Beyond US border, Mexico primes shale potential

Tayvis Dunnahoe, Editor

Oil production from 14 of the most active counties in the South Texas Eagle Ford shale reached 28 MMbbl in the last year. Gas production doubled from the previous year to 271 bcf, and for the same period, condensate tripled to 21 MMbbl, according to a March report from the Eagle Ford Task Force, which was established by the Texas Railroad Commission. By 2015, the Eagle Ford shale will become the largest stand-alone energy project in the world as measured by capital expenditures, the report indicates.

Meanwhile, across the border from South Texas, Mexico is gearing up to initiate its own shale boom.

"The Eagle Ford doesn't stop at the border," said Edgar Rangel-German, commissioner with Mexico's National Hydrocarbons Commission (CNH). The US Energy Information Administration (EIA) reported in 2011 that Mexico has the second-largest shale gas potential in Latin America and the fourth-largest in the world. The country contains 61 tcf of natural gas reserves but the EIA report places Mexico's shale gas potential at 680 tcf. Mexico state oil company Pemex has been analyzing the numbers cited by the EIA along with the CNH. "In terms of resources, being ranked fourth in the world was a nice surprise, but we believe the EIA's numbers are overestimated," Rangel-German said.

Mexico's CNH was established under new laws in the country's 2008 reform. The commission is responsible for sanctioning reserves, technically sanctioning E&P projects, analyzing information concerning natural resources, and overseeing operations in Mexico. The country is in its earliest phase of unconventional development, and its potential lies in the difference of resources versus reserves. "We have a vast volume of resources," Rangel-German said. According to the commissioner, Pemex is currently working to establish development plans for 20, 30, and 50 years. "Some of these vast resources will be transformed into reserves within the next decade," he said.

In 2010, Pemex drilled its first Eagle Ford test in the Burgos basin. Now with 15 wells drilled, production is proven in northern Mexico, though it is not yet commercial. "As we move to the west from South Texas, we've discovered good quality, liquids-rich gas, and we have also found good quality shale oil in other basins," Rangel-German said. The productive formations are similar to those found in the US: Upper and Medium Cretaceous (Ocinaga and Agua Nueva formations), Upper Jurassic (Pimienta and La Casita formations). "The highest volumes are found in the Upper Cretaceous and Upper Jurassic," he noted. Pemex has determined a medium estimate of 300 tcf for both of these formation types, which is slightly lower than the EIA estimate of 454 tcf.

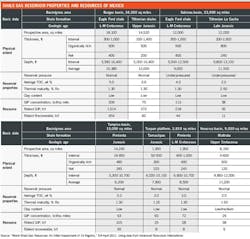

In terms of unconventional resources, Mexico has six main provinces. Tampico-Misantla, which contains the Burros-Picachos platform, holds the highest potential. Other basins include the Southeastern Gulf/Tamaulipas-Chicontopec and Alta Mira. Tampico-Misantla is the most promising basin considering its organic content, maturity, and the complexity of the formation (see table).

Pemex is in the characterization phase, and the company plans to drill close to 200 evaluation wells within the next 4 years. "Drilling activity has centered on identifying the most promising provinces," Rangel-German said. Once these tests have fully characterized the various plays and uncertainty has been reduced, Pemex plans to drill 600 more wells. "These numbers will change as we approach 2014/2016," Rangel-German said. Ultimately, the company estimates 30,000 wells will be required to fully develop Mexico's shales.

Technology and partnership

There are several challenges facing Mexico in its unconventional resource development. Private investment continues to be prohibited. "The minister of energy has announced that a new congress will bring forth proposals for reform," Rangel-German said. But the landscape for private capital expenditure remains unclear.

According to Jeremy Martin, director of the Energy Program with the Institute of the Americas, "reform is mostly discussed in terms of oil." Mexico's conventional resources are well established, both onshore and offshore. Much of the current debate centers on known quantities of oil and gas. Because shale development is unknown, it is difficult to determine how much of the proposed reforms will open the door for private investment in Mexico's shale operations.

In the current legal framework Mexico's minister of energy has set up "field labs." These serve as a knowledge-sharing environment where private companies are assigned an area of 100 to 150 sq km. Tests are drilled and specific technologies are applied to optimize best practices for developing the area. The goal would then be to propose a 10- to 20-year development plan.

For conventional operations, the 2008 reform prompted an incentive-based contract that acts as a hybrid between a service- and a fee-based contract extended for a period of one to two years. During this term, the companies drill and test a series of pilot wells. Once a development plan is in place, the contract provides a base payment and allows for up to 70% to 75% cost recovery. Performance is awarded on additional production over what Pemex has considered in the original development plan. "This current contract model has been applied to conventional developments," Rangel-German said. "It is likely that something similar to this will be put in place for Mexico's unconventional development."

Other challenges

The obvious challenge for Pemex in the short term is technology. Identifying the sweet spots, conducting microseismic, and delineating best practices for safe and efficient completions are at the top of Pemex's list for optimizing the country's unconventional resource potential. "This challenge can easily be overcome because the technology is out there," Rangel-German said, adding that "it's a matter of establishing a good program for transferring this knowledge to Pemex through successful, productive contract models and R&D programs."

It will be some time before Mexico is producing its unconventional resources at a level now seen in the US. Midstream infrastructure could be an early challenge once production comes online over the next 3 to 5 years. "It's too early to tell how we are going to carry these resources to market," Rangel-German said. "Our main focus is to provide the best possible data and input, so that lawmakers can decide the best way to do this." Infrastructure and pipeline systems will be crucial in handling new capacity, but with an early focus on consumption over exportation.

The biggest challenge, as Rangel-German sees it, is human resources. "In Mexico, we lack expertise in developing unconventional resources," he said. Human capital, as it were, will drive Mexico's unconventional resource growth. Whether Pemex can entice engineers to relocate to Mexico or develop the local workforce, the availability of expertise will determine the success of this new paradigm. "Technology and environmental concerns are both important to focus on as we move into the development of unconventional resources," Rangel-German said, "but human resources and infrastructure are paramount."

Onward

Mexico's move into unconventional resources is about sustainability. According to the EIA, Mexico's US imports of natural gas reached a record high in 2012 at approximately 1.7 bcfd, while it exported 790,000 b/d of oil.

While the potential exists for Mexico to take charge of its unconventional resources, its current political framework remains somewhat of an obstacle. "Pemex works within the entire mosaic of energy resources," Martin said. These opportunities in Mexico abound, according to both Rangel-German and Martin, but it is uncertain when reforms will take place to advance new initiatives. "We just don't know," Martin said, adding that Mexico's energy industry will "have to wait." There is expectation of further reforms to be announced this summer.

In the meantime, many observers are confident. "Natural gas is the fuel of the future," Rangel-German said. "Having access to this fuel represents sustainability and energy security—not just for Mexico, but for the North American region.