BHP plans to double Eagle Ford output by 2016

Rachael Seeley, Editor

HOUSTON, Tex.— BHP Billiton is focusing the bulk of its US onshore spending on the Eagle Ford shale this year and seeing promising results from field trials aimed at increasing production and reducing costs at its wells in the South Texas shale play.

Rod Skaufel, president of North American shale for BHP, told UOGR, "We've got a significant effort under way around completion optimization and well spacing."

The company is testing high-temperature gels for better proppant transportation, different stage spacing to maximize stimulated rock volume, and reservoir modeling to simulate stress capture and optimize well sequencing.

The results are promising. Skaufel said initial 90-day cumulative production totals for Eagle Ford wells where field trials are being conducted are 10-40% higher than production for comparable surrounding wells.

It is difficult to translate initial production rates into estimated ultimate recovery rates because efforts are in their early days, but, Skaufel said, BHP is "very encouraged" by what it is seeing.

"Not only are the results supported by production, but we also use microseismic and production logging as a way to try and validate what is happening downhole. Both of those indicate that we are stimulating more rock volume," he told UOGR.

Trophy asset

The Eagle Ford shale is a key unconventional onshore play for BHP Billiton.The company is a top producer in the shale play and will allocate $3 billion of its $3.9 billion budget for the onshore US to development of the Eagle Ford in fiscal year 2014.

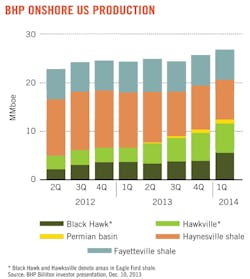

Investor materials show net production was higher than 100,000 boe/d in September 2013. Seventeen of the 26 rigs that BHP now operates in the US are working in the Eagle Ford shale —14 rigs are in the Black Hawk area, and 3 rigs are in the Hawkville area.

Black Hawk, in which BHP Billiton holds 70,000 net acres in DeWitt and Karnes counties, is receiving the greatest development emphasis. BHP figures the area, in the heart of the Eagle Ford's lucrative condensate window, is generating 70% rates of return on individual wells. Production from Black Hawk averaged 60,000 boe/d (80% liquids) in September.

The Hawkville area, where BHP Billiton holds 250,000 net acres in La Salle, McMullen, and Live Oak counties, straddles NGL and condensate-rich areas. Net production averaged 66,000 boe/d (45% liquids) in September.

Building a foundation

BHP made its first foray into US shale in 2011. Its first big purchase was Chesapeake Energy's assets in the Fayetteville shale in Arkansas for $4.8 billion, followed by the acquisition of Eagle Ford shale pioneer Petrohawk Energy for $12.1 billion.

Skaufel said the company initially had no US shale workforce. "When we first bought the Fayetteville (assets) from Chesapeake, their operations folks came with it, but that was it," Skaufel said. "We have recruited extensively, and we've got engineers and geologists literally from every major shale player."

BHP's shale division is more than 2,000 workers strong, and the company recently broke ground on a 30-story office tower in Houston.

Besides recruiting the right personnel, BHP also set its sights on acquiring the right equipment.

The company is now operating 26 new AC rigs with skidding capacity purpose-built for its shale operations. Skaufel explained, "When we first got into shale our drilling group clearly wanted modern-generation AC rigs because they have better control and better horsepower to the bit—so we were clearly looking at newbuilds."

The company settled on Helmerich & Payne Inc.'s FlexRigs and Nabors Industries Ltd.'s PACE-X rigs. Skaufel said both rigs are capable of skidding to new drillsites on multiwell pads, which saves time.

"If you're doing development drilling with four to eight wells on a pad you want a rig that can skid to the next location," Skaufel said. "That takes 12 hr as opposed to dismantling the rig and moving it to the next location, which may be 15 ft away and it takes 5 days."

Skaufel said the rigs have worked well. Drilling times in the Eagle Ford shale have declined 35% in the past year as the company worked to make its operations more efficient through company initiatives, including its pacesetter program.

The pacesetter program involves breaking down a well into sections of a hole—surface casing, production casing, horizontal section—and looking across the company's rig fleet to see which rig has drilled that section of hole the fastest. "We look at how they do it, and then we try to replicate that across our entire rig fleet," Skaufel said.

The average time required to drill and complete a well in the Eagle Ford's Black Hawk area is 20 days, down from 30 days a year ago. Skaufel said some Black Hawk wells have been drilled in as few as 12 days.

The total cost of drilling and completing a well in the Black Hawk area has also fallen to $9 million from $10 million—due entirely to drilling cost reductions.

Overcoming obstacles

Skaufel said unexpected challenges BHP has faced in the Eagle Ford include the high turnover rate of a relatively inexperienced workforce and the complexity of managing operations at numerous well sites at once.

Another challenge has been coordinating all of the moving pieces at a drillsite with different contractors.

On any given day, the company has drilling and completion activities under way at well sites across the shale play—an endeavor that, Skaufel said, involves the integration and coordination of many activities across multiple work fronts.

"Initially, I don't think we really had an appreciation for how intricate the work environment is and how well coordinated it needs to be," Skaufel said.

All of the hard work in the shale play is paying off for BHP. Current development plans show net production has the potential to reach 200,000 boe/d in fiscal year 2016, up from more than 100,000 boe/d currently.

"We're spending $3 billion/year in one of our trophy assets, and we feel like we are doing it right," Skaufel said.