OGJ Newsletter

Market Movement

Long-term power contracts boon for gas

There seems to be a fundamental change under way in the dynamics of natural gas pricing in North America.

And that change is likely for the better.

Part of the impetus for this change is the energy debacle in California and how that augurs for the future of the North American natural gas market. Another driver for change in gas markets is the role of higher-priced oil and the industry's capability for fuel-switching.

The outlook for California's energy markets changed dramatically this month with the introduction of new legislation designed to lock down long-term electric power contracts, notes analyst Raymond James & Associates Inc., St. Petersburg, Fla.

At the same time, plans called for the state to purchase electric power on behalf of California's two largest investor-owned utilities via 1-10-year purchased-power agreements with wholesale electricity producers, for a grand total of as much as $10 billion.

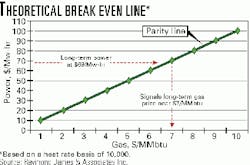

Looking at the first and second rounds of bids in the California wholesale power market, average prices for power were $69/Mw-hr. For 5-10-year power contracts, that would mean power producers would be justified in paying $5-7/MMbtu for natural gas over the next several years, Raymond James said (see chart).

If these power contracts are signed, says Raymond James, it would set the stage for a new era in natural gas contracts. Since natural gas deregulation commenced, the average duration of a natural gas sales contract has fallen from several years to the currently dominant bid-week monthly gas sales.

"The first long-term contracts signed at these price levels could spark a frenzy by utilities to lock up natural gas reserves required to satisfy not only the local distribution companies but also secure supplies necessary to fuel the massive power generation build-out currently under way," Raymond James said.

The analyst notes that power producers can secure these supplies by signing long-term contracts or by buying the gas reserves outright. Either approach is bullish for E&P stocks.

Beyond the obvious boon to power suppliers-by eliminating uncertainty over credit risks and payments and by locking in prices well above levels anyone would have projected not long ago-these long-term contracts will have a domino effect on gas supply contracts that will bolster natural gas producers.

"As the convergence between the gas and power markets continues to strengthen each day, we would anticipate coincident long-term natural gas contracts to be signed at levels well above current price forecasts," Raymond James said. "Natural gas assets and E&P stock evaluations should improve significantly as uncertainty is mitigated by greater visibility in future natural gas prices."

Role of fuel-switching

With long-term power contracts providing an upper end of about $7/MMbtu to the range of natural gas prices over the next few years, is there a corresponding market dynamic that could establish a lower end to that range?

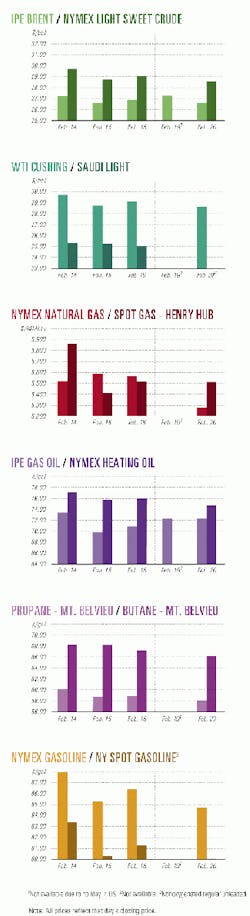

Raymond James thinks so, and cites the role of fuel-switching in easing the pressure on natural gas storage withdrawals in recent weeks. Natural gas futures prices by last week had fallen below $6/MMbtu as demand slackened despite another surge of cold weather in mid-February.

A big factor in the reduced call on gas storage has been a greater-than-expected level of fuel-switching. Raymond James now estimates that fuel-switching accounts for 5 bcfd of demand reduction, vs. its earlier estimate of 3 bcfd.

The analyst estimates that, since the end of 2000, total US gas demand has been slashed by 10 bcfd, with about half coming from reduced industrial consumption and half from switching and conservation.

"The most important change in our thought process has been the realization that a near doubling of seasonal heating oil imports allowed unprecedented fuel-switching from natural gas to heating oil," Raymond James said. "The irony is that increased fuel-switching has now established a longer-term 'floor' on natural gas prices that is equivalent to the btu content of heating oil. Today, that equivalent price would be near $6/Mcf."

Supply-side disappointments

While the demand reduction effect of fuel-switching has been greater than expected, the market is bolstered by a supply-side contribution that has fallen short of expectations.

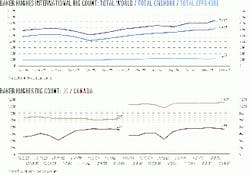

Recent US and Canadian gas production data suggest that gas supply is up only about 1 bcfd year-to-year, vs. earlier expectations of about 2 bcfd-from added production in the US and Canada as well as increased LNG imports.

Raymond James reckons that about 4 bcfd of additional supply has hit the market, but with only 1 bcfd of this supply available on a sustained basis.

Simply put, a comparison of recent state production data and production data from companies' fourth quarter earnings reports indicates that North American natural gas supply has not responded to increased drilling yet.

Coal's role

Over this bullish outlook for natural gas markets looms the specter of a strong resurgence in coal-fired electric power generation.

In mid-February, two major announce- ments signaled a possible revival of interest in constructing and operating new coal-fired electric power plants in the US.

The spike in natural gas prices has added luster to the economics of new baseload, coal-fired power plants. A sustained gas price above $4.50/Mcf means that new baseload coal-fired power plants become extremely competitive, notes Raymond James.

But the analyst suggests that this new-found boom in coal-fired power plant construction might be smaller than some anticipate.

"Despite the improving economics, coal will not displace gas-fired generation in the short run or in the long run," Raymond James said. "Short term, 95%+ of all the newly announced electric capacity in this country is scheduled to be natural gas-fired.

"Given the current shortage of electricity, generators simply do not have time to change to coal or other fuels. These gas-fired plants will be built over the next 2 or 3 years. Longer term, there are other limitations on coal-fired electric generation that may override economic considerations."

Such limitations include long construction lead times, large siting requirements, emissions issues, and rising coal prices, says Raymond James: "ellipseThese new coal-fired plants will be on a much more limited scale and scope than the build-out currently under way for natural gas-fired electric capacity."

null

null

Industry Trends

Internet technology is reshaping the energy industry.

And it is doing so in ways that few participants yet comprehend, said Robert P. Peebler, vice-president of e-business strategy at Halliburton Co., at a Feb. 15 e-business workshop in Houston sponsored by the Society of Petroleum Engineers.

The ability to share immediate information is enabling virtual integration-several companies partnering in energy operations-to replace vertical integration, where the company does everything itself, Peebler said.

Going far beyond traditional outsourcing, virtual partners and remote service providers collaborate to become an integral part of an E&P company's "value proposition."

"Core is what you do to create future shareholder value. Context is everything else," he said. "The question is, 'How do you get 80% of what you do focused on your core operations and get rid of everything else?'"

His answer is the collaborative virtual integration of a variety of companies, with each making its own contribution toward the common goal. "What's context for you is core for someone else," Peebler said.

Rather than having a central "master-slave" command structure controlling the cooperative effort, however, the system will voluntarily organize itself into a true collaboration, Peebler said, with each component contributing its own specialized work.

Those virtual partners "must be economically aligned and effectively integrated with the company's internal systems, including its information technology. The 'virtual IT' system of the future, therefore, must extend far beyond the corporation's firewall," Peebler said.

SCORE SHOWS DRILLING UP SHARPLY IN EVERY MAJOR REGION.

Houston-based Global Marine's worldwide Summary of Current Offshore Rig Economics (SCORE) for January was 42.1, an increase of 13.1% over December and one of the largest month-on-month increases ever reported.

"The majors are back in the game!" said Global Marine Chairman, President, and CEO Bob Rose. "After being on the sidelines for more than 2 years, the major oil companies may make 2001 the year of the drillbit."

SCORE compares the profitability of current mobile offshore drilling rig rates to the profitability of rates at the 1980-81 peak of the offshore drilling cycle, when speculative new rig construction was common and SCORE averaged 100%.

In 1980-81, new-contract day rates equaled the sum of daily cash operating costs plus about $700/day per $1 million invested.

In the Gulf of Mexico, January's SCORE increased to 46.7, up 10.8% from December and up 65.9% from a year ago. The gulf rating is up 11.4% from 5 years ago.

The North Sea SCORE for January was 34.2, up 22.2% over last month and up 76% over the same month last year, but down 40.7% from 5 years ago.

Government Developments

The new administration of Mexican President Vicente Fox is questioning some traditional elements of that country's energy policy, a Cambridge Energy Research Associates (CERA) conference in Houston was told.

Jose Luis Aburto, a former deputy energy minister who now is with the office of Mexico's secretary of energy, said "several inconsistencies in Mexico's energy policy" require changes.

Although Pemex and the Federal Power Utility (CFE) have previously "fulfilled expectations to a large degree," he said, they "now lack elements" necessary for Mexico's energy growth, particularly in providing natural gas to fuel energy power plants. "In many ways they have become a burden," Aburto said.

"In order to correct the limitations we have in Mexico, we need capital, technology and skills. The only way we're going to be able to solve these problems in time to satisfy demand is to open up to private investment in a much more effective way than we have in the last decade," he said.

Alaska Gov. Tony Knowles said earlier this month that there is not enough congressional support to pass legislation allowing development of the Arctic National Wildlife Refuge (ANWR) coastal plain.

US President George W. Bush plans to make ANWR leasing a keystone of his forthcoming energy policy, and Knowles agreed it should be. The governor said three things changed recently that will impact the fate of ANWR exploration-two positive and one negative.

Making an unscheduled talk at the recent CERA conference, Knowles said the election of President Bush was positive because of the president's commitment to pursue ANWR development. Also, Bush named Vice-Pres. Dick Cheney, an oil industry veteran, to head his energy task force.

"The negative-I don't think there are the votes in Congress now to get it through," Knowles said.

"Oil production in ANWR and protection of the refuge are not mutually exclusive," he said. "We can extract the oil that our nation needs while preserving the arctic environment."

The US Minerals Management Service has issued a final environmental impact statement (EIS) examining the possible effects from FPSO systems proposed for use in the development of deepwater oil and gas resources in the Gulf of Mexico.

MMS also released the comparative risk analysis on the possible use of FPSO systems in the gulf.

The EIS said potential site-specific impacts are essentially the same as with other deepwater development and production systems.

Most of the risk of oil spills is associated with the shuttle tankers, not the FPSO itself, and that risk is comparable to the risks from other deepwater systems and from pipelines.

It said excluding FPSOs would not reduce cumulative environmental impacts because other systems would be used in its place.

The analysis did find that emissions associated with shuttle tankers, absent additional restrictions, could exceed air quality limits in the Breton Class 1 air quality area. The EIS was limited to the central and western Gulf of Mexico planning areas.

Quick Takes

Maersk Oil is advancing its development off Qatar.

Qatar has approved plans for further development of Al Shaheen field on Block 5 off Qatar, said Maersk Oil Qatar.

The program would increase production to 200,000 b/d of oil in 2004 from 112,000 b/d.

This year Maersk will drill 40 production wells, 20 water injection wells, and a number of appraisal wells. The company also will convert 14 existing wells to water injection and install production platforms interconnected with pipelines, facilities for gas compression, and a gas export pipeline to Qatar Petroleum's North field Alpha platform.

Once pipelines are installed, some production may begin from the drilling rigs before permanent facilities are in place in 2003.

In other development news, Petro-Canada, operator of Terra Nova oil field off Newfound land, says first production will be delayed until late this year due to design and workmanship problems identified in several key vessel systems of the project's FPSO. The irregularities were found during the vessel's onshore hookup and commissioning after its arrival at Bull Arm, Newf., from a South Korean shipyard. The company said final cost estimates for the field's development could appreciate as much as 15% from the previous $2.5 billion (Can.) estimate, and additional time is required for remedial work to address design engineering and workmanship. The company said the delay is disappointing, but Terra Nova remains attractive, with estimated reserves of at least 370 million bbl of crude oil and a projected 15-year production life. Production is expected to be 130,000 b/d in 2002.

Tyumen Oil (TNK) said its newly formed subsidiary TNK-Uvat will develop the Kalchinskoye, Irtyshskoye, and Yuzhno-Pikhtovoye oil deposits in Western Siberia under a production-sharing agreement. TNK holds 99.7% of the firm, which was formed Dec. 27. Other shareholders are SINCO, Novosibgeologya, and Tyumenneftegas, each holding 0.1%. A seismic survey is under way. TNK claims reserves in the three sites total about 98.7 million tonnes of oil. After finalizing the PSA, TNK-Uvat will explore the southern portion of the region.

After remapping its Kvitebjørn gas field, Statoil is asking Norwegian authorities to approve a revised development and operation plan that includes development of the field's flank areas. By enlarging the development area on Block 34/11 in the Norwegian North Sea, Statoil expects to upgrade reserves to 52 billion cu m of gas from 47 billion cu m and 135 million bbl of condensate from 105 million bbl. Project manager Bjarne Bakken said the expansion requires drilling 11 wells instead of 9, and reconfiguring the layout of the wells. Kvitebjørn costs are expected to increase by 500 million kroner to 10.5 billion kroner. At the heart of the current development plan, unchanged by the expansion, is a fully integrated, fixed steel production and drilling platform, with living quarters, in 190 m of water. The development, which includes oil and gas trunklines connected to the gas treatment facilities at Kollsnes and Mongstad, is scheduled to be on stream in 2004.

Cabinda Gulf Oil Co. (CABGOC), a unit of Chevron, awarded Technip a front-end engineering service contract for the development of the Benguela-Belize-Tombocco oil fields in 1,100-1,400 ft of water on Block 14 off Angola. CABGOC operates Blocks 0 and 14. The fields will be developed with a 42-slot drilling and production facility. Tombocco's remote production center will likely be tied to the Benguela-Belize drilling and production center. Technip Upstream will carry out the fee project with the participation of two subcontractors: Intec Engineering for subsea studies and ODA for drilling studies. The 17-week-long Phase 1 will cover definition engineering and optimization. Phase 2, to be completed 38 weeks after the date of order, will cover preliminary engineering, including preparation of equipment, procurement, and construction bid packages.

Ecuador has selected the OCP Ecuador consortium to build a proposed $1.1 billion export crude oil pipeline.

The decision had been expected last year (OGJ, Dec. 4, 2000, p. 30). The 450,000 b/d line will mostly parallel the existing 311-mile trans-Ecuadorian pipeline (SOTE) crude oil pipeline-currently operating at 380,000 b/d capacity-with a "considerable" deviation, north of Quito, to Quinind

Ecuador's President Gustavo Noboa said the new line could allow the country's oil output to reach 800,000 b/d by first quarter 2003. For some time, field development plans have been stalled due to lack of transportation capacity.

Blocks that have so far remained closed to exploration will be offered on new bidding rounds, and several other projects such as the joint ventures, the strategic alliances, and the Ishpingo-Tiputini-Tambococha program may well be carried out by Petroecuador.

OCP Ecuador consists of Argentina's Techint and five companies that produce oil in the Oriente basin: Occidental Ecuador, Alberta Energy, Kerr-McGee, Repsol-YPF, and Agip.

The line is scheduled for completion within 25 months of signature; construction will begin after completion of an environmental study and administrative procedures. Operation is slated for 2003.

The line will have capacity to carry 450,000 b/d of 16-22° gravity crude. The five firms that will use the line currently produce 120,000 b/d of oil, which is pumped through the SOTE pipeline.

In its deviation to Quinindé, the new pipeline will cross environmentally sensitive areas in the western foothills of the Andes.

At the maritime terminal at Balao, there will be five 750,000 bbl tanks for crude storage and two loading submarine lines with a flow capacity of 60,000 bbl/hr. Two mooring systems can receive tankers having capacity of 130,000 dwt and 250,000 dwt.

In other pipeline news, Canada's National Energy Board took another step toward tighter pipeline safety regulations. NEB released the results of a survey conducted last fall on its proposed Damage Prevention Regulations aimed at preventing damage to pipelines under NEB jurisdiction. NEB said 118 companies, groups, and individuals returned surveys with suggestions for the new rules. More than 80% of respondents indicated strong support for one-call centers for NEB-regulated pipelines, line location accuracy requirements, standardized crossing designs, development setbacks based on land use, minimum qualifications for pipeline locators, and standards for public awareness programs. NEB said it would use the information to develop draft regulations that will be circulated to interested companies, groups, and individuals later this year. NEB also plans to hold public meetings across the country to gather feedback. The Damage Prevention Regulations will replace the existing Pipeline Crossing Regulations. The new rules will govern activities on or adjacent to pipeline rights-of-way in the interest of public safety, the environment, and personal property.

Chevron Offshore (Thailand) plans to INCREASE production from its Gulf of Thailand license. The company will increase crude oil production 164% to 90,000 b/d by 2004-05 from Block B8/32 and natural gas production by more than 130% to 340 MMcfd. The license covers 2,900 sq km about 201 km offshore.

Chevron told Thai authorities that four new fields on the tract are driving the higher production; North Jarmjuree, South Jarmjuree, Kung, and Maliwan will be developed in stages over the next 4-5 years.

Already the largest oil producer in Thailand, Chevron Offshore's current production is from Tantawan and Benchamas fields.

The company estimates its oil reserves on Block B8/32 at 350 million bbl and its gas reserves at more than 2.5 tcf.

Production from Maliwan is due to start in November at 1,000 b/d, ramping up to 13,000 b/d by 2005. Production of 50 MMcfd of gas from North Jarmjuree is scheduled to start in early 2003, increasing to 190 MMcfd of gas and 6,000 b/d of oil in 2005 (OGJ Online, Nov. 13, 2000).

In other production action, BG Group said that it has brought one Egyptian field on stream and found gas with another well. At the Rosetta concession in the Nile Delta, BG and partners began delivering gas into the national grid Jan. 31, less than 45 months after drilling the discovery well. Production will eventually reach 275 MMcfd. All production from the $330 million development project is promised to Egyptian General Petroleum Corp. under a 25-year agreement to supply the Egyptian market (OGJ, Nov. 17, 1997, p. 32). At Rosetta, six wells are tied back to an unmanned platform. Production flows through a 66-km gas-condensate pipeline to a terminal near Idku, 50 km east of Alexandria. Condensate is shipped by pipeline to a gathering point at Abu Qir, 15 km east of Alexandria. BG operates Rosetta with 40%; a unit of Royal Dutch/Shell holds 40%; and Edison International holds 20%. BG and Edison also participated in the Sapphire-2 appraisal well, north of Rosetta in the West Delta Deep Marine concession. Sapphire-2, the eleventh consecutive successful well drilled in the concession since 1998, tested 33.2 MMcfd of gas and 755 b/d of condensate. The flow rate was constrained by testing equipment. BG operates West Delta Deep Marine with 50%, and Edison owns 50%.

BP Exploration (Alaska) will join Anadarko Petroleum and Alberta Energy Co. in a JV to explore for natural gas on a tract covering more than 3 million acres on Alaska's North Slope.

BP acquired a one-third interest in Anadarko's 3.1 million-acre agreement with Arctic Slope Regional Corp. The area is in the foothills area of the Brooks Range region, and stretches east-west for 250 miles from Colville River to Canning River.

The joint exploration effort is already under way and includes several seismic surveys this year. Anadarko is the operator, and each company holds a one-third interest in the program.

In exchange, Anadarko received from BP an interest in a satellite prospect near Prudhoe Bay and an interest in selected seismic surveys conducted by BP on the North Slope.

BP will also purchase a one-third interest in about 230,000 acres of state leases jointly acquired by Anadarko and AEC at the North Slope area-wide lease sale in November 2000. AEC will retain its one-third interest.

Elsewhere on the exploration front, Sinopec and CNOOC will establish a joint management committee to supervise exploration and production activity in the East China Sea. CNOOC CEO Fu Chengyu said Sinopec and CNOOC will each have a 50% stake in the oil and gas reserves and share operatorship in the East China Sea. Sinopec conducts E&D in the area through unit Sinopec Star Petroleum. Sinopec Star has combined proven oil and gas reserves of 425 million tonnes of oil equivalent, of which 20% is in the East China Sea. Sinopec unit China Petroleum & Chemical is expected to buy Sinopec Star's upstream assets sometime this year.

Petrobras said it found evidence of oil in the 1-BRSA-33-ESS well in the Campos basin off Rio de Janeiro at an interval of 2,814-2,900 m. Water depth on location is 1,245 m. The well will be drilled to 3,824 m.

Petrozuata-a joint venture of Conoco and Venezuelan state oil firm PDVSA-started up its $3 billion upgrading plant in eastern Venezuela that will convert extra heavy crude from the Orinoco Oil Belt into a high-quality, synthetic crude for export.

Conoco holds a 50.1% stake in Petrozuata, while PDVSA holds 49.9%.

The upgrader was designed to process about 120,000 b/d of 9° gravity extra-heavy crude from the Zuata area of the Orinoco Oil Belt and produce some 103,000 b/d of a lighter, 21-25° crude.

Conoco President Archie Dunham told reporters that over the next year Conoco and PDVSA will study the feasibility of building another upgrading plant to handle more crude from the Orinoco Belt.

The Orinoco Belt is said to contain an estimated 270 billion bbl of recoverable, extra-heavy crude re-serves of which only 6% have been tapped.