Goodrich seeks to optimize drilling, completion recipe in complex Tuscaloosa Marine shale

ST. HELENA PARISH, La., — Goodrich Petroleum Corp. is moving ahead with exploration of the Tuscaloosa Marine shale (TMS) in Louisiana and Mississippi, despite recent mechanical setbacks. The company's efforts have yielded encouraging results, with two wells testing at initial production rates of more than 1,000 boe/d.

Goodrich, based in Houston, is working to find the right combination of horizontal drilling and completion techniques to unlock the potential of the TMS.

"Like all emerging plays, we have experienced a number of challenging, unique issues with this play, some of which we have been able to successfully mitigate," Chief Executive Officer Walter Goodrich told analysts in February.

Great potential

The Cretaceous TMS covers about 5,900 sq mi across the Gulf Coast region of Louisiana and Mississippi. With thickness of 500-800 ft, it occurs at depths of 9,000-14,000 ft and comprises gray and black, organic-rich shale with layers of fine-grained sand, with carbonate layers present in some areas. A 1998 study by Louisiana State University estimated the formation could hold more than 7 billion bbl of oil.

Higher clay content present in the TMS, compared to other unconventional oil plays, is considered one of the greatest risks to commercial development. Clay content is greatest in the upper portion of the formation and falls as depths increase—with minimal clay and more calcite present at greater depths.

Goodrich has had success mitigating the clay issue by landing horizontal laterals in the lower portion of the formation below an area known as the rubble zone, which is characterized by natural fractures.

Goodrich does not plan to land any more wells above the rubble zone this year after three recent wells experienced completion difficulties drilling out the frac plugs after hydraulic fracturing.

One of these wells is the Weyerhaeuser 51H #1 well in St. Helena Parish, La. John Freeman, an analyst with Raymond James, noted the release of an initial production rate for the well was delayed while the company worked to drill out the frac plugs. The Weyerhaeuser 51H #1 was drilled to a total measured depth of 19,655 ft, true vertical depth 12,759 ft, and completed with 23 frac stages on a 6,200 ft lateral.

A similar frac plug issue was experienced at Goodrich's Huff 18-7H #1 well to the north in Amite County, Miss. Chief Operating Officer Robert Turnham said Goodrich was unable to reach an obstruction in the frac plug lateral at about 500 ft, likely caused by a tight spot in the casing.

Despite the setback, the Huff 18-7H #1 well was completed with an initial, 24-hr production rate of 530 boe/d (about 95% oil) on a 13/64-in. choke. "It appears we may be getting some contribution from the lateral at the reported rate, as 500 b/d of oil from 500 ft is too prolific versus past results and expectations," Turnham said.

CEO Walter Goodrich said the company believes the issues are being caused, or exacerbated by, the higher clay content present in the upper portion of the TMS relative to the lower section.

"In essence, what we believe has occurred in these upper target wells is the higher clay content has increased the elasticity of the formation itself which, during the pumping of an individual frac stage, is creating a slight amount of deformation, but not rupturing, of the casing stream which is leading to the difficulties drilling out frac plugs," Goodrich said.

About 30 modern-era horizontal wells have been drilled into the high-resistivity TMS. Of those, Goodrich said, 22 have been drilled into the lower landing target, where there is generally less clay and more quartz present. Drilling out the frac plugs for these wells presented little difficulty. Conversely, five of the eight wells drilled into the upper landing target experienced "significant problems drilling out the frac plugs," Goodrich said.

Mitigation plan

In an effort to mitigate the recent completion issues, Goodrich is drilling its latest wells —the C.H. Lewis 30-19H #1 and CMR 8-5H #1 in Amite County, Miss., and Blades 33H #1 in Tangipahoa County, La.—into the lower target beneath the rubble zone.

Louisiana Department of Natural Resources data show the Blades 33H #1 was drilled to a true vertical depth that is 471 ft deeper than the Weyerhaeuser 51H #1 in neighboring St. Helena County, which experienced problems drilling out the permanent flow-through frac plugs, which are no longer being used. The Blades well was reached a true vertical depth of 13,230 ft and was being completed in late March.

Meanwhile, Goodrich reported its CMR 8-5H #1 produced an average of 900 boed during its first 6 days online. The well had a lateral length of 5,300 ft and was fraced with 20 stages using composite plugs that were successfully drilled out prior to flow back.

Leading operators

Goodrich is poised to be one of the most active operators in the TMS this year and has allocated 70-80% of its capital spending budget, $225-300 million, to the formation. Plans call for drilling 24-32 gross wells and adding a fourth rig in the latter part of the year.

The average well costs $13 million to drill and complete. Costs are expected to fall to $10 million/well as the company shifts into development mode—drilling multiple wells from a single pad and reducing the amount of time needed to drill and complete a well.

Daniel Jenkins, director of investor relations for Goodrich, told UOGR he expects to see further cost reductions down the road as service companies to set up offices in the area and producers move toward more efficient pad drilling operations.

Goodrich is optimistic about the potential of the TMS, and last year expanded its acreage position to more than 300,000 net acres after purchasing 185,000 net acres from Devon Energy Corp. for $26.7 million.

Another operator expanding its footprint in the TMS is Halcon Resources Corp. Halcon recently declared the TMS one of its three core operating areas and last year expanded its TMS land position to about 300,000 net acres from 75,000 net acres. Halcon was founded in 2011 by Floyd Wilson, previously head of Petrohawk Energy Corp., a company that pioneered development of the Eagle Ford shale in South Texas and was sold to BHP Billiton in 2011 for $12.1 billion.

About $95 million, or 10%, of Halcon's 2014 capital spending budget is allocated to the TMS. Halcon plans to run an average of two rigs and spud 10-12 gross operated wells in the formation during the year. Chief Operating Officer Charles Cusack III said the company has been "working the Tuscaloosa Marine Shale from a geologic standpoint and monitoring industry activity in the play for quite some time." Halcon is in discussions with several potential joint venture partners to further exploration efforts.

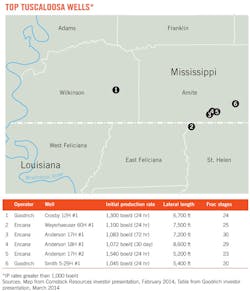

Also active in the TMS is Encana Corp., which has posted some of the most promising results in the TMS to date. Encana operates four of the six TMS wells that have flowed at initial production rates greater than 1,000 boe/d. Three of these are in Amite County, Miss., and one is in Wilkinson County, Miss. (See map).

Encana will continue with appraisal work across its 302,000-net-acre TMS position this year and plans to spend $125-150 million to drill 9-12 net wells.

A new TMS entrant, Comstock Resources Inc., in November purchased 51,000 net acres prospective to the formation in Wilkinson and Amite counties, Miss., and East Feliciana and St. Helena parishes, La. The acreage is near some of the best wells drilled in the play. Comstock is considering additional lease acquisitions. Chief Operating Officer Mark Williams said the TMS fill-in acreage can be purchased at a "very attractive" cost. The company plans to drill two TMS wells this year for a total estimated cost of $27 million.

Jenkins said there has been a lot of collaboration between TMS operators, and Goodrich has data sharing agreements in place with Halcon and Encana. In 2013, Goodrich participated in the drilling and completion of 13 gross TMS wells with Encana. Goodrich operated six of the wells and Encana operated the other seven.

"There has been a concerted effort by all operators in the play to share data and information. There is nothing better for all of us, quite frankly, than to have several operators drilling good wells," Jenkins said.

Tax incentives

Despite uncertainty about whether the TMS will prove commercial, operators continue to be lured to the formation by its sizable resource base and favorable tax treatment in Louisiana and Mississippi.

In Mississippi, Gov. Phil Bryant last year signed a law that reduced the severance tax for oil and gas production from horizontal wells to 1.3% from 6% for 30 months or until payout of the well, whichever occurs first. "That's a very significant improvement in the economics of the early-time wells," Goodrich said.

Louisiana has no severance tax for the first 2 years of production, with the rate rising to 12% after 2 years.

Oil produced from the TMS is also likely to sell for close to Louisiana Light Sweet (LLS) crude prices, which have been commanding a premium to benchmark West Texas Intermediate crude. Jenkins said TMS crude sells for a discount of about $2.00-2.25 to LLS.

Production would likely to move to the St. James terminal on the Mississippi River between Baton Rouge and New Orleans, La. and then to refineries along the Gulf Coast.

Goodrich is aware of at least five companies that plan to drill in the TMS in 2014, including Halcon, Encana, Sanchez Energy Corp., and Comstock.

With continued success in the play, Turnham said, as many as 45-60 wells could target the formation this year, up from just 10 in 2013. If plans materialize as expected, he said, 2014 "will be a very big year for the TMS."