Industry getting word out about the why of high gasoline prices

The industry is finally starting to get the word out about high gasoline prices-most notably the debacle in the Midwest.

It's not a moment too soon, given the silliness issuing forth from Washington in past week or so on this issue. Perhaps the silliest of all was also the penultimate in spin doctoring from Al Gore, who has certainly learned his lessons well at the feet of his master. Earlier this week, Gore denounced the plans for a federal investigation of his questionable fund-raising tactics a year ago (remember the Buddhist nun with the wads of cash?) as nothing more than a smokescreen, engineered by Republicans with the intent of diverting attention away from George W. Bush's ties to the oil industry at a time of high gasoline prices.

Wow. Spin doctoring two issues from opposite ends of the same statement and getting them to intertwine. The chutzpah of that statement takes one's breath away.

No sense in wasting space here to recount all the foolish statements and idiotic legislative proposals of the past week, much less the "serious" efforts such as Clinton calling out the FTC hounds on oil companies to get to bottom of all this.

As industry studies and testimony have amply demonstrated in the past week, and in the immortal words of the illustrious pundit Pogo: "We have met the enemy and they is us."

Because the gasoline price increases of recent months have outstripped those of crude oil prices, the popular and superficial reasoning has been to conclude that said price hikes have been "unfair and inappropriate" and likely the result of collusion or price-fixing among the oil companies."

Were it that simple. In a recent study, the Petroleum Industry Research Foundation Inc. (PIRINC), focused on the factors contributing to gasoline price increases across the US and in the hardest-hit areas of the Midwest. PIRINC concluded, "Apart from higher crude prices and low stocks, other domestic factors include the problems associated with the introduction of more-stringent, Phase II reformulated gasoline (RFG). These have inhibited both domestic production and imports. The Unocal patent infringement case further inhibited supply. Disruptions to the logistics system, notably pipelines serving the Midwest, and problems of blending ethanol as opposed to MTBE in making Phase II gasoline contributed to price spikes in parts of the Midwest.

"Each of these domestic factors individually had only a minimal impact. But together, they produced a noticeable shortfall in supply of an extremely price-inelastic product and therefore a sharp increase in gasoline prices.

"As these problems are overcome, prices are already beginning to moderate. However, until inventories are rebuilt, the system remains vulnerable."

As straightforward and comprehensible as this explanation is, however, it does not make for as effective a sound bite as "Consumers are getting gouged (or my personal favorite, 'Gored') at the gasoline pump, and oil companies are enjoying record profits."

Let's face it, it's a lot easier for the average citizen to comprehend such good guy-bad guy simplifications than it is to appreciate even the most rudimentary lesson of Economics 101: If demand exceeds available supply, price serves to alleviate a shortage.

Sobering message

PIRINC's new study details how all these disparate elements came to pass and then evolve into a full-blown public relations crisis for the oil industry.

But the more-sobering subtext of PIRINC's message is that the worst may be yet to come.

"While this summer's immediate gasoline problems are easing, they highlight serious regulatory issues that remain with us," the New York think tank said. "None of the individual problems contributing to the national-and especially local-gasoline price run-ups were major in and of themselves. However, they came together in the context of a tight global oil market. This condition may persist for some time."

PIRINC contends that the regulatory system currently in place adds significantly to national and local vulnerabilities.

"The multiplication of 'boutique' gasolines reduces the flexibility of the distribution system to respond to local supply problems. When they do develop, the regulatory authorities are then faced with a choice of going back on their standards, at least temporarily, or standing by and accepting the inevitable, necessary price spikes," PIRINC said. "If standards are waived, then those in the industry who made the greatest effort to meet the standards are penalized relative to those who did the least. Creating a 'no good deed goes unpunished' precedent sends exactly the wrong signal for future compliance efforts."

And count on the next wave of regulatory initiatives to re-create the same set of Hobson's choices. EPA and a number of states are working on a phase-out of MTBE over the next 3 years-penalizing those who invested to produce the stuff to meet air quality standards in the first place. So what is the No. 1 choice to replace MTBE? The very same ethanol that was at the center of this year's debacle in the Midwest-so count on even more disruptions in the future.

As PIRINC notes, "The requirement for the use of an oxygenate is itself questionable, since vehicles with fuel injection instead of carburetors (fuel injectors have been in use since 1983) don't need it. California, the country's leader in fuel stringency, has asked that the oxygenate requirement be waived.

"There is no argument about the need to improve local air quality and that vehicle emissions will continue to be a legitimate, prime target of regulatory concern.

"But recent price developments are an urgent signal of the need to reassess the process in view of the supply risks associated with the present system, especially if tight global market conditions persist."

Well said. Now, what is the likelihood that the Clinton administration would undertake said reassessment of its own policy and process vs. continuing to bash the oil industry-itself hardly a winner in a public popularity contest-over high gasoline prices?

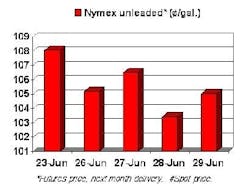

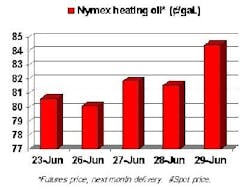

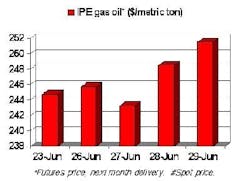

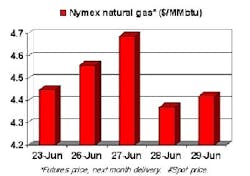

Some in Washington think energy will fade as a campaign issue in the fall, once gasoline prices have slipped back down. Not so fast. Traders are already notching up big gains for later-month contracts for heating oil, as a worsening shortage in inventories looms there (and that situation just got worse with the fire and subsequent shutdown of a big Kuwaiti refinery that is a major supplier of distillate). Natural gas futures are setting records and poised to eclipse the $5/MMbtu mark (which is mostly being felt just by power plants and industrial users now, but the odds are increasing that the weather forecasters will finally get it right this winter about a return to normal temperatures) and could go sharply higher in the fourth quarter. And many are predicting a rash of brownouts and blackouts across the US later this summer, which is expected to be warmed than it was last year.

It wouldn't be surprising to see these developments add up to a mosaic of concern over energy supplies-not just high energy prices. Whether that translates to pressure for an energy policy that works or just to another round of industry bashing and more of the same lack of focus or initiative on energy issues-if not new barriers and constraints-may just depend on how good a job the industry does in getting its side of the story told in the public arena.

OGJ Market Hotline Pulse

Price June 30,2000

null

null

null

null

null

null