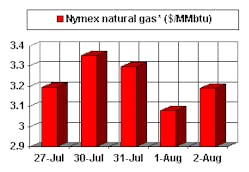

The $3/MMbtu floor for natural gas prices continues to hold, thanks to a brutal heat wave scorching the US Midwest.

How long that floor holds remains largely up to the weather and the prospect of continuing firm oil prices spurring fuel-switching back to gas from fuel oil.

After breaking through the $3/MMbtu floor last month, spot and futures gas prices have bounced around that critical milestone for several weeks, trending up closer to around $3.20 in the last few days.

The record power loads in the Midwest in the past week or two have weighed heavily on the rate of injections into storage, but not enough to keep the year-to-year storage surplus from growing again.

After 7 consecutive weeks of storage injection rates topping 100 bcf/week, last week's lower rate of 77 bcf should have been a welcome surprise for the market. But the market apparently is in no mood for half-measures, as apparently many traders had expected a much lower injection number, cutting into the year-on-year surplus a bit more. So futures prices held below $3.20/MMbtu for most of this week. For the month of August, spot prices are estimated at $3.06/MMbtu, only 2¢ more than last month and a startling 67¢ below the same time a year ago.

Even a record heat wave affecting a number of the key market hubs could only buoy prices a little bit, and the near-term weather outlook is for more of the same east of the Rockies, so the temporary strength in gas prices should be sustained at least another week or two.

Last week, US cooling degree-day temperatures were 6% warmer than normal and 27% warmer than the same week a year ago. For the cooling season to date, temperatures have been 5% warmer than normal but 2% cooler than last year.

Demand still lags

What's been especially surprising is the failure of industrial gas demand to rebuild, suggesting the lingering effects of the economic slowdown as well as the fuel-switching situation.

It's likely that the oil production cut that OPEC announced for Sept. 1 will have some effect in the fall, as oil prices strengthen more when those cuts filter through the system into October. As heating oil stocks are built up in anticipation of the heating season, look for that component of the market to tighten again. The overall effect of increased demand will be to lift both crude and heating oil prices, making natural gas more attractive by comparison. Some analysts are predicting a return to $30/bbl in the fall, so that prospect should spawn a flurry of fuel-switching back to gas.

The rebound in industrial demand will then recoup some of the lost demand natural gas has seen this year. And should cooling loads continue to stay strong in the Midwest and perhaps pick up in the Northeast. If Tropical Storm Brady continues its sweep across the Gulf Coast, the shutdown of many platforms will make a dent on the supply side. Meanwhile, some economists are pointing to signs of life returning to a moribund economy.

All these factors combined could nudge gas prices back up towards $4/MMbtu.

But it would probably take that combination of factors to eat away substantially at the storage surplus.

Even if injection rates drop down to its usual seasonal level of 50 bcf/week in the weeks to come, the US gas storage surplus could easily remain at 400 bcf year-on-year. Currently, storage is 2.2 tcf vs. 1.9 tcf a year ago, the prior 3-year average of 2.18 tcf, and the prior 6-year average of 2.06 tcf.

Absent weather events or oil price shocks affecting gas supply and demand, respectively, and thus causing the rate of injection into storage to throttle back more, the market is likely to see gas storage end the heating season next year well into surplus.

Bearish mood

The overall bearish mood of the gas market is sending analysts back to their forecasts with scalpel in hand.

Raymond James & Associates, for example, ratcheted down its US natural gas price forecast twice last month alone.

"On the heels of several additional bearish gas storage injection reports, it is becoming clear the the expected rebound in gas-fired electric demand is simply not showing up," RJA said in a July 23 report. "In fact, we cannot remember a time when there has been less visibility on al the fundamental gas price drivers. Specifically, we have no definitive data that can pinpoint year-over-year changes in North American gas supply, gas-to-oil fuel switching, industrial gas demand, and gas-fired electric demand.

"The only definite thing we know about natural gas fundamentals is that there has been approximately 5-6 bcfd more gas in the system over the past few months than there was this same time last year. Unfortunately, we cannot prove whether this year-over-year differential...is supply related or demand related."

The truth is probably a little of both.

RJA slashed its gas price forecast again, to $2.75/MMbtu for the third quarter from $3.25/MMbtu and to $2.50/MMbtu for the fourth quarter from $3.50/MMbtu. And the analysts trimmed its prediction for gas prices in 2002 to $3.50/MMbtu from $4.00/MMbtu.

If the economy slowly rebuilds its strength, boosting oil and gas demand to respectable levels; OPEC cohesion holds; a heat wave continues well into the summer; and an early cold wave hits during the early part of the heating season, such a bearish forecast might be avoided, and we could be looking at a $4/MMbtu by midwinter and a mild year-on-year storage deficit by the end of the season.

That's enough "ifs" to suggest that the market ought to be grateful for $3 gas right now.

OGJ Hotline Market Pulse

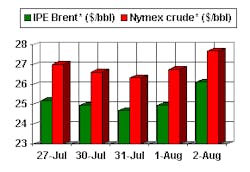

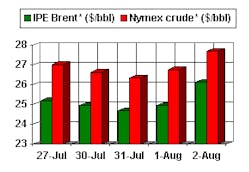

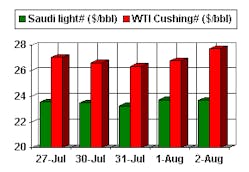

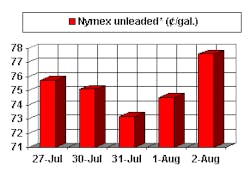

Latest Prices as of August 3, 2001

null

null

Nymex unleaded

null

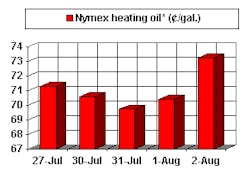

Nymex heating oil

null

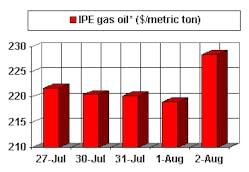

IPE Gas oil

null

Nymex natural gas

null

NOTE: Because of holidays, lack of data availability, or rescheduling of chart publication, prices shown may not always reflect the immediate preceding 5 days.

*Futures price, next month delivery. #Spot price.