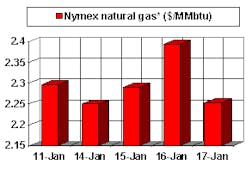

NOTE: Because of holidays, lack of data availability, or rescheduling of chart publication, prices shown may not always reflect the immediate preceding 5 days.

*Futures price, next month delivery. #Spot price.