OPEC's oil market schizophrenia: hike or cut?

Not to denigrate mental illness, but oil markets today seem to be as schizoid as the US electorate in the presidential race.

Despite some bearish signals, oil prices have trended north of $35/bbl this week. Panic continues to mount about heating oil supplies, although production is at a record high and stocks are showing signs of rebuilding. OPEC is being pressured to boost oil production and may yet do it again before long but at the same time is mulling a production cut.

The rollercoaster state of the oil market today tends to lend credence to OPEC's claims that the group's production levels are not the only-perhaps not even the chief-determinant of oil prices. Futures oil prices on the New York Mercantile Exchange continue to hover near $35/bbl today, down slightly from the over-$35/bbl levels seen earlier this week. This reduction of heat in oil prices is largely a market response to OPEC officials trying to "spin doctor" the week's earlier comments out of Vienna about a possible production cut on the horizon.

Some interpreted those earlier comments as an abandonment of OPEC's pledge (especially Saudi Arabia's) to keep oil prices at $22-28/bbl, and prices tracked upward about $1/bbl since the OPEC meeting. Overall, oil prices are up more than $2 since the first of the month.

But OPEC was simply stating its case that there are adequate supplies of oil on the market, regardless of what oil prices would indicate otherwise. The problem, the group's officials continue to emphasize, lies with shipping and refining bottlenecks and inadequate stocks of key products-namely heating oil. Putting more oil onto the market now will do little to ease oil prices now, their argument goes, because upward price pressures stem from speculators and infrastructure problems, not crude availability. Instead, pouring more oil into a market that may already be saturated with come the end of the heating season could trigger another oil price collapse next spring. Hence, the growing sense of urgency over reducing crude oil supply in the near term.

In their spin-doctor efforts, Saudi Arabia and Algerian officials sought to reassure consuming nations that there was no sudden born-again price hawkishness affecting the entire group, that in fact, there remains fealty to a long-term equilibrium price of $25/bbl.

But traders keep looking at the persistant inability of US oil inventories to rise appreciably, despite OPEC's fourth production increase of the year (and the culprit here may be a lack of tanker availability). Their jitters continued with the approach of the deadline for the renewal of the UN-brokered accord with Iraq calling for the sale of otherwise sanctioned oil to raise funds for humanitarian needs in Iraq. Speculation has run rampant that the latest wave of violence in the Palestinian-Israeli struggle might prompt Iraq to instigate some sort of boycott against consuming nations that support Israel; even a unilateral boycott by Iraq could take more than 2 million b/d of oil off the market. While Saudi Arabia alone could probably cover that amount with its spare productive capacity, such a move would effectively leave the world without an oil supply cushion. Oil supply would thus be strained to capacity, and the price of oil would reflect supply at the margin-probably to the tune of more than $50/bbl.

Why, then, are OPEC's production increases not denting the upward pressure on oil prices? First, there remains the question of just how much actual supply has accrued from those announced increases. As London-based Centre for Global Energy Studies points out, the numbers OPEC has touted-3.7 million b/d at last report-largely reflected this year increases in quotas only. In many instances, OPEC members were already producing over quota, so the new quota numbers tended to simply represent an effort to bring quotas in line with new production levels. With this in mind, CGES reckons that the actual increase in oil supply resulting from these announced changes is really only about 1.5 million b/d.

Given the increase in oil demand from a year ago of about 1.5 million b/d, the seasonal uptick in demand of more than 2 million b/d, and the increase in non-OPEC supply this year of less than 1.5 million b/d, it's not surprising that inventory stockdraws throughout the year have hobbled efforts at building stocks for the fourth quarter. Had OPEC actually produced that incremental 3.7 million b/d of oil this year, markets would now be oversupplied and stocks would be building toward a potentially precipitous overhang for the second quarter of next year-even with a return to cold winter weather. But the problem now lies with inadequate stocks, especially of heating oil and inadequate infrastructure. So it serves little purpose to beat up on OPEC about its production levels now-except, of course, for the obligatory political grandstanding from the Clinton administration. That's because another production hike would do little to help oil supply next year but perhaps a lot to hurt oil prices-and it would do nothing to help consumers in the US Northeast with their heating oil bills this winter. However, some OPEC officials have reiterated a commitment to boost supply a fifth time, in case of a severe winter or a supply disruption. This is purely intended to mollify jittery markets, but, again, will have little effect on heating oil supplies or prices.

In fact, there is every reason to believe that, if OPEC does not roll back at least 2 million b/d of its increased production in the seasonally slack second quarter, that $22-28/bbl price range will just look like wishful thinking.

OGJ Hotline Market Pulse

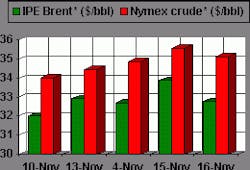

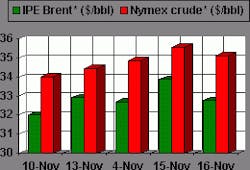

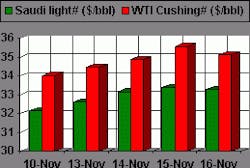

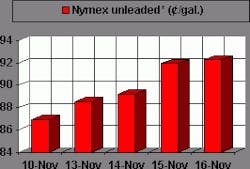

Latest Prices as of November 17, 2000

null

null

Nymex unleaded

null

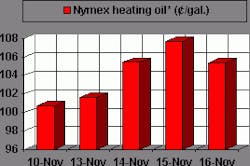

Nymex heating oil

null

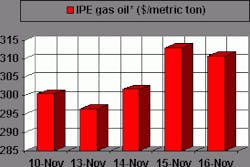

IPE gas oil

null

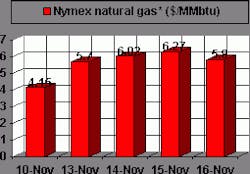

Nymex natural gas

null