Gas prices cool off briefly, but it's just the calm before the storm

Overheated US natural gas prices finally have cooled off a bit, thanks to a forecast of warmer-than-expected weather in the US Midwest.

But look at the levels from where they are cooling off. Just as jaw-dropping as the ascent to more than $9/Mcf this week on the heels of the arctic express that blanketed most of the US early this week was the stunning drop of $1.27/Mcf the day after natural gas futures on the New York Mercantile Exchange reached that historic high.

Spot prices rode the same rollercoaster, as the national average composite spot price for the week ended Dec. 8 soared more than $2 to $8.09/MMbtu from $5.96/MMbtu the week before and $2.08/MMbtu the same time a year ago. But a sharp drop is expected in the composite spot price this week.

The price rollercoaster has been so wild of late that the exchange has begun routinely calling a halt to trading on the upside as well as the downside.

The 13% plunge in the NYMEX January contract closing price was the biggest 1-day drop in more than four years on the exchange. It brought the contract to a close of a still-whopping $8.15/Mcf Dec. 12, but the slide continued through Thursday, when the contract closed at $7.54/Mcf. That's a drop of almost $2 in 3 days.

The abrupt price softness doesn't just stem from a rise in temperatures, contends UBS Warburg. The analyst thinks the market itself is starting to get paranoid about government intervention over the wild price spiral for natural gas.

"Though some are blaming the decline on the moderating temperature outlook, we believe key drives of the correction are growing fears of government regulation and increasing numbers of industrial/commercial shutdowns," UBS Warburg said.

But don't start prodding the bears just yet. The National Weather Service has forecast another wave of frigid weather across the US next week. And natural gas storage is still extremely low. For the week ended Dec. 1, natural gas in storage totaled 2.43 tcf, the lowest level at the this time of year since the American Gas Association starting tracking these numbers in 1993.

For the week ended Dec. 8, industry pulled 158 bcf from storage. This is more than double the 73 bcf withdrawn the prior week and the same time a year ago and compares with a drawdown of 49 bcf in the same week in 1998. And so the record low number for natural gas storage stood only a week, plunging to 2.27 tcf. That compares with 2.9 tcf the same time a year ago, a prior 3-year average of 2.8 tcf, and a prior 6-year average of 2.7 tcf.

Last week's 158 bcf drawdown pushed the year-to-year storage deficit to 588 bcf, compared with year-to-year deficits of 503 bcf and 499 bcf the preceding 2 weeks. UBS Warburg expects the deficit to rise to over 600 bcf this week.

Cambridge Energy Research Associates predicts that, if its expectations of December storage withdrawals continue to be realized, the gas market wil begin the new year with inventories at a record low of 1.85 tcf. That's a decline of 650 bcf from the beginning of this year.

"This deficit will reverberate throughout the gas market next year and probably beyond," CERA said. "Indeed, the enormous increase in storage injections that is likely to be required next summer would keep the pressure on gas markets throughout 2001, although prices will fall off of the extreme winter peaks."

Accordingly, CERA expects Henry Hub gas will average $5.50-6.50/MMbtu next year-also a record high.

But the price spikes owe to more than just low inventories. The lack of available pipeline capacity in the US is the main culprit in gas prices on the West Coast and in the US Northeast reaching staggeringly high levels. Both regions have reported daily prices peaking above $20/MMbtu. The shortage of gas in California has become so severe that prices over $40/MMbtu have been reported.

"If sustained, these price levels will induce a political reaction that will shake the industry," CERA warned.

Government intervention?

There is something to be said for CERA's and UBS Warburg's expressions of concern over government intervention. The Senate energy committee this week called a number of industry officials in for testimony over the stratospheric level of natural gas prices and concerns over possible curtailments.

Although there was no hue and cry for government intervention yet, UBS Warburg saw the temporary price respite as a healthy development for the gas industry.

"Beyond evidence of further industrial/commercial 'demand destruction' this week, we note that any sustained period of exorbitant prices would likely trigger governmental intervention similar to that in US power markets."

The US finally has a president-elect, one who faces the ire of a constituency sharply divided-with at least half in opposition to him-and the specter of a Congress also split almost virtually down the middle.

President-elect George W. Bush will be inaugurated at a time when the heating season typically gets under way in earnest, and the half of his constituency already unhappy that he is the one taking the oath from the Chief Justice no doubt will remember his energy industry ties when gas futures top $10/MMbtu nationwide and goes to who knows where in California.

So there's no connection between Bush's victory and high gas prices, you say? One will be made, rational or not, leaving him in a tough spot to deal sensibly with the issue. If the industry wants to see a positive response to this crisis-greater access to federal lands, an Alaskan gas pipeline, drilling incentives, added Lower 48 pipeline and storage capacity, expedited permitting for LNG terminals, etc.-it has to step up and state its case clearly and unequivocally now. Waiting for a new energy secretary or new president to run with the ball may put the industry too far behind in the game.

Remember a regulated gas market? Remember price tiers? Take-or-pay lawsuits? The gas bubble?

Do you miss them?

OGJ Hotline Market Pulse

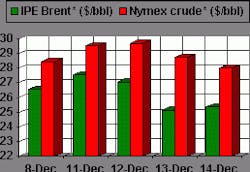

Latest Prices as of December 15, 2000

null

null

Nymex unleaded

null

Nymex heating oil

null

IPE gas oil

null

Nymex natural gas

null