The Broe Group of Denver, a conglomerate that owns Great Western Oil & Gas Co., formed a joint venture with Canada's largest pension fund to buy Encana Oil & Gas (USA) Inc.'s Denver-Julesburg basin assets for $900 million.

Under the joint venture, Canada Pension Plan Investment Board (CPPIB) planned to own 95% with Broe Group owning the rest and overseeing daily operations. The deal, with an effective date of Apr. 1, was expected to close in the fourth quarter.

Encana agreed to sell all its D-J basin acreage, concentrated in southwest Weld County, Colorado. The 51,000-acreage (net) largely involved mature oil and gas assets with only 9,000 acres being undeveloped, an Encana 2014 annual report showed.

For 2015, first-half production was 52 MMcfd of natural gas and 14,800 b/d of crude oil and natural gas liquids from more than 1,600 wells, Encana said. The acreage is near Erie, Colo., where residents complained about noise. Encana and Erie city officials reached an agreement in August (see story p. 3 this issue).

Broe Group has D-J basin experience through its ownership of Great Western Oil & Gas of Denver. Claude Pumila, Broe Group chief operating officer and chief financial officer, said, "We think it's a good time to be a buyer of assets."

CPPIB said the D-J assets aligned with oil and gas investment goals. Separately in late September, CPPIB agreed to invest $745 million on a partnership with Wolf Instructure Inc. of Calgary to develop midstream projects in Canada (see story p. 14 this issue).

Avik Dey, CPPIB's head of natural resources in Toronto, told Bloomberg News that CPPIB found energy investments to be attractive.

"We think we can make returns through cycles, and right now there's a compelling opportunity to invest," Dey said.

Dallas Salazar, chief analyst for CapGainr.com wrote an Oct. 11 article for Seeking Alpha, saying the deal was favorable for Encana's ongoing debt-reduction efforts, and that it was equally noteworthy because of the pension fund's involvement.

"This type of non-traditional capital coming in to purchase the D-J basin assets might well lead to other asset offtakes by the massive Canada Pension Plan Investment Board," Salazar said.

Encana staying in Denver

Doug Hock, an Encana spokesman in Denver, said the company planned to keep its office in Denver and for now planned to keep its 800,000 acres and 3,495 wells in the Piceance basin.

Encana booked impairment charges of $3.6 billion for 2015 as of Nov. 15, including a third-quarter writedown of $1 billion to reflect downward asset-value revisions..

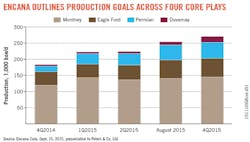

Doug Suttles, Encana president and chief executive officer, said the sale was in line with Encana's strategy of focusing on four core area: the Permian and Eagle Ford oil and gas shale plays in Texas as well as the Duvernay, and Montney shale gas plays in Canada.

The D-J basin deal follows earlier divestitures. Encana this year sold its Haynesville gas assets to GEP Haynesville LLC, a joint venture formed by GeoSouthern Haynesville LP and funds managed by Blackstone Group LP's GSO Capital Partners LP (OGJ Online, Aug. 25, 2015); and, along with Cutbank Ridge Partnership, certain natural gas gathering and compression assets supporting Montney development to Veresen Midstream LP (OGJ Online, Apr. 1, 2015).

Last year, Encana invested more than $10 billion to acquire assets in the Permian and Eagle Ford, with its purchase of Ft. Worth-based Athlon Energy Inc. (OGJ Online, Sept. 29, 2014); and assets from an affiliate of Freeport-McMoRan Oil & Gas LCC (OGJ Online, Oct. 8, 2014).

Combining all its announced deals this year as of early October, proceeds from divestitures in 2015 were expected to total $2.7 billion compared with Encana's goal of slashing $3 billion in net debt by Dec. 31.