OPEC tries to navigate oil prices to $25/bbl; uncertainty prevails

OPEC continues to try to navigate oil prices between the Scylla of Iraqi supply surprises and the Charybdis of weakening oil demand.

The group's latest effort to micromanage oil markets has yielded a 1.5 million b/d cut, as expected. Not surprisingly, oil prices dipped a bit in response, just as they did when the Iraqis halted oil exports Dec. 1 over yet another dispute with the UN. Markets had already built in a discount in oil prices because OPEC had been telegraphing the move for some weeks now. The fact that oil prices fell instead of rising with news of a cut simply reflected the anticipation of some traders that the cut might track what price hawks in OPEC had been seeking: 2-3 million b/d.

The quota cut, the first from OPEC in 2 years, is slated to take effect Feb. 1. As with other quota changes in recent years, it excludes Iraq, still under an international sanctions regime with export sales governed by the UN.

However, the actual cut is likely to be less than the 1.5 million b/d official level as of Feb. 1-in large part because Saudi Arabia reportedly has already taken steps to trim its output by almost 500,000 b/d-about 1.2-1.3 million b/d, by some top analysts' conjectures.

Under the latest accord, reached last week at OPEC's ministerial meeting in Vienna, OPEC's production would drop to 25.2 million b/d. The cuts and new production levels break out individually, in b/d, as: Saudi Arabia, 486,000, to 8.189 million; Iran, 219,000, to 3.698 million; Venezuela, 174,000, to 2.902 million; UAE, 132,000, to 2.201 million; Nigeria, 123,000, to 2.075 million; Kuwait, 120,000, to 2.021 million; Libya, 81,000, to 1.35 million; Indonesia, 78,000, to 1.307 million; Algeria, 48,000, to 805,000; and Qatar, 39,000, to 653,000.

This move follows a year in which OPEC production quotas were ratcheted up, in several steps, by 3.7 million b/d to 26.7 million b/d.

Reactions

The immediate response from consuming nations was one of disappointment and concern.

The outgoing Clinton administration-after departing US Energy Sec. Bill Richardson undertook a futile whistlestop campaign to jawbone OPEC into a minimal cut if no cut could be avoided-called the reduction "a mistake."

Still, Richardson claimed credit for averting a much deeper cut than could have been possible, which he said would have undermined stability in global markets and hurt world economic growth.

IEA expressed concern about the cut as well, claiming such "unilateral efforts to set oil market prices simply aggravates volatility."

A mistake?

That theme was picked up by one key analyst, London-based think tank Centre for Global Energy Studies.

CGES contends that OPEC had lulled itself into a false sense of well-being after a year in which oil prices averaged over $28/bbl and oil demand showed no sign of weakening in response.

"OPEC appears to believe that the world economy can live happily with $30/bbl," CGES said last week. "It is wrong."

The analyst contends that OPEC seems to regard the $10/bbl fall in oil prices that began late last fall as the beginning of a collapse that must be reversed, rather than a correction from an unsustainably high level.

However, CGES maintains that high oil prices in 2000 have already undermined economic growth prospects for 2001. It cites stock market analysts' forecasts of 1.1% in real GDP growth in the US in 2001, with a recession in the first half of the year, adding that "the outlook could be even worse, if oil prices do not fall

CGES estimates that global oil demand will climb by 1.3 million b/d "at most" this year, as economic growth stalls.

"If OPEC's pursuit of high oil prices undermines economic recovery in the second half of the year, demand growth could be even lower," the analyst said.

By cutting production, OPEC will prevent the rebuilding of oil inventories that the world needs, CGES contends: "Even with relatively low demand growth, the world will enter the winter of 2001-02 with stock cover just 1 day higher than at the start of this winter."

CGES reckons that, although oil prices may ease slightly over the summer, they will strengthen again near yearend as stock cover falls again.

"To avoid a serious slowdown in economic growth, the world needs oil prices below $20/bbl, but OPEC appears determined to keep them at $25/bbl," CGES said. "Eventually something will have to give."

More cuts later?

But another top OPEC-watching analyst sees a very real possibility of still further cuts on the horizon.

Middle East Economic Survey reports that OPEC officials have had an eye on the situation with Iraqi oil exports all along in the weeks leading up to the reduction announcement.

MEES cited comments by OPEC officials "that, if there were to be no serious production cut beginning in February, there would be a counter-seasonal stock-build in the first quarter, followed by a larger stock-build in the second quarter, leading to a serious decline in prices."

And Iraq remains a wild card. Baghdad had halted exports Dec. 1 in a dispute with the UN over a surcharge it sought to impose on tanker liftings that was not part of the UN-brokered oil-for-aid sales program. That slashed Iraqi production to 1.2 million b/d in December from 2.7 million b/d in November.

Given the status of Iraqi supplies and the production cut by the rest of OPEC, MEES estimates the potential first-quarter stock-draw at 900,000 b/d: "However, if Iraq returns to the market any time soon with the normal range of production of over 2.5 million b/d, this would more than offset the inventory draw-down that OPEC was hoping to create, necessitating a further cut in production in order to defend prices.

"Until Iraq returns to the market-and when that might be is anyone's guess-the OPEC 10 will have little choice but to proceed independently of Baghdad, because they are as much in the dark as anyone else."

Given the predilection that Saddam Hussein has for tweaking the US and UN, Iraq is likely to remain a wild card for the market in the months to come. It would be surprising if Saddam did not try to test the resolve of the incoming administration of Pres. George W. Bush. That, in turn, could see any production cuts by the OPEC 10 rolled back swiftlyand even the threat of a greater Iraqi supply disruption could add a premium to oil prices, propping them up by another dollar or two regardless of physical supply-demand fundamentals.

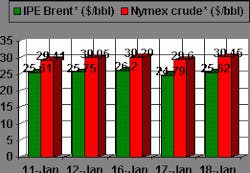

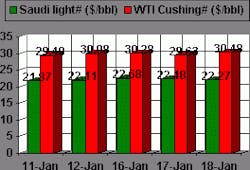

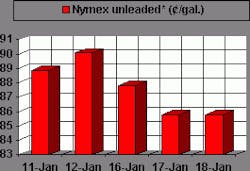

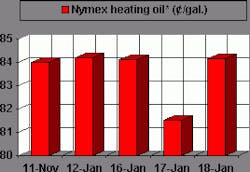

OGJ Hotline Market Pulse

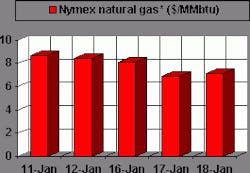

Latest Prices as of January 19, 2001

null

null

Nymex unleaded

null

Nymex heating oil

null

IPE gas oil

null

Nymex natural gas

null