Permian production competes on a world scale

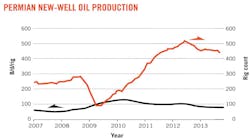

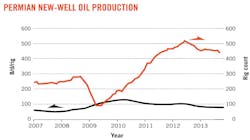

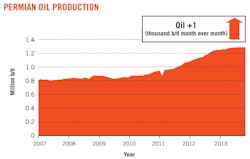

The Permian basin in West Texas has reentered the race to become the world's largest oil-producing region. According the US Energy Information Agency's (EIA's) Drilling Productivity Report for October 2013, oil production in the Permian has increased by 93,000 b/d year over year. According to the EIA, each rig working in the play provided an average 79 b/d of new production in October. With the rig count approximately 450, daily production has risen substantially.

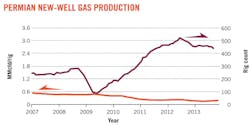

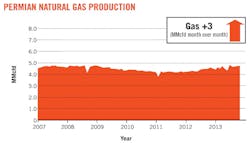

Natural gas production was increased by an average 173 Mcf per each active rig in October.

Characterized by its diversity, the Permian basin includes a wide number of potential plays such as the Wolfcamp, Spraberry, Bone Spring, and Cline shales. Most activity is now centered on the Delaware and Midland sub-basins. The Wolfcamp shale can be found throughout the basin and is generally considered the source for many of the oil and gas fields currently being developed.

Spraberry/Wolfcamp alone is producing 450,000 boe/d. Pioneer Natural Resources Co. said in May that it expects this to grow to 2.5 million boe/d in 20 years.

Pioneer recently announced that it placed on production its fourth horizontal Wolfcamp D interval well in the Midland basin.

The company has 16 horizontal wells on production across its northern acreage, of which 10 are Wolfcamp shale interval wells and six wells are Spraberry shale wells in Midland, Martin, Andrews, and Upton counties.

Stacked pay zones in the Permian basin are providing operators with an opportunity to multiply their acreage position. The Midland basin offers ample opportunity to produce oil from the Lower Spraberry and Wolfcamp B plays. According to a recent report by Raymond James, the Spraberry sequence contains two additional productive zones—the Middle Spraberry and the Jo Mill—that are vastly underexplored. To date, wells drilled in the Wolfcamp A have shown positive results for operators as well. When combined with the Clearfork, Dean, and Cline shales, the Midland basin becomes several potential oil plays.

Lessons learned

For companies like Pioneer, learning to commingle production from stacked plays such as the Wolfcamp/Spraberry has been a huge driver of increased oil supply within the last 5 years. Prior to this, neither formation was considered economic as an isolated interval. Combining two of these intervals within a single well has proven successful.

According to Raymond James, it is unclear exactly how effective this technology is for ramping up per well production. Although, the report said, it will most likely enable operators to efficiently develop acreage with minimal outlays and possibly turbocharge production.

According to the EIA data and additional well reports from operators in the area, the Permian will likely continue to increase production in the coming years.