Devon to raise Eagle Ford shale production by 40%

DEWITT COUNTY, Tex.—Devon Energy Corp. plans to spend nearly $1.3 billion to increase its Eagle Ford shale production nearly 40% in 2014 as the company begins full-scale development of its new position in the booming South Texas play.

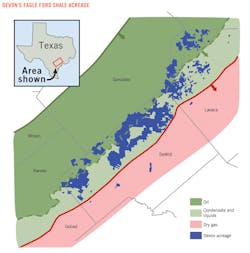

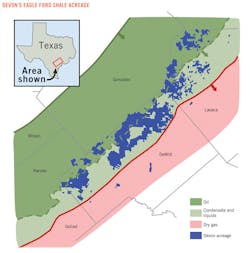

Of the planned Eagle Ford spending, $1 billion will be concentrated on the company's 50,000-net-acre position in DeWitt County, with the remaining $300 million slated for its 32,000 net acres in neighboring Lavaca County.

Net production from Devon's Eagle Ford position is expected to rise to more than 70,000 boe/d by yearend 2014 from 53,000 boe/d in November 2013. Output is 56% light oil, 20% NGL, and 24% natural gas.

Plans call for drilling about 230 wells in 2014 using a combination of 3,500-ft and 5,000-ft laterals. Two hundred wells will be spuded in DeWitt County, where Devon and partner BHP Billiton plan to run 16 rigs in 2014. Three other rigs will be operated exclusively by Devon in Lavaca County, where 30 wells are planned.

Oklahoma City-based Devon entered the Eagle Ford shale late last year via a $6 billion acquisition from privately held GeoSouthern Energy Corp. The deal, expected to close in the first quarter, brought the company a combined 82,000 net acres in an oil and liquids-rich area in the eastern portion of the play, in DeWitt and Lavaca counties, and added 400 million bbl of low-risk, recoverable resources to the company's books.

Devon is partnered with BHP across the majority of its Dewitt County acreage, some 50,000 acres. Under the agreement, BHP is operator of drilling and completion work while Devon operates production.

Sizable potential

As of late November, 250 wells were producing and another 60 wells were waiting on completion across Devon's Eagle Ford position. The company figures it has a further 1,200 derisked drilling locations remaining—a well inventory that will last 5 years at the current pace of development.

Chief Operating Officer Dave Hagar sees an opportunity to increase estimated ultimate recoveries (EUR) from Eagle Ford wells through the improvement of completion techniques, production optimization, and enhanced recovery.

"This is a relatively young play with significant opportunity for improvement," Hagar said.

EURs are now pegged at 850,000-950,000 boe for Devon's DeWitt County wells and 400,000-500,000 boe for its Lavaca County wells.

Efforts are also under way to lower costs through continued reductions in the time needed to drill and complete individual wells. Hagar said spud-to-rig-release times across Devon's new position fell 35% to 22 days during the past year under the direction of GeoSouthern and BHP. Drilling and completion costs now are $9-10 million/well in DeWitt County, and $9 million/well in Lavaca County.

Devon estimates lease operating expenses at $5/boe in DeWitt County and $6/boe in Lavaca County.

Initial production (IP) rates of Devon's wells are among the highest in the Eagle Ford play. Of the 205 wells drilled and completed across Devon's acreage since 2011, Hagar said, 75% have achieved 30-day IP rates higher than 830 boe/d—ranking them among the top 25% of wells drilled in the play.

In an investor note, Morningstar Equity Research analyst Mark Hanson said, "Unquestionably, the acreage Devon picked up through this transaction is among the best in the Eagle Ford, with impressive IP rates, EURs, and well-level returns." Morningstar figures net production from Devon's Eagle Ford assets—assuming 5 more years of drilling inventory—will likely peak in 2018 at around 150,000 boe/d, of which 83,000 b/d will be oil, 30,000 b/d NGL, and 215 MMcfd gas.

Strategic significance

Devon's Eagle Ford acquisition is part of an effort by the traditionally gas-heavy producer to aggressively focus on production of oil and NGL—a strategy being pursued by a number of Devon's peers, including Chesapeake Energy Corp., EOG Resources Inc., and Encana Corp. Devon in recent years sold its international and offshore assets to focus on emerging unconventional North American plays and has collected nearly $10 billion from asset sales since 2009.

More divestitures are planned for 2014. Devon hopes to sell conventional assets in Canada and other noncore assets in the US.

Devon's asset base is now focused in five core areas: the Eagle Ford shale, the Permian basin, Canadian heavy oil projects, the Barnett shale, and the Anadarko basin. Company-wide production was expected to average 593,000 boe/d at the end of 2014, with the Eagle Ford accounting for 53,000 boe/d.

"The Eagle Ford is one of the most prolific light oil plays in North America," Devon Chief Executive Officer John Richels told investors. "This acquisition clearly adds a new core, light-oil asset to Devon's portfolio that offers some of the highest rate-of-return drilling opportunities in North America."