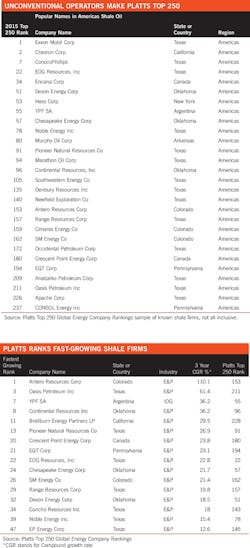

Unconventional oil, gas operators moving higher Platts Top 250 Global Energy Company Rankings

Producers working various US unconventional plays were among the fastest-growing companies as reported by Platts in its latest Top 250 Global Energy Company Rankings, announced during October by the global energy and commodities information provider.

The rankings, now in the 14th year, were unveiled to more than 300 energy executives at an annual dinner in Singapore hosted by Platts and held in partnership with Singapore International Energy Week.

The Platts Top 250 rankings reflect the financial performance of publicly traded energy companies with assets greater than $5 billion, and are based on a combination of asset value, revenue, profit, and return on invested capital (ROIC) for fiscal 2014.

Exxon Mobil Corp. retained its top slot for the 11th consecutive year while integrated oil majors made up only half of the Top 10. Two refining and marketing companies-Phillips 66 and Valero Energy Corp. -joined the Top 10 in 6th place and 8th place, respectively.

Phillips 66 climbed from its previous ranking of 13th place and also retained its positon as the world's biggest refiner.

Shale retained center stage, helping to usher 113 Americas companies (89 US and 14 Canada) into the latest Top 250, Platts said. Despite a much lower price environment, unconventional operations in some US plays continue to evolve, Platts analysts noted.

For instance, production continues to grow in the Permian basin of West Texas and Mexico, and producers continue to knock down Permian costs, requiring fewer rigs for higher oil output.

Antero tops fastest-growing

Tight oil and shale producers figured among the worlds' Top 10 and Top 50 Fastest Growing energy company rosters, Platts said. Midstream and refining companies also figured among those lists.

Antero Resources Corp. of Denver ranked first in the Top 50 fastest-growing companies. Antero holds about 400,000 acres in the Marcellus shale. It was the first time for Antero to make the Platts rankings.

Unconventional plays and regional players continued to "upend the energy rankings," a Platts news release noted.

"Companies with advantaged, oil-rich shale acreage have been able to outperform the sector's average growth by operating at lower cost than the shale industry average," said Robert Perkins, a coauthor of a Platts analysis of the Top 250 Global Energy Company Rankings.

Gas utilities benefit

Even gas utilities like AGL Resources have benefitted from booming shale gas volumes moving through growing transportation infrastructure, specifically pipeline assets.

Platts noted that overall corporate growth rates for energy companies slowed to 7.3% from 10% on a 3-year compound growth rate. The fundamental and market data came from a database compiled and maintained by S&P Capital IQ, a unit of McGraw Hill Financial.

Companies (many of which directly or indirectly benefit from shale) shown in the Fastest Growing list, collectively enjoyed a combined 56% CGR, up from 46.8% the previous year (see table).

Some 128 of the world's Top 250 Global Energy Companies were electric utilities, gas utilities, independent power producers, multiple utilities, and renewable electricity producers, Platts said.

Utilities advanced in the 50 Fastest Growers list. All 10 of the highest-placed utilities moved higher in the Top 250, indicating reduced exposure to pure commodity price risk that these diversified and often partly regulated companies face, as compared to mid-cap oil and gas firms.