Non-OPEC oil supply growth the new market wild card

The Organization of Petroleum Exporting Countries has held a whip hand over oil markets for most of the last 2 years, deftly steering the market to a point where $25/bbl (NYMEX futures) has pretty much remained a floor for most of the past 2 years.

Hewing to its price band target of $22-28/bbl for the OPEC marker basket of crudes, but eyeing specifically $25/bbl for that marker basket (corresponding to about $27-28/bbl for WTI), OPEC has shown remarkably consistent cohesion. The OPEC 10 (minus Iraq) group has ratcheted production up or down in response to anticipated future supply and demand movements, departing from its traditional stance of "closing the barn door after the cows have gone."

Much of this strategy has been led by Saudi Arabia, which arguably holds a whip hand over the rest of the OPEC 10, now that Venezuela and Iran are back on board. The UAE and Kuwait are pretty much in line with the Saudis, and there is little that the rest of OPEC can do because of their own limits on productive capacity.

Iraq, of course, remains the perpetual wild card, but one that the Saudis have readily handled, with the kingdom acting as a swing supplier whenever Iraqi petulance meant no (legal) Iraqi oil on the market.

It has been OPEC cohesion and careful modulation of supply-especially when there was a danger of oil prices softening in the near term-that has kept oil prices bolstered these past 2 years, but, in truth, Saudi Arabia has been the real power here. It even took a non-OPEC power, Mexico, to step in and mediate between a quarreling Saudi Arabia and Venezuela just at a time when a change of governments in the latter made such a rapprochement between the OPEC founders possible. That was the beginning of the turnaround. Had the tripartite agreement not come to fruition, the Saudis, unhappy with Venezuela (actually PDVSA) continually flouting its quota (at least in the Saudis' eyes), likely would gone for another market share grab as it did in late 1985, and the oil price collapse of 1998 would have been much deeper and longer-lasting.

Saudi Arabia still holds the whip hand, because it has the greatest spare productive capacity and thus can accommodate the loss of 2 million b/d from Iraq without spiking prices much, and because it also can use that surplus to seize more market share, thus collapsing prices.

What's happening to markets today is the direct result of the Saudi-led OPEC modulating supply to prop up oil prices at a level of at least $25/bbl (OPEC basket). What is also happening is that worldwide demand continues to weaken in response to high oil prices, and OPEC seems little concerned at this point to take the upward price pressure off. Simply put, the Saudis have revenue needs that requires that the OPEC basket price remain at $25/bbl for awhile. Even if demand continues to weaken, and prices soften in response, in theory, OPEC could continue to throttle back output to keep prices at least within its target band.

The question of the day, then, becomes: at what point does Saudi Arabia, as a surrogate for OPEC, begin overreach and set the stage for a new wild card to enter the scene: non-OPEC supply growth.

It was the price spikes of the 1970s oil crises that ultimately spawned the boom in non-OPEC supply growth, notably the US, Mexico, and the North Sea. It also spawned a surge in OPEC production outside of Saudi Arabia. And therein lie the roots of the 1986 price collapse.

How far are the Saudis willing or able to take their balancing act, in light of non-OPEC supply growth? Certainly, the industry has shown remarkable resilience in the face of low oil prices before, and the exponential, computer-driven gains in efficiency and productivity have enabled oil companies to produce more oil than before, and with lower overhead.

At the same time, oil companies were notably conservative in their spending plans in 1999 and early 2000, as if waiting to see if the upturn were real. And many companies seized the opportunity to use the upsurge in cash flow to clean up their balance sheets or to acquire other companies and assets.

But that seems to changing now. Salomon Smith Barney estimated worldwide E&P spending by publicly traded oil companies rose about 12% last year vs. an 11% drop in 1999. And the analyst is now expecting a 20% rise in E&P outlays in 2001; Canadian Energy Research Institute (CERI) forecasts a comparable increase in 2002.

This typically translates into increased non-OPEC oil production, but the rate of growth also has a couple of natural governors on it: oil prices, of course, and exploding service and supply costs.

Still, the expectation is for more growth in non-OPEC supply in response to higher prices. CERI noted a jump in non-OPEC oil supply of 1.2 million b/d in 2000, the biggest gain for that category since 1995.

Given expectations of increased drilling and production activity in 2001 and 2002, CERI predicts "solid non-OPEC suply growth in 2001, albeit not as strong as last year. Non-OPEC supply growth looks to be exceptional in 2002."

Calgary think tank projects that non-OPEC oil supply will grow by about 930,000 b/d this year to 46.8 million b/d and by 1.6 million b/d in 2002, with growth spread across the three major non-OPEC groups-OECD, non-OECD, and former Soviet Union, with the FSU making the biggest relative gains.

"Through the 1990s," noted CERI, "non-OPEC supply ran on only two of its three cylinders, the OECD and non-OECD.

"With the revival in the FSU and robust prices, non-OPEC supply is being transformed into a hotrod Lincoln.

"A shift in Saudi priorities from price to market share, however, could quickly turn the Lincoln back into a Chevette."

Dubious automotive analogies aside, will the Saudis see this coming soon enough to steer the market to a soft landing as it seeks to recapture market share lost to the non-OPEC suppliers? If not, another oil price collapse could be on the horizon in a couple of years.

OGJ Hotline Market Pulse

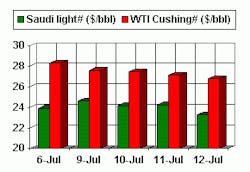

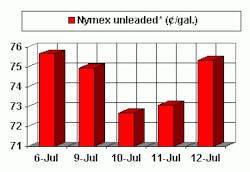

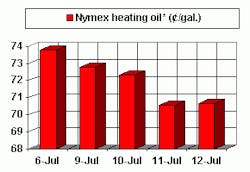

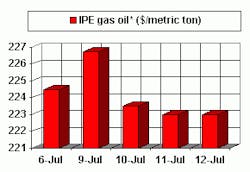

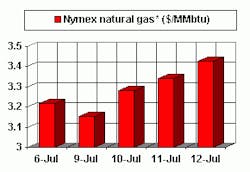

Latest Prices as of July 13, 2001

null

null

null

Nymex unleaded

null

Nymex heating oil

null

IPE Gas oil

null

Nymex natural gas

null

NOTE: Because of holidays, lack of data availability, or rescheduling of chart publication, prices shown may not always reflect the immediate preceding 5 days.

*Futures price, next month delivery. #Spot price.