Base oil markets in East Asia will require only limited investments

During the next 5 years, only limited new investment in base oil production will be required in East Asia. Although regional base oil capacity utilization will improve from 82 to 90% and base oil margins will recover, they will not return to their precrisis levels.

Chem Systems presents these key points in a report highlighting the unique lube market characteristics for each country within the East Asia region.

After declining 5% in 1998, Asian lubricant consumption increased 2.5% to 10 million tonnes in 1999. Lubricants-demand growth will be nearly 3% in 2000, followed by moderate growth in the next decade.

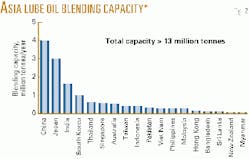

Fig. 1 breaks down the contributions of countries to 2000 demand. As Fig. 2 shows, Asia has more than 13 million tonne/year of blending capacity, sufficient for demand growth.

One of three levels categorizes each lubricants oil market: mature, transitional, or emerging. As expected, product quality is highest in mature markets and lowest in emerging markets. Competition in both mature and emerging markets is concentrated, and thus entry barriers are high. Transitional markets, on the other hand, have fragmented competition and moderate entry barriers.

Mature Asian markets include Japan, South Korea, Taiwan, Hong Kong, Singapore, Australia, and New Zealand. Transitional markets include Thailand, Malaysia, Indonesia, and the Philippines. Emerging markets include Bangladesh, China, India, Myanmar, Pakistan, Sri Lanka, and Viet Nam.

The multitiered nature of most Asian markets, particularly in emerging and transitional market countries, requires that marketers carefully consider their brand positioning. The traditional strategy of emphasizing only high-end market offerings runs the risk of missing out on lower profile, but attractive, high-volume market segments.

Emerging markets in the region, which account for 51% of regional demand, will drive regional demand growth and increase their share of regional demand to 54% by 2010. China represents one third of this total regional demand.

Lubricant demand in the region's mature markets, including Japan, which now accounts for 37% of regional demand, is expected to grow below regional averages during the next decade with their share declining to only 31% of regional demand in 2010.

Whereas most of the region's current base oil capacity is designed to produce Group I base oils, the limited new base oil capacity that will be built in the region will produce Group II or Group III base oils.