OPEC's Mar. 27 meeting ultimate outcome: long-term oil market stability?

Oil markets are approaching what may well prove to be one of the most pivotal OPEC meetings in history.

A great deal is at stake for the oil industry, OPEC, non-OPEC exporters, and consuming nations, depending on the outcome of this meeting, scheduled for Mar. 27 in Vienna. What's really at stake, however, is more than merely the numbers game involved in postulating near-term supply-demand and oil prices. The fundamental lesson we will learn from this meeting is whether OPEC has achieved the kind of credibility needed to assure stable oil prices for the foreseeable future. If it has, then that becomes a self-fulfilling prophecy: oil prices are likely to stay stable for the foreseeable future. That has enormous implications for the global economy, alternative fuels, Middle East geopolitics, and the prospects for the Kyoto treaty on climate change.

Backdrop

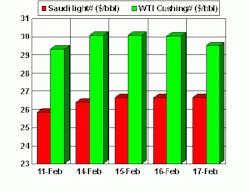

Oil prices have broken the crucial psychological watershed for producers and consumers alike this past week: $30/bbl. Coupled with the latest numbers on stocks and the US government's recurring hints of intervening in markets because of the hysteria over heating oil in the Northeastern states, the pressure is increasing on OPEC to do something to ease the upward drift in oil prices.

But OPEC in the past few weeks has been resisting that pressure and instead hinting at actions that could effectively boost oil prices still further, beyond the Persian Gulf crisis high of $32/bbl en route, at least briefly, to the stratospheric, near-$40/bbl level seen in the early 1980s. OPEC Sec. Gen. Rilwanu Lukman this week said that OPEC needs to "exercise caution" in considering a possible increase in oil production, in order to not "destabilize the market, now that we have good prices." Kuwaiti Oil Minister Sheikh Saud Nasser al-Sabah refuted reports about a possible OPEC decision to increase oil production at the Vienna meeting: "We are not backing down on the agreement. Our position is clear

Meanwhile, the Clinton administration continues to insist it does not intervene in markets out of one side of its mouth-while holding out "as an option" the possibility of releasing SPR oil in order to soften the heating oil price spike (note that no one thinks of it as a supply crisis, just a price crisis) out of the other side of its mouth. Such doublespeak itself is a back-door manipulation of markets, as Clinton himself demonstrated in his comments this week about OPEC that bespoke a keen awareness of oil market psychology.

OPEC compliance with its pledged production cuts has wavered a bit in recent weeks, with the compliance rate dropping to 76% in January vs. 78% in December. While some analysts like to point to this as a sign of continuing erosion in OPEC discipline, the fact that the market is looking at $30/bbl while stocks continue to be drawn down at a rate of well over 2 million b/d suggests otherwise. More likely is that, as they agreed, Saudi Arabia, Venezuela, and others found ways to make a bit more oil available in December out of concern for a Y2K bug-related supply shortfall. And Iran was trying to make up for some below-quota production earlier in the seasons. That hardly constitutes a breakdown in discipline.

So everybody insists that OPEC must increase production rather than extend production cuts in order to avoid severe economic consequences-not to mention damage to its markets. There are already noteworthy signs of demand slippage and non-OPEC supply increases in the months to come. The International Energy Agency trimmed its estimate for oil demand this year by 300,000 b/d to 77 million b/d (which is, in turn, a 2.4% increase in demand from revised 1999 data). The IEA also boosted its estimate of 2000 non-OPEC production this year by 200,000 b/d to 45.6 million b/d (which represents an increase of 2.5% from revised 1999 figures).

Scenarios

Yet OPEC continues to insist that it will continue to walk the tightrope between higher revenues and market damage. That's what makes this next meeting so crucial. If the organization can show it can deliver a "soft landing" for oil prices in the second quarter (when gasoline demand is already projected to up sharply in the US vs. last year), it can probably sustain oil prices at a level comfortable both for its members and for consuming nations for the rest of the year. Once that has been accomplished, a new watershed of confidence in the outlook for oil price stability will have been established. There are other factors pointing in that direction already. The IEA issued a welcome contrarian report last week that shows that the recent more than doubling of oil prices in the past year is not excessive, when viewed historically, and still has not shown signs of crimping economic growth. When adjusted for inflation, a price of more than $25/bbl for Brent works out to about $7.52/bbl in 1972 dollars. That compares with an inflation-adjusted price of $5.25/bbl in 1972 for 1999's average Brent price of a little less than $18/bbl.

IEA noted that oil imports now represent only about 4% of the total value of IEA member country imports, compared with about 13% in the early 1980s. While that points to the role of rising oil prices in the inflationary times of the early 1980s, it also suggests the growing importance of global trade reforms and the expanding role of the service sector-which is much less influenced by rising energy costs than is the manufacturing-industrial sector-in the economies of developed nations. In other words, higher oil prices are just not as damaging to the global or most individual national economies as they used to be.

In an aside that certainly cheered OPEC, IEA said, in so many words that, if consuming nations are so concerned about the effects of higher oil prices to consumers, they should look first to reducing taxes on oil products, which in many IEA member countries constitute the lion's share of an oil product's cost, rather than put pressure on oil-exporting nations to reduce the price of crude oil.

Not a bad idea. How about a tax holiday for heating oil this winter? And another for gasoline when the summer driving season starts? (Don't hold your breath.)

As stated here before, Iraq may well provide the catalyst for OPEC to engineer the soft landing markets are looking for. Saddam has been caught smuggling oil because higher oil prices have spurred him to smuggle as much as possible (unlike the UN oil-for-aid sales, Saddam gets to keep every petrodollar of the smuggled oil revenues). Iraq also is blustering more defiance on arms inspections and threatens to cut off the oil-for-aid sales if its demands aren't met. Don't be surprised if such a cutoff comes in the next few weeks. That could spike oil up well into the mid-$30s, providing a bonanza for Smuggler Saddam.

The perception of this turn of events might spur the US to make a move toward releasing SPR oil; meanwhile, frantic whistlestopping by Sec. Richardson to Riyadh and other OPEC capitals might just convince the Saudis and others to undertake a preemptive increase in production-in light of the Iraqi-spawned "supply crisis"-just ahead of the Vienna meeting. Then, at the meeting, OPEC simply rolls over the new production levels as its new quota. Thereafter, it incrementalizes supply up or down from quarter to quarter for the rest of the year, setting the precedent of supply and thus price stability.

Sound far-fetched? Then take comfort in the words of Saudi Arabia's oil minister, Ali I. Naimi: "Oil prices have peaked now" and would fall into a range of $20-25/bbl when the peak demand season ends. Certainly sounds like a prediction of price stability to me.

OGJ Hotline Market Pulse

Latest Prices as of February 18, 2000

null

null

Nymex unleaded

null

Nymex heating oil

null

IPE gas oil

null

Nymex natural gas

null