IEA-OPEC debate over oil prices gets testy ahead of OPEC meet

The debate over high oil prices is getting a bit testy the week before the OPEC meeting in Vienna.

Not long after a couple of US senators proposed rattling the SPR "sword" at OPEC in order to leverage some more oil production out of the exporters group, we now have the unseemly spectacle of the leaders of the respective world's biggest oil-consuming and oil-producing organizations exchanging cross words at the world's most prominent (at least in terms of dignitaries) oil conference.

OPEC lashes out

At the World Petroleum Congress this week, Rilwanu Lukman, OPEC secretary-general blasted government tax policies that he contends are really to blame for high gasoline and heating oil prices. Lukman pointed out that consumers didn't get to benefit from low oil prices because governments exploited the opportunity to hike taxes on refined products. By way of example, he noted that the UK hiked its tax take on refined products to $96/bbl during 1999-while crude oil prices were in the doldrums at $10/bbl-from $80/bbl in 1997 and $64/bbl in 1995. He also noted that taxes account for more than two thirds of the pump price of motor fuels in the European Union and that EU governments earn triple the revenues that producers get from the sale of crude oil.

But perhaps his most telling argument was one that just doesn't seem to be getting enough play these days: OPEC will have to invest billions of dollars to develop the reserves needed to meet rapidly escalating oil demand in the future.

The subtext here seems to be: Higher oil prices now are justified as a de facto "tax"--or investment, if you want a fuzzier term-on consumers to fill their future oil needs. At least consumers will get a "return" on their "investment"--expanded future oil supply availability that helps avoid a really serious oil shock later, thus moderating oil prices over the long term. Compare that motivation, Lukman seems to say, with a greedy government that takes advantage of a temporary collapse in a commodity price to underwrite its own profligate spending.

He certainly has a point, especially if you take the subtext down to a deeper layer: All the stereotypes about wealthy sheikhs notwithstanding, someone is going to have to pony up the cash to find and develop the oil reserves to meet oil demand in 2010 (or 2020, for that matter). And rest assured that if all that incremental oil must come from the remaining non-OPEC supply sources, it will have to take gigantic sums of money invested in ultradeepwater, arctic, environmentally sensitive, oilsands, oil shale, and synthetic fuels. For that to happen, the world needed to have already embarked on a mission with a Manhattan Project scope and a near-religious-crusade fervor, as well as invest huge sums in alternate energy sources and conservation measures. And it will take an assumption that crude oil prices will remain above $30/bbl, in real terms, for the foreseeable future.

Oh, wait. We already did that. And it bombed, big time.

Peel away still another layer, and the almost-subliminal subtext is this: Despite progress in the Middle East peace talks, the region remains unstable. To wit: the escalating tensions between moderates and fundamentalists in Iran, the still-explosive Palestinian issue, the new power vacuum in Syria and Lebanon, the restive Kurds, and, above all, Saddam. A cash-strapped Saudi Arabia, Kuwait, and UAE and the consequent domestic instability in such nations are not good things to have if one wants an abundant supply of cheap oil to last pretty much until solar or hydrogen or whatever water-into-wine alternate energy solution finally makes fossil fuels obsolete later this century.

IEA lashes back

The amicable relations between IEA and OPEC that prevailed when oil prices were low seem to have faded.

IEA Executive Director Robert Priddle responded to Lukman's comments by griping about how OPEC is trying to manage the market.

Consumers can't be expected to accept production control through collusion, he said.

(I guess collusion is okay, though, when consuming nations seek to control supply, which is the basis upon which the IEA was founded.)

Priddle, in rejecting Lukman's suggestion that producers and consumers cooperate along the lines of OPEC and some key non-OPEC exporters (Mexico, Oman, Russia, Norway, Malaysia), says this approach implies that consumers could offer security of demand in exchange for security of supply. But he contends that consuming-nation governments cannot affect demand to such an extent. (Although Lukman might have countered: But what would the elimination of energy or fuels taxes do to demand?)

Priddle also maintains that fuels taxes don't affect prices receive for crude oil. Technically, he's correct. But it is the high price of gasoline and diesel that is, in fact, driving the crude market right now-and a fuels tax holiday would sharply reduce fuel prices and might well take some heat out of the crude oil market.

Still, Priddle has a point when he criticizes OPEC's new price-band rule as flimsy, covert, and unenforceable. It certainly would help cool markets if OPEC could make this process-entailing an automatic 500,000 b/d supply increase or decrease when the price of the OPEC marker basket of crudes strays outside a band of $22-28/bbl for at least 20 days-more transparent. While that upper-limit test has been met, nothing happened-although indications are that OPEC cheating has already put that much more oil on the market.

What happens June 21?

All of this testiness aside, what's going to happen in Vienna on June 21? Well, there is little doubt that Iran-joined probably by Algeria and Libya-will fight a Saudi-led effort to boost production.

An intriguing side note to this battle will be the EPA's investigation of the gasoline price spike in the US Midwest (someone please explain to me why an environmental agency has suddenly become an expert on commodity markets). Although the refiners have offered explanations about the switch to summer reformulated gasoline, low stocks, and refinery and pipeline outages, EPA has foreshadowed the result of its own investigation by saying it's not buying those explanations.

(Given EPA's own role in the problem stemming from its ever-tightening fuels specs, this situation is reminiscent of Claude Rains as the Vichy police chief in the movie Casablanca, exclaiming amid an SS raid on an illegal casino that he is shocked, shocked to find gambling going on here, as he discreetly pockets his own winnings.)

OPEC will certainly be looking at the denouement of this little drama to validate Lukman's assertions about consuming nations' own complicity in high fuel prices.

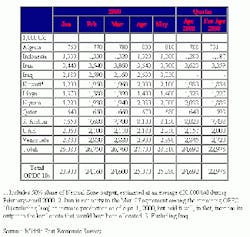

But what probably will happen will be a Saudi "victory" in which OPEC carries out its "commitment" to boost quotas by 500,000 b/d. One look at the table below shows that the extra 500,000 b/d is already there. Iran will refuse to sign this agreement, but increase its production, anyway-as much as it is capable of. The others who can follow suit in OPEC also will do so, with Saudi Arabia, Kuwait, UAE, and Venezuela probably showing the most restraint because they have the greatest ability to affect the market.

And the effect of this, although it won't put all that much more crude on the market, will be largely psychological, especially coinciding with the likely peaking of demand related to gasoline stock replenishment ahead of the July 4 holiday in the US. IEA is already ratcheting down its estimate of oil demand this year because of higher prices and increasing its estimate of non-OPEC supply (mainly the former Soviet Union).

So, oil prices are likely to drop back below $30/bbl and inch toward $25/bbl or so as the summer winds down.

Then comes the fall and, with his eye on the US presidential election race, Saddam's October surprise.

OPEC production, quotas

null

OGJ Hotline Market Pulse

Latest Prices as of June 16, 2000

null

null

Nymex unleaded

null

Nymex heating oil

null

IPE gas oil

null

Nymex natural gas

null