Eagle Ford economic boost jumps to $87 billion

The Texas Eagle Ford shale supported more than 155,000 full-time equivalent jobs and provided more than $2.2 billion in revenue for local governments and the state in 2013, according to a study by the University of Texas at San Antonio (UTSA).

The shale play had an $87 billion economic impact across a 21-county region last year, compared to $61 billion in 2012.

"We just continue to be surprised to the upside with the Eagle Ford shale," said Thomas Tunstall, research director for UTSA's Institute for Economic Development.

The annual economic impact study is the fourth issued by the institute. Researchers analyzed counties directly and indirectly involved in Eagle Ford production.

They estimate that by 2023 the shale play will support more than 196,000 full-time equivalent jobs, yield more than $4 billion in government revenue, and generate economic output of $137 billion.

Last year, UTSA researchers forecast an economic impact of $89 billion for 2022, but that estimate was increased on the arrival of new manufacturing projects associated with relatively low-cost, US-sourced natural gas and plans for new processing, refining, and port facilities.

With US gas prices hovering near $4/Mcf, US manufacturers pay a fraction of what their counterparts pay for gas in Japan and Europe. In September, Tunstall told a Houston audience that gas prices are about $12/Mcf in Europe and $17/Mcf in Japan.

Low gas prices played a role in voestalphine Group's decision to site a $750 million steel plant in the Port of Corpus Christi, which lies 70 miles south of the Eagle Ford shale. Spokesman Matthias Pastl said gas is much more expensive in the company's Austria headquarters (UOGR March-April 2014, p. 10). The port will also be home to a $1 billion seamless pipe plant announced by TPCO America Corp.

San Patricio and Nueces counties are included in the study.

Climbing production

Eagle Ford shale oil and condensate production has ascended rapidly in recent years, rising to more than 1.1 million b/d in June 2014 from 580 b/d in 2008. Gas production from the play now exceeds 4 bcfd.

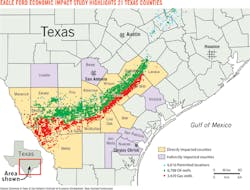

UTSA researchers examined an area that encompasses 15 core counties where Eagle Ford shale drilling is most prevalent, including: Atascosa, Bee, DeWitt, Dimmit, Frio, Gonzales, Karnes, La Salle, Lavaca, Live Oak, Maverick, McMullen, Webb, Wilson, and Zavala counties.

Also included were six nearby counties with play-related economic activity, but not significant drilling. These are: Bexar, Jim Wells, Nueces, San Patricio, Uvalde, and Victoria counties (see map p. 20).

Researchers found the shale play attracts more capital investment than any other shale play in the US. Tunstall said this year capital spending will range from $23 to $30 billion. The estimate is in line with a projection by the research and advisory firm Wood Mackenzie Ltd., which foresees play-wide capital spending of $27 billion.

The influx of Eagle Ford-related investment is evident in rural Bee County. Beeville, the seat of the county government, had a population of 13,000 in the 2010 census. Last year, researchers found, it permitted 330 new homes valued at $75 million and issued 19 permits for other construction projects valued at $2.5 million. Another $41 million was invested in well construction.

DeWitt County, the second-highest producing county in the Eagle Ford shale, is also feeling the impact. The county will be the site of a $65.8 million capital investment by Kinder Morgan Energy Partners LP, which is extending the 300,000 boe/d Kinder Morgan Crude Condensate pipeline through the county.

In Cuero, the seat of DeWitt County government, three hotels valued at more than $7.3 million opened last year, along with a 60-unit apartment complex valued at $3.2 million. The city also permitted a new housing development worth $4.5 million and issued four commercial permits valued at $6.2 million (UOGR, July-August 2014, p. 1). Cuero had a population of 7,000 in the 2010 census.

In Frio County, researchers found, the influx of capital has led to several public infrastructure projects. These include the construction of a police station, a community center, and a municipal water treatment system. Renovations are also planned for the county sewage system.

Tunstall encouraged South Texas communities like these to appeal to the state government for a greater share of the proceeds generated by the severance tax on oil and gas production. Right now, he said, all of this revenue goes to the state capital in Austin, and rural counties must compete with larger cities to receive a share when the state legislature makes spending decisions.

There is a lot of money to go around. With Texas production at 30-year highs, the state's Rainy Day Fund last year swelled to $6.2 billion.

The legislative influence of South Texas communities where most Eagle Ford production takes place has lessened in recent years as Texas' population becomes increasingly concentrated in large metropolitan areas. Houston's Harris County is represented by six state senators, compared to just four for the entire 21-county study area.

South Texas communities could benefit by coming together in Austin to advocate for a greater share of the severance tax collections, Tunstall said. He also recommended that these counties collect the maximum 2% county sales tax allowable under state law and use the funds to finance infrastructure projects.

Robert McKinley, associate vice-president of economic development for UTSA, said: "Investments in infrastructure-roads, water, waste water, education, medical facilities, and other things-are the key foundational components needed to ensure the long-term viability of many rural communities in the region."

Tunstall said, "The ongoing activity presents South Texas community leaders with a rare opportunity to ensure the long-term viability of their cities, towns, and counties."