Unconventional technology renews production for Mississippi Lime

LOGAN COUNTY, Okla.—The Mississippi Lime, or Miss Lime, is a conventional limestone reservoir that responds well to unconventional technology. For many operators in Oklahoma and Kansas, the Miss Lime pays out like many other shale plays in other parts of the country.

"The Miss Lime has been productive across most of the state of Oklahoma," said Kim Bradford, chief executive, Osage Exploration and Development Inc. "Historically, the Mississippian has been produced vertically, and now horizontal drilling and hydraulic fracturing are renewing production."

Typically, resource plays are homogenous in composition. According to Steve Slawson, vice president, Slawson Energy, "the Mississippi Lime is unique because it's not consistent." For many resource plays such as the Bakken, operations are somewhat more predictable with fairly consistent production from well to well. "In the Miss Lime you can drill a 500 b/d well right next to a 50 b/d well," Slawson said.

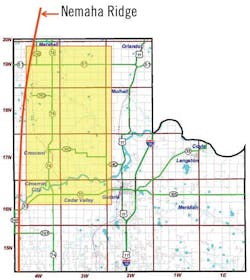

Osage Exploration (25%), Slawson Energy (45% as operator), and US Energy Development (30%) are partners on the Nemaha Ridge project in Logan County, Okla. Cumulatively, the companies hold approximately 32,000 net acres in the county.

Drilling on the prospect was initiated in December 2011. In April 2012, Osage reported that its Wolf 1-29H produced 733 b/d of 40° API gravity oil and 863 Mcfd of gas in its first 30 days. The well was drilled to a vertical depth of 5,816 ft, with a lateral step out of 4,104 ft. It was fraced in 12-stages. As of February of this year, the well has shown cumulative production of 91,742 boe.

The Miss Lime is predominantly heterogeneous. "Over any 300-, 600-, or 1,000-yard span the rock can be highly differentiated," Bradford said.

Operators such as Chesapeake and Sandridge kicked off the play in 2009, mostly in the northern part of the state in Woods, Garfield, and Alfalfa counties. For this portion of the play, the production comes primarily from the "chat," which is not a geological term but jargon used to describe the highly porous, water-bearing zone of reworked tripolyte that was redeposited on top of the solid member of the Mississippian and is represented by an average porosity of about 30%. These wells typically come in half gas and half oil for the first week of production with a 90% water cut. "Even if you're producing 5,000 to 6,000 b/d of water with a with a 10% oil cut, that's 500 to 600 b/d of oil and that's not a bad well," Bradford said.

The Miss Lime, when it has natural fractures, typically has a lower cost per well. In some cases, drilling and completion expense can total half and even a fourth of a typical unconventional well due to the low-horsepower required.

Osage Exploration announced in April that it had spud 10 wells this year to date, fully 50% ahead of its 20-24 planned wells for 2013. Photo from drillsite in Logan County, Okla.

In the partnership's Nemaha Ridge project, only the solid member of the Mississippian is present. "Our production is very different," Bradford said, noting that to date wells have come in at 80% to 85% oil, 15% to 20% high-btu gas with an initial water cut of 50%, and dropping from there.

With its proximity to the Nemaha Ridge, the Logan County project benefits from the highly fractured nature of the Mississippian Limestone. When the Nemaha Ridge occurred, it resulted in a 300-ft vertical throw. "That was a dramatic tectonic event," Bradford explained. Logan County lies on the east side of the ridge in central Oklahoma.

Directly to the west, in neighboring Kingfisher County, the Mississippian pay is on average around 600-ft thick. Historically, this region comprises the highest concentration of vertical wells in the state and boasts the highest cumulative production throughout Oklahoma. To the east in Logan County, which was the upthrown side when the ridge occurred, the Mississippian was highly eroded and today has a thickness of approximately 300 ft. Due to the thickness of the formation west of the Nemaha Ridge, vertical development prior to the advent of horizontal drilling gravitated to the Kingfisher side where the formation is twice as thick, leaving the formation pressure on the east side of the ridge relatively untapped. "Historically, these vertical wells used very few fracs, if any," Bradford said. "They tended to come on quickly and then rapidly decline." Horizontal drilling is now allowing operators to access thinner, less developed zones, which is the case in Logan County.

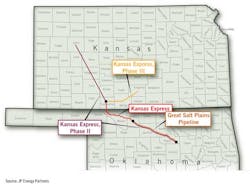

JP Energy Partners announced in April that it had completed its open season and was proceeding with construction. The first phase of the pipeline will provide transportation from Coldwater, Kan., to Cushing. Future phases of the project will extend the pipeline North to Gove County, Kan., and East to Kingman County, Kan.

Multistage fracturing has equalized production, and the formation as it exists in Logan County has proven to be somewhat homogenous. "There are thick and thin zones in this portion of the Miss Lime, but overall it's been fairly consistent," Bradford said. It is perhaps too early to tell, but the partners are hopeful that horizontal drilling and hydraulic fracturing will extend well life in the project beyond that of nearby historical production.

The partnership drilled and completed nine wells in 2012, accelerating from one rig to two rigs drilling continuously in the fourth quarter, with each well taking approximately 25-28 days to drill at an average cost of $3.5 million per well. With an accelerated drilling plan, the partnership announced in April of this year that it had spud nine wells to date in 2013, fully 50% ahead of its plan to drill 20 to 24 wells for the year. It had eight wells in production and an additional 12 wells in various stages of drilling, completion, and flowback.

Logan County, Oklahoma Osage Exploration (25%), Slawson Energy (45% as operator), and US Energy Development (30%) are partners on the Nemaha Ridge Project (in Yellow), which encompasses approximately 32,000 net acres.

Source: Osage Exploration and Development Inc.

Largely, horizontal drilling and hydraulic fracturing have revolutionized operators' abilities to garner new production from historical reservoirs like the Miss Lime.

"The Miss Lime is not an unconventional play, but it's attractive due to its huge aerial expanse and low economic risk," Slawson said.

On the northern boundary

Tug Hill Operating, a division of Fort Worth, Tex.-based Tug Hill, has had a presence in Kansas since Nov. 2011. The company drilled its first well in March 2012 in Comanche County, and it now holds a vast acreage position throughout 26 counties. "This has provided a lot of target areas, which we have found to be different geologically," said President and CEO Michael Radler.

Tug Hill Operating's drilling activity to date has been primarily in Comanche (six wells), Barber (four wells), Hodgeman (three wells), Kiowa (one well), and Ness (one well) counties. "We have approximately 12 wells staked and permitted in six counties in Kansas," Radler said.

Tug Hill Operating is currently the largest privately held oil and gas company targeting the Mississippian Lime formation; it is also the third-largest lease holder in the play with more than 800,000 leasehold acres. "In the case of the Mississippian Lime play, unconventional means different things," Radler said. By definition, an unconventional play is one that does not conform to what is generally believed. "In our opinion, the trapping mechanism is what makes this play unique," Radler noted. "In the past, the play has been developed with vertical wells drilled and completed in a conventional manner, however, a lot of oil and gas remains in the play due to its complex geological makeup," he explained. What has remained is now being produced by means of horizontal drilling and multistage fracturing.

Tug Hill Operating's primary focus is on drilling and producing clean natural gas in the US. While the company is actively developing the Mississippian Lime in Kansas, it has other targets in its sights. "At this point, we have drilled one horizontal well in the Chattanooga shale, and we are waiting on completion," Radler said. "Once we evaluate the science, including logs and cores, we'll determine next steps in our drilling schedule." The company sees other secondary targets on a region-specific basis, including among others Lansing/Kansas City, the Marmaton, and the Viola.

Infrastructure growth

"Existing crude pipeline infrastructure in Kansas does not accommodate near- or long-term oil production from the Mississippian Lime play to Oklahoma without extensive trucking, and Cushing, Okla. is our preferred market," Radler said. In January the company signed a 15-year agreement with JP Energy Development, an affiliate of JP Energy Partners, to transport crude oil from south-central Kansas to Cushing via the Kansas Express, a new interstate crude oil pipeline. The company dedicated 600,000 acres to JP Energy Development to move oil to market.

The Kansas Express will be the second pipeline in the Mississippian Lime play for JP Energy Development, and it will have capacity to take on additional producers. The pipeline will most likely facilitate more production for producers in both northern Oklahoma and Kansas. For Tug Hill Operating, the added infrastructure will give it access to the Cushing market and limit the number of trucks on Kansas highways.

JP Energy Partners announced in April that it had completed its open season and was proceeding with construction. The first phase of the pipeline will provide transportation from Coldwater, Kan., to Cushing. Future phases of the project will extend the pipeline north to Gove County, Kan., and east to Kingman County, Kan. Actual construction of the 12-in. pipeline is expected to begin this quarter with completion targeted for fourth-quarter 2013.