Can the current strength in oil prices be sustained for the longer term, or is another downturn just around the corner?

If one looks at the way the stock market is valuing oil company and oil service company stocks, one would have to assume the latter. Built into the current oil share prices is an expectation that oil prices will again slump to $18-19/bbl .

But Weeden & Co.'s Charles T. Maxwell thinks that oil and service share prices are substantially undervalued-and thus underowned-by institutional investors, which have "completely misperceived" the scope and duration of their profit cycle.

"Market recognition of oil shares as attractive investments has been clouded in recent years by fear of surpluses of crude and natural gas based on four historic collapses of prices and profits in the oil industry in 1974-75, 1986-87, 1991, and 1998-99," Maxwell said. "Low price-earning rations on most oil stocks hae reflected investors' uncertainty about what the future might hold."

In short, the debate over whether this is a secular recovery in oil markets is still a lively one.

Maxwell expects average quarterly crude oil prices to stay within the Organization of Petroleum Exporting Countries' price band of about $24-30/bbl ( in West Texas Intermediate-equivalent terms for the next 3 years at least, and probably longer.

"Expectations presently built into the stock market prices of oil shares suggest an impending dive by crude to the $20 mark or into the teens," he said. "However, such a descent is likely to be thwarted by new political, economic, and geological realities relating to oil...Wider recognition of this should, slowly but surely usher in changed investor perceptions of the value of oil and gas reserves in the ground and a better appreciation of the earnings power of entities that can efficiently find, develop, process, and distribute increasingly hard-to-come-by oil volumes to an energy-hungry world."

It all comes down to whether the macro view of the world economy. If a deep and extended global economic downturn is in the offing, then the prospects of a crippled growth rate for oil demand would support a view of another oil price collapse.

"But if you see the world slowly emerging from its present difficulties in late 2002 or 2003 in reasonable shape, you might wish to listen to other, more upbeat arguments supporting the case for oil prices staying in the low-to-mid-$20 area for several years and eventually breaking out to the upside sometime later in the 5-year period."

Maxwell contends that crude oil is making the transition to a surprisingly price-resilient commodity for several reasons.

First, the present up cycle, unlike the previous four, was not the result of a political or military development that suddenly removed part of supply from the market, thus creating a temporarily high capacity utilization that spiked oil prices. While production capacity utilization currently stands at 95%, it is not the result of some anomalous geopolitical event, Maxwell notes: "Low levels of investment in capacity resulted from a period of years when returns were well below normal. Also, there was a slow investment reaction to accelerating growth in oil consumption, coupled with a dwindling 'cushion' of excess capacity, which may now be down to 4 million b/d in a 77 million b/d world production universe."

Restoring that cushion will take years and require an unprecedented scale of capital spending by industry. Maxwell reminds us that there is traditionally a time lag of 2-4 years before capital spending impacts the oil volumes it is intended to support.

However, the self-fulfilling prophecy of an anticipated price decline in the light of such increased spending will put some downward pressure on oil prices, so Maxwell sees a "golden descent" for oil prices, as WTI slips to $26.50/bbl this year and $24.50/bbl next year from an averate $30.30/bbl in 2000. Correspondingly, he sees the average return on capital employed withing in the industry as inching down to 19% this year, 17% in 2002, and a low of 16% in 2003 vs. the 20% level in 2000.

And will OPEC cohesion stay the course, a necessity for such an upbeat forecast? Maxwell contends that it will, pointing primarily to the fact that it has already done so for the past 21/2 years. Again, given the expectation that the world economy is not in for a long and deep recession, OPEC can remain united on policy and effective on implementing cuts up to at least 4.3 million b/d. And concerns over Iraq and the Palestinian-Israeli conflict pose prospective price opportunities mainly on the upside.

Will non-OPEC crude supply make that much of a difference in such a forecast? Maxwell contends that there are limits-more so today than at any time in the past-on the potential for non-OPEC supply to grow. He points to the extreme lateness of a supply response to extremely high oil and gas prices and the recent track record of non-OPEC supply growth as being continually scaled down each year.

All of which points to a growing dependence on OPEC underpinning a regime of oil prices staying in the low-to-mid-$20/bbl for the foreseeable future. This, in turn, will allow oil companies to use their higher-than expected cash flow to pay down debt, buy back more shares, acquire other companies' assets, and raise dividends.

"This will probably make them far more attractive as long-term investments down the road several years than their current, relatively low price-earnings ratios might imply today," Maxwell said.

But wasn't the expectation of perpetually high oil prices dashed in the mid-1980s, as conservation, alternate oil and other energy supplies, and price-induced demand declines came to the fore? Perhaps the difference here is in the matter of degree. The oil price spikes of the 1970s and early 1980s were unprecedented. Certainly, massive oil price hikes and collapses had occurred before, all the way to the dawn of the petroleum industry in the 19th century. What made the modern-era price spikes unprecedented was the degree to which petroleum had become the drive for the world economy. And not only is the recent price spike a fraction, in relative percentage terms, of the 1970s spikes, the effect of higher oil prices on the global economy, while still a huge influence, is more muted today than it was 2 decades ago.

To this writer, the real question is whether oil companies will continue to remain conservative in their budget actions and his make the supply response a protracted one. While Maxwell makes the point that finding sizeable new reserves outside of OPEC gets more difficult each year, there is also the prospect of alternate sources of energy. This is not about solar and wind power and the like. Expectation of $25/bbl WTI lingering might well spur accelerated new development of oil sands, switching to natural gas, proliferation of clean coal and nuclear power, and development of a gas-to-liquids industry with genuine critical mass. All of these areas have made important strides in terms of technical, economic, and environmental improvements.

At the same time, proponents of the Kyoto global warming pact declare a resuscitation of that initiative; implementation of Kyoto as outlined would have a devastating effect on oil demand.

It is difficult to gauge the impact of these demand-side concerns. But if, as Maxwell contends, the conventional supply-side response is some years away and if the world is not headed for depression, then the oil industry can be assured of a nice window of profitability perhaps to the midpoint of the decade at least.

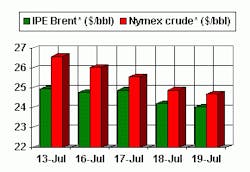

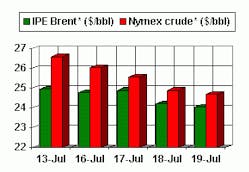

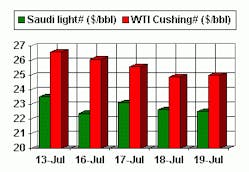

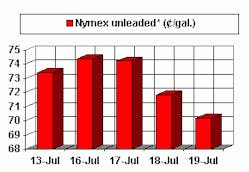

OGJ Hotline Market Pulse

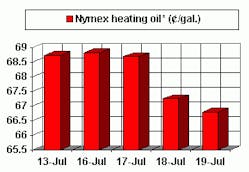

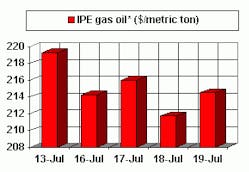

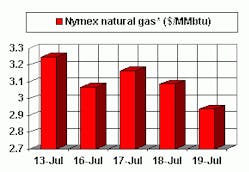

Latest Prices as of July 20, 2001

null

null

null

Nymex unleaded

null

Nymex heating oil

null

IPE Gas oil

null

Nymex natural gas

null

NOTE: Because of holidays, lack of data availability, or rescheduling of chart publication, prices shown may not always reflect the immediate preceding 5 days.

*Futures price, next month delivery. #Spot price.