FIVE ENHANCED RUN LIFE ESPS AT THE HEART OF PERDIDO SEAFLOOR SEPARATION, BOOSTING STATIONS

Installed in 350-ft caissons where cyclonic separation takes place, pumping systems can move up to 125,000 b/d while helping conquer extreme back, spar riser head pressures

Because the Perdido Regional Development involves three widely spaced, ultra-deepwater fields whose reservoirs are made up of older rock with tighter porosity and permeability along with low temperatures and pressures, Shell Exploration and Production (Shell) decided early on to handle all production via equipment placed on the sea floor, including artificially lifting production liquids to the Perdido spar topsides from a water depth of more than 8,000 ft (2439m).

Under this accelerated production plan, Shell would route the gathered oil and natural gas from 35 subsea completions – including 22 wet-tree, Direct Vertical Access (DVA) wells clustered beneath the Perdido spar itself – through two seafloor manifolds and then into five separate vertical processing and boosting stations, each installed on the sea floor in close proximity to the spar and each armed with a powerful electrical submersible pumping (ESP) system.

For this vital system, Shell in December 2006 chose Baker Hughes Centrilift and its innovative array of enhanced ESP run life subsea production solutions. Other Baker Hughes products, including a number of Baker Oil Tools downhole safety and production management and monitoring products, are being installed during completion of the subsea wells, which is still ongoing.

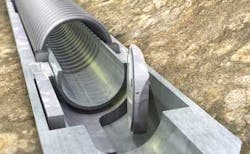

The Centrilift ESPs, however, would be set just below the mud line inside five pre-drilled, 350-ft (92-m) deep, 36-in (91-cm) diameter caissons directly connected to the spar’s production risers. There, cylindrical-cyclonic separation and ESP boosting would take place. The caissons, lowered into five so-called shallow “dummy” wells, and the ESPs, each encased in a pressure vessel with an inlet/outlet connection system on top, would be installed by a construction vessel to await first production.

Combined, the 10-in. diameter,1,600-hp ESPs are capable of delivering up to 125,000 b/d of oil and associated natural gas from the Perdido fields – Silvertip, Tobago and Great White – to the spar topsides.

The Perdido seafloor production handling setup is the world’s deepest application of a full host-scale subsea separating and boosting system, and will remove fluid back pressure on the wells, particularly those completed at Silvertip and Tobago, which will reach the processing/boosting system in lengthy 10-in. (25-cm) seafloor flow lines, some up to 30 miles (48 km) or more in length.

ESPs the only subsea boosting system qualified for ultra-deepwater

As noted, Perdido Regional Development wells tap older Paleocene reservoirs, which exhibit sub-normal flowing tubing head pressures – about 750 psi – compared to younger Gulf of Mexico pools. However, once arriving directly below the Perdido spar, the fields’ multiphase flow will be confronted with a head pressure exerted by 8,000 ft of fluid in the risers, hence the need for artificial lift. ESP systems were chosen for this project because they were the only subsea pumping systems designed to operate at these water depths and corresponding pressures.

In caisson separation, the multiphase fluids are conditioned in the inlet piping and enter the caisson at a downward angle and at a tangent, which causes the fluids to disengage from the gas. Gravity, in turn, causes the separated gas to travel upward inside the production riser tubing annulus. Meanwhile, the tangential velocity inside the caisson keeps the oil/water fluids from re-entraining with the gas, which swirl downwards to the bottom of the caisson, where the ESP then pumps them through dedicated tubing inside the production riser for topsides handling.

Whatever the horsepower/pump rating, Centrilift ESPs are specifically designed to handle high gas volume fractions (GVF). This is particularly important for seabed boosting systems, where gas content can be significant, such as at Perdido. The multiphase pump technology includes the ESPs’ patented split-vane impeller design, which is key to keeping gas from accumulating in the pump and locking it. Under certain circumstances, Centrilift ESPs can handle up to 70% GVF without gas locking.

Subsea separation/boosting exhibits a number of enhanced run life benefits. For example, once the gas is removed from the flow stream, the heat retained in the fluid phase, coupled with the high flow capacity of the ESP, helps prevent hydrate formation. For that reason, Shell did not specify physical heating elements for the Perdido caissons or pumps.

However, Shell did award Baker Hughes with the contract for chemical engineering and design services, with a list of deliverables that included flow assurance, monitoring and surveillance, chemical injection, chemical product development and others. Baker Hughes also was awarded with the first fill contract in 2009, along with a one-year contract to supply chemicals and chemical services.

SURELIFT gauges, monitoring tools

Each Perdido ESP package is equipped with a number of Baker Hughes Intelligent Production Systems’ SURELIFT™ gauging and monitoring instruments designed to optimize output from the ESPs. All SURELIFT instruments are connected inside the ESP pressure vessel by a single mono-conductor cable to power the sensors and transfer the signal cleanly to the surface.

Among the SURELIFT sensors and gauges on each ESP package are:

- The SURELIFT/E Pod, which connects to the bottom of the lower ESP motor and interfaces with resistance temperature device (RTD) sensors for real-time motor winding temperatures along with lower-caisson pressures/temperatures.

- The SURELIFT/E Fixed-Venturi Flow Meter Carrier, which houses a dual gauge for monitoring real-time ESP flow rate and discharge data.

- The SURELIFT/E Dual-Gauge Carrier, which houses a dual gauge whose lower end supplies density and temperature data and whose upper end supplies real-time pressures/temperatures from the middle- caisson level.

- The SURELIFT/E Single-Gauge Carrier, which supplies upper-caisson level pressures/temperature.

- The SURELIFT/E Vibration Sensor, which connects to the ESP intake pump to measure dual X and Y vibrations.

Additionally, Baker Hughes’ ESP/Intelligent Production Systems data specialists are working closely with Shell’s Perdido commissioning team to assure that all SURELIFT real-time data interface with Shell’s SCADA worldwide monitoring system.

Rounding out hardware installations for the ESP installations are the Baker Hughes ESP cable/control line cutting tool, a mechanically operated device designed to cut through the ESP cable, the tubular encased conductor (TEC) wire and chemical injection pack in the event the tubing inside a production riser must be cut and retrieved. The cutter is a critical component of a systems solution approach to intervention.

While Baker Hughes is in the forefront of subsea processing and boosting technology, it also historically has been a key provider of drilling and completions equipment and services, and continues to contribute significantly to preparing Perdido wells for production.

One trip, multiple sampling

In the realm of formation evaluation, Baker Hughes is providing new downhole tools designed to record formation pressures and collect multiple, high-purity samples of formation fluid types and behaviors and then deliver the data to the surface in real time, all in a single trip of the tool array.

Chief among those being utilized in Perdido wells is the Reservoir Characterization Instrument™ (RCI) string, a wire line-conveyed package that takes large-volume, early development samples of well fluids, along with formation pressures and temperatures, and takes them during only one trip into the hole.

The RCI tool can be configured with a straddle sealing array, which employs a modular design for operational flexibility. This overcomes limitations placed on the standard probe configuration in fractured, vuggy and tight-borehole formations. The twin inflatable sealing elements are set in the borehole mud cake wall to isolate a 1-m (3.3-ft) test section, exposing a larger sampling area that requires less draw down.

Included in the RCI string being used in Perdido wells is Baker Hughes’ new In-Situ Fluids eXplorer™ tool, which monitors the real-time physical properties of the fluids being pumped from the formation through the RCI tool. This tool also takes samples in volumes that total up to 4.8 quarts (4.5 liters) and holds them in multiple sealed carriers for later hands-on examination. This capability far exceeds that of traditional wire line formation test tools, which are capable of taking only a few, sometimes highly contaminated formation fluid samples.

Other RCI tool applications include vertical interference testing, rock strength determination and cased-hole testing and sampling.

SCSSVs, real-time completion measurements

For well completions, Baker Hughes is supplying Perdido wells with Neptune™ nitrogen-charged, tubing-retrievable surface controlled subsurface safety valves (SCSSV), which feature innovative non-elastomeric seal technology – an industry first for nitrogen-charged valves.

Additionally, for the 22 subsea completions in the Great White field, Shell chose Baker Oil Tools’ MPas™ one-trip mechanical isolation packers, the industry’s only non-inflatable mechanical packer that conforms to irregular wellbore geometries.

Run as an integral part of the casing or liner string, the MPas packer uses an elastomeric element with composite structure that is hydraulically set. Shifting a balance sleeve allows wellbore hydrostatic pressure to act against an atmospheric chamber, which applies the setting force. A lock mechanism maintains the setting force for the life of the well, even if hydrostatic pressure is removed.

Also, as part of well completion hardware, Baker Atlas ran cement bond integrity measurements using its segmented bond tool (SBT), which provides 360-deg. evaluation of cement bonding to identify any channels in the cement annulus which could result in a poor hydraulic seal and, conversely, find zones of uniform bonding across only a few feet of casing. The data can help avoid costly squeeze cementing procedures.

The Baker Oil Tools Neptune series nitrogen-charged tubing-retrievable surface-controlled subsurface safety valve is designed for completions requiring low operating pressures due to control system limitations.

For ease of interpretation, SBT measurements are displayed in two log presentations, both of which are available in the logging mode as the data are acquired, processed, and plotted in real time.

Finally, on some Perdido wells, Baker Hughes completion engineering specialists are running Real-Time Compaction Imaging (RTCI) logs, which use fiber-optic sensors to monitor sand screen and casing deformation. The RTCI service was co-developed by Baker Hughes and Shell.

Because undetected completion deformations can lead to costly workovers, lost production, and even the potential of loss of the entire well, Shell took advantage of the RTCI technology, which uses thousands of sensors incorporated within the sand screen instrumented with optical fibers to monitor strain and acquire a 3D, high-resolution deformation image of the screen in real time.

Shell plans to re-run compaction logs throughout the life of the wells.

Baker Hughes

2929 Allen Parkway

Houston, Texas 77019

Tel: 713-439-8135 • Fax: 713-439-8600

Email: [email protected]

Website: www.bakerhughes.com