New technology raises bar for New Mexico oil production

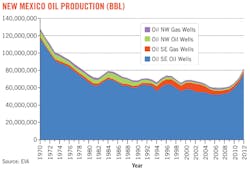

New Mexico's oil and gas industry finished strong by producing more than 80 million bbl of oil in 2012—an amount not seen in the state since 1978-79. Increased production trends have been observed in reports from both the Energy Information Administration (EIA) and the New Mexico Oil Conservation Division.

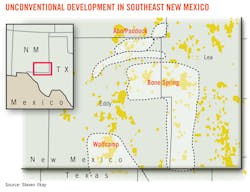

New Mexico's increased production comes primarily from Lee and Eddy counties in the southeastern part of the state. This region comprises a confluence of both conventional formations and newer shale formations that are shared with Texas' Permian basin region to the south.

"The New Mexico story is different than that of Texas," noted Steven Ilkay, independent oil and gas advisor. The Wolfcamp and Bone Springs formations are shared assets between the two states. "The northern portions of these plays tend to be oilier and have better economics in New Mexico," Ilkay said. The sweet spots for both plays in New Mexico are the western part of Lea County and the eastern half of Eddy. "With the exception of a very small portion of Loving, Winkler, and Ward counties in Texas, these areas have the best economics out there," Ilkay said.

New Mexico's increase in oil production began around 2008. "Production charts for New Mexico's most productive counties show that it is almost exclusively unconventional," Ilkay said. "There's nothing unique about these areas as they've long been known as oil-bearing." Lea and Eddy counties combined produced 57 million bbl of oil in 2008, which was more than 90% of the state's total output for that year. In 2012, both counties combined added 70 million bbl to New Mexico's production—a 25% increase.

"If you look at drilling permits in the state, most of them are horizontal," Ilkay said. There were 42 permits issued in 2008, and 261 permits were issued in 2011. According to state records, permits for 2012 exceeded 2,000, although, Ilkay pointed out, this number could include other permits not related to drilling such as easements or right-of-way permits to lay pipeline.

Unconventional approach

Production from Eddy and Lea counties, while predominantly from the Wolfcamp and Bone Springs, also includes increases from the region's conventional, older producing formations.

"New technology and techniques are breathing new life into older formations such as San Andres," Ilkay said. "People are drilling horizontal there and are seeing better results." This is also true for Andrews County, Tex., which lies adjacent to Lea. The San Andres is well known as one of the older producing formations in southeast New Mexico and in the Permian basin of West Texas. "It's a shallow formation that is bread-and-butter for smaller operators wanting to drill a successful well or for large multinationals seeking to develop huge drilling inventories," Ilkay said.

Average well costs in San Andres run from $300,000 to $400,000. Horizontal drilling and hydraulic fracing can increase the cost up to more than $1 million. However, Ilkay estimates that initial production and ultimate recovery can be up to five or seven times higher for a single well. "We're seeing a lot of that in New Mexico and West Texas. It's not new discovery but just the application of modern techniques and drilling technology," he said.

The numbers indicate that New Mexico's production will continue to climb in 2013. According to EIA data, New Mexico's monthly oil production has outpaced the 2012 amount from January through March by an average of more than a million bbl.

While Ilkay agrees that production will likely continue to increase, he said, "It's hard to maintain a high level of production, but we have found that decline rates are smoother in New Mexico." This comes at a sacrifice of flashy IP rates found in similar wells just to the south, but the flatter decline curve adds some stability to New Mexico's ultimate recovery rates. "For an investor that has a time frame of more than a few months in mind, that's really what matters," Ilkay said.

The recent growth in New Mexico's production is entirely linked to unconventional resource development. More importantly, the technology derived from shale development is the main driver behind intensive production growth. "The entire delta from 2007 or 2008 can be attributed to unconventional development," Ilkay added.

Environment: natural, economic

Other than Wolfcamp and Bone Spring development in the south, the Mancos, located in the northwest of the state, is promising to many operators.

In March, WPX Energy Inc. reported that two wells it drilled in 2010 in a dry natural gas section of the Mancos shale formation had produced 2 bcf to date. The Mancos has the interest of many speculators, but a boom in northwestern New Mexico is not imminent. The play has yet to prove up like its counterpart in the south.

Colfax County, which is located in the Raton Basin in northeast New Mexico, has been active for some time with operators producing coalbed methane. The presence of Niobrara tight sands just north in Colorado also has interest. Given the rapid expansion of other well-known shale plays in the region, many communities find themselves at a crossroads. In some cases they embrace the economic development that shale resources can bring to an area. In others, they take measures to prevent the industry from gaining a foothold.

Mora County, just south of Colfax, recently enacted what many are calling the first county-wide ban on hydraulic fracing in the US. In May, the county's commissioners voted unanimously to ban hydraulic fracturing and, as an added measure, the wording was adopted to extend this prohibition to individuals and to companies. The county is cash-poor but contains a substantial amount of federal land. Its ordinance was drafted with assistance from the Community Environmental Legal Defense Fund.

While Commission Chairman John Olivas and many organizers from the county consider the move to be a positive step, not all of their constituents agree.

According to Greg Nibert, chairman of the Chaves County Commission, New Mexico's oil and gas producing counties provide more than 40% of the entire state budget, he was quoted as saying. With these funds ultimately applied to education and other social programs, many of Mora's neighbors have spoken out against the county's ban.

Mora County has reached out to other commissioners to encourage similar action, which if followed could cost the state 33,000 jobs and approximately $5 billion in future investments.