Even as estimates of global oil demand plunge, the Organization of Petroleum Exporting Countries continues to hold to its strategy of cutting output at the slightest sign of price weakness.

That was fully evident at the group's last meeting, which locked in yet another production cut that takes effect next week. That 1 million b/d cut was approved without so much as a formal meeting of ministers-executed through a flurry of faxes and phone calls.

This capability to turn the market on a dime, so to speak, illustrates a new phase in OPEC's supply management, according to London-based think tank Centre for Global Energy Studies:

"OPEC remains terrified of a price collapse and will act quickly whenever prices start to weaken," CGES said. "It has decided that to prevent prices dropping below $22/bbl [the lower end of its official basket price band], it needs to act well before they reach that level, setting an effective floor for the basket of between $23/bbl and $24/bbl."

That, in turn, creates a floor for crude futures traded on the New York Mercantile Exchange-with West Texas Intermediate as an analog-of about $25-26/bbl.

This goes beyond the psychological effect on futures markets. CGES contends OPEC is micromanaging the market to prevent crude oil stock levels from rising and thus putting downward pressure on oil prices. As of June, OPEC's production was pretty much in line with the second quarter's zero stock-change call on the group's oil, according to the think tank. That's usually the low point in the seasonal call on OPEC oil.

The latest cut is expected to bring OPEC's production down to about 25.8 million b/d in September-assuming 2.6 million b/d from Iraq, CGES estimates, adding that about 500,000 b/d of "leakage" is likely.

This pullback of supply from the market will come at a time for demand typically rises in anticipation of the heating season, the weakening demand picture notwithstanding.

Pegging incremental oil demand growth this year at a paltry 0.6%, or 440,000 b/d, CGES notes that while refinery runs continue to fall across Asia, the call on nevertheless will increase in response to seasonal changes.

Price pressures

Accordingly, the think tank contends that oil stocks will have to be drawn down at a rate of 600,000 b/d in the third quarter and 1.4 million b/d in the fourth quarter, thus putting upward pressure on oil prices in spite of the weak demand-growth environment.

So while there is little immediate concern about price levels, as stocks are drawn down at the approach of winter, prices are likely to strengthen.

"At some stage in first quarter 2002, OPEC may need to act as quickly to prevent prices from overheating as it did this year to prevent them from collapsing,." CGES said.

However, OPEC has already shown that it is not as willing to take a rapid-response stance as oil prices nudge toward the upper end of its target price band-$28/bbl, or $30/bbl for WTI/NYMEX crude-because there has not been a serious test of this price level so far this year.

That $30/bbl magic mark may well arrive late in the fourth quarter, says Energy Security Analysis Inc.

"Even accounting for weaker demand growth, global throughputs will still rise seasonally in the fourth quarter, after abnormally low runs in the third quarter," ESAI said. "OPEC"s decision to remove more oil from the market before this period will exacerbate these deficits and make a U-turn quota increase more likely."

Caught in middle

It is ESAI's contention that crude markets are caught between bearish-to-neutral current fundamentals and expected bullish fundamentals.

"The speculators have recently been betting on big decreases in prices," the Wakefield, Mass., analyst said late last week. "...Two weeks ago, the noncommercials had built up their biggest net short WTI position since the collapse of oil prices in 1998."

ESAI contends that the latest report shows substantial speculator short covering, urged by concerns over the latest OPEC cut and the decline in US crude stocks-a drop of 12 million bbl for the week ended Aug. 17.

"Once the shorts have been flushed out, however, there will be less bullish momentum, and prices will likely drift down again," the analyst said. "But by the fourth quarter, even assuming only modest compliance with new OPEC quotas, crude prices will likely start approaching $30 again, and we will again be talking about the need for an OPEC output increase."

In the meantime, it looks to be a bull market for refiners in the US. The report today of the Citgo Petroleum Corp. refinery at Lemont, Ill., remaining down for 6 months vs. the previously estimated 6 weeks has already caused retail gasoline prices in some areas of the Midwest to rocket up by 25

OGJ Hotline Market Pulse

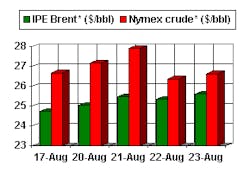

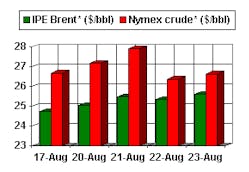

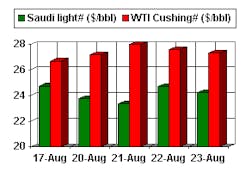

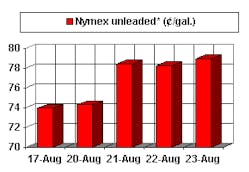

Latest Prices as of August 24, 2001

null

null

Nymex unleaded

null

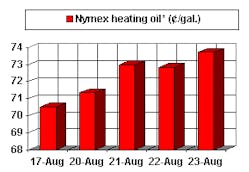

Nymex heating oil

null

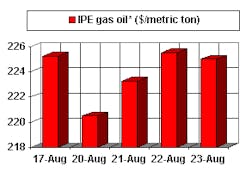

IPE Gas oil

null

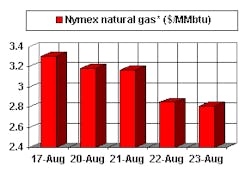

Nymex natural gas

null

NOTE: Because of holidays, lack of data availability, or rescheduling of chart publication, prices shown may not always reflect the immediate preceding 5 days.

*Futures price, next month delivery. #Spot price.