Watchers of the US natural gas market are getting a rude awakening about the outlook for gas supply-demand and prices: Demand for gas is a good deal more elastic than many of the market bulls have presumed.

In a dramatic turnabout, US gas prices have plunged by almost $2/MMbtu in the past 2 months, and the bottom is not immediately in sight. Spot prices are down by more than $1/MMbtu in the past month alone and even are lagging year-ago price levels.

What happened to expectations of lofty prices for natural gas persisting through the spring and summer? Well, those lofty prices managed to put a pretty substantial squeeze on demand. And those same lofty prices sparked a pretty fair ramp-up in US production and imports of natural gas. The upshot is that the startling prospect of a US gas storage level that looked in the first quarter like it had the potential to approach zero in terms of working gas deliverability at the end of the last heating season has not only become a surplus but one that threatens to linger to the next heating season. The gradual initial slippage in prices from softening demand has sparked a frenzied pace in storage injection rates in the past 2 months. The rate of injection into storage since Mar. 31 has roughly tripled the rate of last year and is half again the average rate for the preceding 7 years.

Unless gas prices fall further, the likelihood is that storage could even top 3 tcf come Nov. 1, over the traditional ceiling expected for the start of the heating season.

Economics 101. Yet we seem to forget these basic rules every time.

Supply-demand shift

Lehman Bros. estimates that the supply-demand curve for US natural gas has shifted by as much as 6-7 bcfd, propelled largely by massive fuel switching to oil or simple curtailments, even shutting down some industrial facilities.

At the same time, early data-from 46 producers that account for perhaps 70% of total US output-suggest that US gas production may have increased by as much as 1.3% from the fourth quarter and 0.6% from the same time a year ago.

In addition, the US Department of Energy estimates that imports of gas, from Canada via pipeline and from a variety of sources (mainly Trinidad and Tobago) as LNG, rose by as much as 1 bcfd in the first quarter.

Meantime, while the consensus was that a surge in power demand for cooling would put a prop under gas prices, that has not happened yet, and it still may not happen to the extent that gas prices could regain the lofty levels of last winter. Lehman Bros. estimates that increased gas-fired power generation will boost demand for gas this summer by about 125-150 bcf. But so far, it's been a cool spring in the US, and the weather forecasts have indicated that summer isn't in a rush to get here.

"Gas prices many need to fall to allow increased consumption," the analyst said. "If consumers need to be induced to use an additional 500-550 bcf [less increased power generation demand of 125-150 bcf], natural gas prices may need to fall further."

So it follows that, in order to revive gas demand, natural gas prices will need to fall enough to spur a reversal in the fuel-switching trend, back to gas from residual fuel oil.

Without a revival in gas demand, working gas inventory levels could climb as high as 34.-3.5 tcf by Nov. 1, estimates Lehman Bros.

Reviving demand

Just as the higher prices squelched demand growth, it will take lower prices to revive it. The loss of industrial demand for natural has become so substantial that a spike in cooling load demand would have to be extremely large in order to offset it. DOE's projections of increased power demand this summer translate to an incremental increase in gas demand of 300 MMcfd in the second quarter and 1.9 bcfd in the third quarter. At the same time, however, a number of inefficient gas-fired power units will be replaced by more-efficient gas fired units. That will result in a big slice being taken out those projections of increased gas demand this summer, with the net increase being closer to roughly zero in the second quarter and 1.5 bcfd in the third quarter, Lehman Bros. estimates.

The upshot, then, is that net demand-excluding the increase in power generation demand-must increase about 2 bcfd during the storage refill season.

What would it take in terms of a gas price to warrant such an increase in demand? Lehman Bros. puts that price at a gas-equivalent that has its floor in residual fuel oil prices and its ceiling in No. 2 fuel oil prices. That translates to $3.75-5.25/MMbtu, at current oil-equivalent prices. But if oil prices fall to $22/bbl, the implied gas price range would be $3-4/MMbtu.

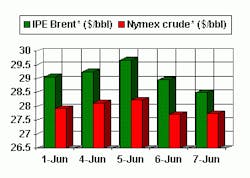

While that is a far from the near-$7/MMbtu average for the first quarter, it still represents a healthy enough price range to sustain growth in drilling activity and stepped-up imports. Even these latter components of supply growth have their limits, however, as they are still constrained by inadequate supply infrastructure. In addition, it becomes increasingly difficult to be skeptical about solidarity among the members of the Organization of Petroleum Exporting Countries-especially the likelihood that oil prices will remain at $25-30/bbl (NYMEX next-month futures contract) for at least the rest of this year and perhaps well into 2002. So that suggests another prop for gas prices.

Thus it seems that the most logical scenario is one in which gas prices track a bit lower before leveling off with hotter weather this summer, then mostly bouncing around between $4 and $5/MMbtu late in the second half-perhaps spiking higher if an early, cold winter arrives.

OGJ Hotline Market Pulse

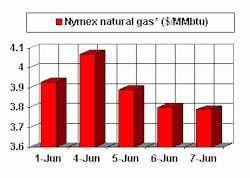

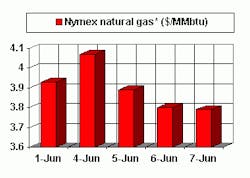

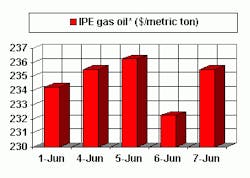

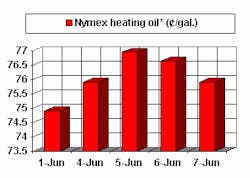

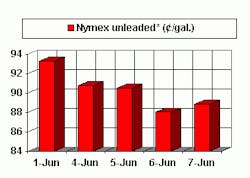

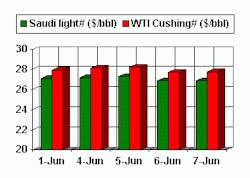

Latest Prices as of June 8, 2001

null

null

Nymex unleaded

null

Nymex heating oil

null

IPE Gas oil

null

Nymex natural gas

null

*Futures price, next month delivery. #Spot price