Growing NGL production alters regional pipeline flows, spurs new gas processing capacity in Utica

NOBLE COUNTY, Ohio—Midstream companies like MarkWest Energy are working hard to increase gas gathering, processing, fractionation, and takeaway capacity to service the rising amount of wet gas production from growing shale plays in the Northeastern US.

"The Utica is just now beginning to ramp up, and it's going to grow a lot over the next few years," said Anne Keller, manager of NGL research at Wood Mackenzie. Keller told UOGR that production from the Utica shale is expected to quadruple to around 1 bcfd by the end of 2014 from roughly 250 MMcfd at present.

The Utica is not expected to reach the total level of gas production coming out of the Marcellus shale—currently around 12.5 bcfd—but it is expected to match the roughly 6 bcfd of wet gas coming out of the more established shale play.

"In terms of ‘processable' gas you can extract NGLs from. . . we're forecasting it will be about equal to the Marcellus," Keller said.

The majority of gas being produced from the Utica is liquids-rich, and handling it requires processing capacity to extract the higher-value NGLs from the gas stream before it can be sold and made to meet pipeline quality standards. Midstream companies like MarkWest Energy, Williams Energy, and Blue Racer Midstream have been working to install this capacity in the Northeast, and their efforts are beginning to pay off.

Keller said the gas processing and takeaway constraints that producers have been facing for the past year or so in the Utica and neighboring Marcellus shales are rapidly being removed.

MarkWest CEO Frank Semple told investors in November that his company has executed long-term agreements with almost 20 producers across the Marcellus and Utica plays. Utica shale customers include Antero Resources, Rex Energy, PDC Energy, and Consol Energy subsidiary CNX Gas Co.

"In just 5 short years, we will have commissioned 2.2 bcfd of processing capacity and we have announced plans for an additional 2.3 bcfd of processing capacity" Semple said.

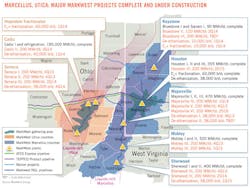

MarkWest's processing capacity additions planned for 2014 include expanding its Seneca complex in Noble County, Ohio, to a capacity of 600 MMcfd and its Cadiz complex in Harrison County, Ohio, to a capacity of 385 MMcfd. The company will also bring online the Hopedale fractionation and marketing complex, which will be capable of producing 60,000 b/d of propane and heavier purity products.

The company is also expanding its gas gathering system throughout Ohio. Semple said 200 miles of high- and low-pressure gathering lines were installed in Harrison, Guernsey, Belmont, Noble, and Monroe counties in the first 11 months of 2013, and plans call for adding another 200 miles of gas and NGL pipelines by the end of 2014.

All this new capacity is giving producers the means to extract more lucrative NGLs from their gas stream and improve profitability.

Key projects

As gas gathering and processing constraints ease in the Northeast, producers now face the challenge of securing long-haul pipeline capacity to move their products to market. Keller said the region is transitioning away from being a net buyer of NGLs to a net supplier, and pipelines are being repurposed and reversed to allow NGLs to move out of the region to petrochemical markets in the Gulf Coast, Canada, and ports for shipment overseas.

One of these projects is Mariner West, a joint effort of Sunoco Logistics and MarkWest. When complete, the system will move 50,000 b/d of ethane from MarkWest's Houston complex in Washington County, Pa., to customers in Sarnia, Mich., near the international border with Canada. It is expected to reach full capacity in the first quarter of 2014.

Also under way is the pair's Mariner East project, which Range Resources is also a partner in. Mariner East is slated to deliver 70,000 b/d of propane and ethane from MarkWest's Houston complex to the Marcus Hook terminal south of Philadephia, Pa. From there it will be processed, stored, and distributed to domestic and international markets. That project is scheduled to come online in the first half of 2015.

Meanwhile, Enterprise Product Partners is working to bring its repurposed Appalachia-to-Texas (ATEX) Express Pipeline online in the first quarter of 2014. The 1,230-mile line will move ethane from Pennsylvania, West Virginia, and Ohio to the Texas Gulf Coast petrochemical market.

Once the projects come online production volumes from the Northeast will have access to new markets.