Another OPEC production increase has been approved, and the market has essentially just shrugged it off.

When OPEC Pres. and Venezuelan Energy and Mines Minister Ali Rodriguez Araque on Oct. 30 called on fellow OPEC members to boost production in accordance with the price-band trigger, there were already such moves under way. That trigger, timed for when the price of a basket of OPEC crudes exceeded $28/bblf for 20 consecutive days, was squeezed Oct. 27. The UAE and Qatar already announced plans to boost production. In keeping with the price band mechanism, OPEC officially agreed to boost production by 500,000 b/d effective Oct. 31. The result? A decline of a few cents in the December crude futures contracts on both the International Petroleum Exchange and the New York Mercantile Exchange, followed by a brief upturn. Next-month oil futures on both exchanges yesterday closed within 20

So what gives? Part of the market indifference to OPEC's fourth production increase in the past year stems from concerns over the escalating violence between Israelis and Palestinians (more specifically, concerns over whether rising Arab anger toward Israelis will manifest itself in such a way as to possibly disrupt oil supplies). Another concern remains the possibility of fresh mischief from Saddam Hussein. Then there is simply the credibility factor: Can OPEC, other than Saudi Arabia, provide the 500,000 b/d promised?

In order of these issues, there is always a possibility that Arab anger over the Israel-Palestine conflict could result in another oil embargo, but that's a slim one. The Persian Gulf nations recognized the foolhardiness of such a move, given their concern over existing consumer antipathy toward OPEC over high oil prices in parallel with efforts through the Kyoto Protocol to halt and even reverse the growth in consumption of fossil fuels for over (spurious though they may be) environmental concerns. The Saudis and Kuwaitis in particular do not wish to be seen as unreliable suppliers spurred into such action by political events, given the US-led coalition that drove Saddam from Kuwait. The heated rhetoric from some Persian Gulf nations notwithstanding, most the world seems to regard the Israel-Palestine conflict with weary exasperation after all these years. AS WEFA Energy Services puts it, "It now appears as if the Israeli-Palestinian political relationship will settle into a cycle of relatively low-level violence, with occasional shootings and suicide bombings followed by Israeli retaliation. The impact on oil markets will gradually wear off as traders become inured to the violence, rather like too many others. However, exceptional levels of casualties could briefly renew price pressure, given the lack of spare capacity in OPEC.

"And perhaps, like Colombian rebels, the suicide bombers will adopt the Willie Sutton rule ('That's where the money is') and attack some oil facilities, such as the trans-Saudi pipeline. In such a case, expect a much stronger market response as companies seek to increase crude inventories against either shortages or the possibility of worse attacks.

As for Iraq, while the flap over Iraq getting paid in euros instead of dollars proved a bit of a red herring, there were other truculent comments made in recent days that has markets fretting about the possibility Saddam may decide to pull crude supplies off the market in December, when the UN-monitored oil-for-humanitarian-aid sales are up for renewal.

WEFA Energy Services sees this prospect as "quite real," but the analyst is not especially concerned: "Partly due to the UN's tendency to approve the new phase at the last minute, not allowing time for contracts and tankers to be arranged, there have been repeated export drops. However, these are not regular, having occurred three times in the past eight phases. Somo, the Iraqi National Oil Corp.'s marketing arm, has already approved contracts for more oil sales than it can deliver under the old phase, effectively covering most of December. Thus, the delays could prove to be minimal."

As for the issue of spare capacity, most of OPEC's roughly 2 million b/d of spare capacity resides with Saudi Arabia-and to a lesser extent the UAE. No one is more committed than the Saudis to keep oil prices for spiraling out of control. However, the pledge to make up any shortfall by its OPEC compatriots in meeting market demand is more of an effort to "talk down" the market, says WEFA, noting that there are limited takers for the added volumes of relatively heavy crude that Saudi Arabia would put on the market.

What we end up with is a market that is largely driven by the status of inventories, which have been at historic lows this year.

"As in the past few months, crude inventory growth has lagged as refinery throughputs are extremely high and deliveries have grown, particularly for middle distillates, suggesting some downstream (and unmeasured) stockbuilding," WEFA said. "

This may ease some of the concerns for heating oil stocks heading into the winter heating season, but it also suggests a crude oil market highly susceptible to volatility in the months ahead.

Someone plotting a crude oil price graph over the next several months could compare it with a chart for an ailing patient's heart rate: It would probably lookas if a doctor had prescribed a regimen of irregular defibrillation.

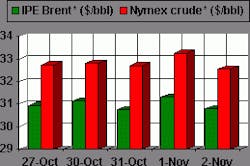

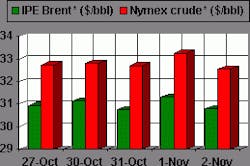

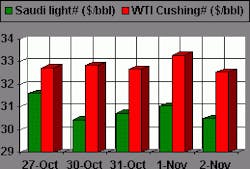

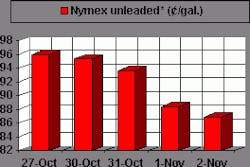

OGJ Hotline Market Pulse

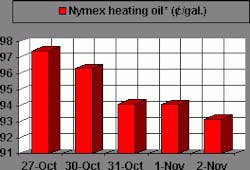

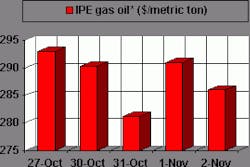

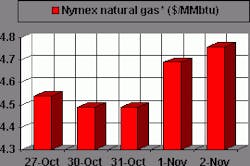

Latest Prices as of November 3, 2000

null

null

Nymex unleaded

null

Nymex heating oil

null

IPE gas oil

null

Nymex natural gas

null