Monterey proves more complex than average shale play

Rachael Seeley,

Editor

A pending cut in the Energy Information Administration's resource estimate for the Monterey shale reflects the complexity of the play relative to other US tight oil plays and the need for more research into its geology.

EIA is expected to cut by 96% its estimate of technically recoverable resources in the massive California formation, to 600 million bbl.

"I think the previous estimate was based on the idea that all tight oil plays are pretty similar," said Jesse Jones, lead analyst for Wood Mackenzie. EIA likely assumed, he said, that the Monterey would see the same rapid improvement in well completion design that has enabled constant well productivity improvements in unconventional plays like the Eagle Ford and Bakken shales.

"The Monterey is so much more geologically complex that there is no cookie cutter solution that's going to work there, so the pace of industry learning is going to be a lot slower," Jones said.

The initial EIA estimate of 13.7 billion bbl, he said, may also have taken into account production from wells targeting conventional formations that are sourced from the Monterey and are often interbedded with it.

The expected resource reduction brings the agency's projections closer to those issued by Wood Mackenzie.

The research and advisory firm performed a Monterey analysis based on wells that it verified produce directly from the formation and arrived at an estimate of 827 million bbl of commercially recoverable resources.

The figure is about one-third higher than EIA's revised resource projections. Jones said this is likely because Wood Mackenzie tends to bias its estimates toward recent well results where improved stimulation techniques have raised recoveries. EIA, by contrast, tends to make extrapolations based on all of the wells that have been drilled in a formation, he said.

Geological complexity

California oil plays lack the relatively homogeneous structure found in other US tight oil plays, like the Permian basin and Bakken shale. Formations in California were deposited more recently and more rapidly, and were folded and faulted by tectonic activity.

"The Monterey shale, in a lot of places, is a couple thousand feet thick but it's also very folded and faulted because of the tectonics in the area... So you couldn't drill a long horizontal well and keep it in zone even if you wanted to," Jones said.

The Monterey is comparatively large, covering 1,750 sq miles in central and southern California. Some portions are so folded that, according to Jones, "you could actually drill a vertical well and it's essentially a horizontal well because the formation is curved straight up."

Most Monterey wells are drilled vertically and stimulated with an acid frac. The Monterey is 1,000-3,000 ft thick, meaning a vertical Monterey shale well comes into contact with at least 1,000 ft of reservoir rock. Other major US shale plays appear thin and flat by comparison. The Marcellus shale, for instance, is less than 400 ft thick in its deepest areas, and horizontal wells are needed to bring more of the wellbore into contact with the reservoir rock.

The Monterey formation is also deeper than other major shale plays, which makes wells more expensive to drill. It is found at depths of 8,000-14,000 ft.

Wood Mackenzie estimates the Monterey shale will this year produce about 76,000 boe/d, of which 85 MMcfd is gas and 61,000 b/d is crude, condensate, and NGL.

Prolific source rock

Don Clarke, a consulting petroleum geologist in Los Angeles, said the organic-rich Monterey serves as the source rock for many large California oil fields.

In the Los Angeles basin, the Monterey was broken along major faults that enabled oil to leak out and become trapped in adjacent reservoirs of sand. Layers of shale above the sand acted as cap rocks, Clarke said, trapping the oil in prolific fields like Huntington Beach and Wilmington. The same process occurred in California's San Joaquin basin, where faults crossing the Monterey resulted in the prolific Kern River, Elk Hills, and Midway-Sunset fields. Jones said most exploration and production targeting the Monterey occur in the San Joaquin basin

"The Monterey is vastly more complex than the Marcellus or Eagle Ford," Clarke told UOGR. The high degree of variability of the formation throughout the state and even within individual basins likely means that a variety of drilling and well stimulation techniques will be needed to exploit it. The Monterey comprises many different facies of rock requiring different approaches to oil extraction.

Some areas are composed of calcareous material that is not amendable to hydraulic fracturing because cracks created in the rock can reseal relatively easily. "A little of the calcium carbonates dissolve and then [the fracture] fills back up," Clarke said. Other areas have brittle dolomite, which fractures easily, making it an ideal candidate for fracing.

Clarke said the shale formation needs more research. "We have all these different variations, and what we haven't done yet as geologists is we have not gone in and mapped where those variations are and how they change," Clarke said.

Occidental leads

A number of companies have had limited success using acidization to stimulate Monterey wells, including Occidental Petroleum Corp. and Venoco Inc.

Occidental is the largest oil and gas producer in California and also holds the largest land position, at 2.3 million net acres. In the first quarter of 2014, output from the Golden State totaled 95,000 b/d of oil, 19,000 b/d of NGL, and 242 MMcfd of gas.

During the last 5 years, Occidental has drilled and completed over 570 unconventional development wells in California. Federal regulatory filings show the company is exploiting seven discrete stacked pay horizons, primarily within the upper Monterey in the San Juan basin.

According to Jones, "Oxy, by far, has drilled more unconventional Monterey shale wells than anybody else."

Occidental is preparing to spin off its California operations into a separate company, to be named California Resources Corp. Jones said the move is modeled after spin-offs undertaken in recent years by ConocoPhillips Co. and Marathon Petroleum Corp. that separated upstream and downstream units.

Spinning off Occidental's California business would free it from competing for capital within the larger company's corporate structure, theoretically enabling it to pursue growth more aggressively.

Jones said Occidental's large California resource base could not compete economically with some of the other areas in the company's portfolio. "By doing this it allows the spin-off company to be a little more entrepreneurial ... it could very well mean they will be a little quicker to figure out the Monterey than they would otherwise have been," he said.

Occidental is already a leader in California unconventional plays. Regulatory filings show the company recently used seismic, stratigraphic, and reservoir analysis to uncover unconventional resources in a new field targeting the Monterey shale in California's San Joaquin basin.

According to regulatory filings, "This area was previously tested from the 1940s to the 1970s with six wells drilled by major oil companies, but hydrocarbon resources were not recognized until our 2012 discovery, following our seismic evaluation and application of our unique and proprietary subsurface models."

Occidental did not name the field but said since the first quarter of 2012 production has increased five-fold to 1,500 b/d.

Venoco Inc., a privately held independent producer, is also working in the Monterey shale. The company plans to spend $4 million on onshore Monterey shale activities in 2014, or 4.5% of its capital spending budget of $88 million.

Federal regulatory filings show the company recently pared its Monterey shale program after failing to see "material levels of production or reserves."

The company began leasing acreage in southern California with Monterey shale potential in 2006 and presently holds 30,000 net acres prospective to the formation primarily in the Santa Maria, Salinas Valley, and San Joaquin basins.

Since 2010, Venoco has spudded 29 wells and set casing on 26 wells targeting the Monterey.

In regulatory filings, Venoco indicated that results from the Monterey "will depend on, among other things, our ability to identify productive intervals and drilling and completion techniques necessary to achieve commercial production from those intervals."

Economic impact

California is the third largest oil producing state and thirteenth largest gas producing state in the US (see table). Wood Mackenzie estimates 2014 production will average 712,000 boe/d, comprising 600,000 b/d of liquids and 620 MMcfd of gas.

Oil and gas development is a powerful economic force in California. A 2013 study performed by California State University, Fresno, for the Western States Petroleum Association found the petroleum industry supports 52,271 jobs in California's San Joaquin Valley, representing 3.1% of total regional employment and paying $4.08 billion in annual labor income. The industry was also found to generate $23.6 billion in sales for businesses, representing nearly 10% of total sales in the region.

California has faced economic challenges in recent years, and growth in the petroleum industry, specifically development of the Monterey shale, could provide an economic stimulus. A separate report by the University of Southern California (USC) in 2013 said, "Falling housing prices, persistent unemployment, and stagnant or declining revenues at all levels of government have imposed tough choices on state and local political leaders."

The USC report, compiled before the EIA's downward revision of Monterey resources, had projected that by 2020 development of the Monterey could add 2.8 million jobs in California, increase per-capita gross domestic product by up to 14.3%, and generate as much as $24.6 billion/year in tax revenues for state and local government.

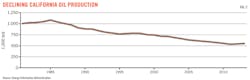

California crude oil production peaked at nearly 1.1 million b/d in 1985 and has declined generally ever since, averaging about 554,000 b/d in February 2014 (see table). EIA analysis shows the state is still an important part of the US production mix, providing about one tenth of total US production.

Regulatory changes

Some Californians hope that increased oil and gas development could be an economic boon for the state, but producers looking to conduct exploration and development must be mindful of potential regulatory obstacles.

Well stimulation techniques like hydraulic fracturing and acidization, are receiving increased public scrutiny. The USC study cited public concerns about wastewater management, the potential for groundwater contamination, increased seismic activity, and transportation and land-use challenges.

Several California municipalities this year enacted hydraulic fracturing bans, including the city of Beverly Hills and Santa Cruz County. However, legislators have so far resisted calls for a state-wide ban. The California Senate in May struck down a bill that would have prohibited all well stimulation until a new study could be conducted on its health and environmental effects.

Regulatory oversight has, however, tightened in other ways. Last September, Gov. Jerry Brown signed into law Senate Bill 4, requiring operators to obtain a special permit from the California Department of Conservation's Division of Oil, Gas, and Geothermal Resources (DOGGER) before performing well stimulation treatments.

Starting on Jan. 1, 2015, operators will be required to disclose detailed information about the composition of well stimulation fluids and provide groundwater monitoring and a water management plans in their permit applications. The rules also call for notifying nearby residents and landowners before stimulation begins and providing water well testing upon request.

Jones said, "I think the industry as a whole, while they weren't thrilled about the bill, are kind of relieved that there is now an established regulatory framework that they can operate in." He added that many of the requirements are considered industry best practices. "They are things that these companies are used to complying with," he said.

DOGGER estimates that, in 2012, 800 wells in California underwent some type of well stimulation that would be subject to new rules. The figure includes 600 hydraulically fractured wells and 200 wells that were subject to some other form of stimulation, like acidization.

Senate Bill 4 also called for three state regulatory agencies, DOGGER, California's Natural Resources Agency, and the State Water Resources Board, to perform separate studies on the environmental impacts of well stimulation.

Jones said the environmental review is the part of the bill "that actually has some potential, depending on what the results are from that, to be a big change."

Imprecise science

It is not uncommon for estimates of technically recoverable resources to change in the early stages of production.

Catherine Reheis-Boyd, president of the Western States Petroleum Association, said the US Geological Survey estimated in 1995 that the Bakken shale in North Dakota held just 151 million bbl of oil. Now, the agency figures the formation holds 7.4 billion bbl of undiscovered, technically recoverable oil, and production is approaching 1 million b/d.

The EIA's downward revision of Monterey reserves reflects only that the current state of technology is unable to unlock the full potential of the play. The amount of oil contained in the formation has not changed.

"We have a great deal of confidence that the skill, experience, and innovative spirit possessed by the men and women of the petroleum industry will ultimately solve this puzzle and improve production rates from the Monterey shale," Reheis-Boyd said.