OGJ Newsletter

Market Movement

IEA cuts oil demand projection

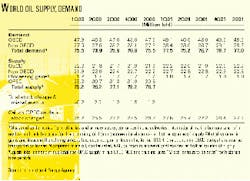

Citing a slowing global economy as the basis, IEA has lowered its projections of worldwide oil demand growth this year by 140,000 b/d.

In its February Oil Market Report, the agency says that demand for oil has been below expectations since October. January's demand growth was weak despite short-term fuel-switching to oil from natural gas in North America. Granted, in Europe and Asia, warmer weather and higher prices suppressed demand, but the remainder of the weakness can be blamed on the economic slowdown.

With inventories of oil low, IEA is blunt in its discussion of OPEC's motives for implementing deep quota reductions and is critical that al though the cut agreed upon in January had not yet had time to affect the market, there was already speculation about how much more of a quota cutback would be necessary to keep prices propped up.

Rather than letting demand be the determinant of supply, the goal of setting its production levels appears to be to maintain the price of oil within a target range. "Producers talk as if their goal were strictly to stabilize markets, but they act as if they were primarily focused on maximizing revenue."

IEA charges that by shorting the market of the barrels it needs to build stocks, OPEC is fostering backwardation and therefore, volatility (see Watching the World, p. 23). This, the report warns, will be the normal state of affairs unless OPEC changes its focus away from price alone.

Crude supply outlook

Preliminary estimates in dicate that fourth quarter crude inventories moved up in North America but fell in OECD Europe and Pacific.

The increase in North America came as a surprise in light of very high refinery crude runs and the suspension of Iraqi exports, but inventories of crude remain extremely low on the US Gulf Coast and Midcon tinent regions.

Fourth quarter crude stocks fell by 270,000 b/d in OECD Europe and by 140,000 b/d in the OECD Pacific countries. IEA projects that non-OPEC supply will move up 870,000 b/d this year (see table). More than 70% of this is expected to come from the former Soviet Union and Mexico.

Strong upstream capital investment in Russia is projected to boost output there by 270,000 b/d and higher output from the Tengiz field is forecast to lift Kazakhstan's production by 90,000 b/d.

Expanded output at the offshore Cantarell complex is expected to increase Mexico's production this year by 265,000 b/d.

Refining margins drop

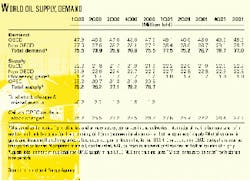

All the major refining centers, except the US Gulf Coast, posted lower margins in January.

Strong local product markets boosted US Gulf Coast refining margins last month. Cracking margins for Brent and WTI were a respective $4.60/bbl and $4.65/bbl, up from $0.55/bbl and $1.38/bbl in December.

Meanwhile, mild winter weather weakened Rotterdam margins. Hydroskimming margins moved $2.39/bbl lower and cracking margins dropped by $1.66/bbl from a month earlier.

Mediterranean margins were the hardest hit among the major refining centers, falling more than $3/bbl from December as high Urals crude prices loomed in the absence of Iraqi exports from Ceyhan, Turkey.

Singapore margins suffered declines of $2.12/bbl for hydroskimming and $1.76/bbl for cracking as a result of the strong price of Dubai crude in the wake of OPEC production cuts and high transportation costs for ocean freight.

null

null

Industry Trends

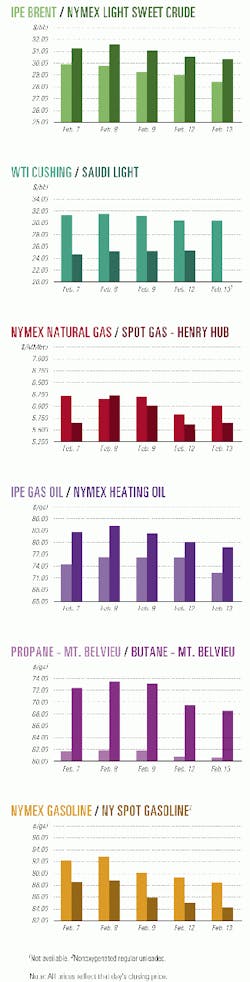

Saudi Aramco stepped up its development drilling spending for 2001-02.

The company this year said it will spend $1.05 billion-an increase of 27.5% over the year before. In 2002, the company will raise that sum another 14% to $1.2 billion, according to a recent report by UBS Warburg LLC.

Over the past 6 years, the company's cost per well has practically doubled. Saudi Aramco's estimated cost per well in 2001 is a bout $4.3 million compared with $1.9 million in 1995 (see table).

In 2001, the company plans to drill 246 wells and 292 in 2002, up from 199 the last 2 years. The last time Aramco drilled 250 wells was in 1998 and only spent $772 million to do so.

UBS Warburg noted that the per well cost increase "reflects a shift toward more gas drilling as well as a shift toward drilling more technologically sophisticated wells. At these levels, per well costs are almost equal to those in the Gulf of Mexico."

A New England study is calling for MORE natural gas pipeline construction in the US Northeast.

The Northeast could be short of electricity during peak winter demand as early as 2003, and unserved capacity could reach 3,000 Mw in 2005, unless the region moves quickly to build natural gas pipelines, says a study commissioned by the New England grid operator.

New England is expected to get 45% of its electricity from gas-fueled power plants by 2005, compared to 16% in 1999, raising questions about the adequacy of the pipeline infrastructure in the region.

Presently, power plants totaling more than 6,700 Mw are under construction throughout the six-state region, all using gas as the primary fuel source.

While no constraints on interstate pipelines are expected this winter, the study by Boston consultants Levitan & Associates Inc. for Independent Service Operator New England Inc., projects 1,700 Mw of gas-fired generation could be affected during peak winter power demand in 2003.

During the coldest part of the winter, there may not be sufficient capacity to satisfy demands of both gas utilities and gas-fired generators, the study found.

"One of the most obvious recommendations is for these gas-fired plants to have dual fuel burning capabilities and back-up fuel capability," said Stephen G. Whitley, ISO New England's vice-president of system operations.

Government Developments

The opening of European gas and electricity markets have received further backing.

European Commission Vice-Pres. of Energy and Transport Loyola de Palacio last month gave preconditions for the "full opening" of gas and electricity markets on the continent within 4 years.

For European Union citizens to reap the benefits of deregulation of these energy sectors, there must be "clear and open access to the networks, a set of trading rules, an improvement of infrastructure capacity, and the respect of social and environmental objectives," she said.

De Palacio, speaking at the World Economic Forum in Davos, Switzerland, said the EU was on the "right track" in its restructuring of the gas and electricity markets, but that "more needs to be done" toward achieving "truly integrated markets that will profit European consumers."

She plans to issue several proposals to the EC "in the weeks ahead" aimed at "deepening" the pace of liberalization so that markets will be "fully opened to all consumers by 2005, with all non-domestic consumers being open to competition in 2003 for electricity and 2004 for gas."

Before these deadlines, said de Palacio, the EC would push for published and regulated access tariffs to "become the norm," because access to the networks is "crucial" to developing competitive markets. In line with this plan, she said, the EC would ensure that the future transmission network operators would be "fully independent" from any involvement in generation and sales to ensure that access is offered on "nondiscriminatory terms."

UK NORTH SEA GOVERNMENT-INDUSTRY INITIATIVE LEADING OIL & GAS INDUSTRY COMPETITIVENESS (LOGIC) this month chose the Nisus consortium to create development design for BP's marginal Wood field, the first discovery to advance under the initiative's "satellite accelerator" program.

Wood field, which has estimated recoverable reserves of 10 million boe, is on Block 22/18-6 between Arbroath and Marnock fields in the central North Sea. BP had not developed the oil and gas discovery because it was considered "subeconomic under current development scenarios."

The Nisus consortium consists of Global Marine Integrated Services Reservoir Management, Stolt Offshore, and Wood Group Engineering.

Phase one of the Wood project will involve funded studies "to confirm that the technical and commercial aspects of the Nisus proposal are viable," said LOGIC Collaborative Project Coordinator Charles Miskin. The project then would move into a contract definition phase this summer.

According to Miskin, the timing of the discovery's development will be "dependent on discussions with the proposed host facility," but first oil is being targeted for second half 2002.

BP Regional President for Scotland Steve Marshall said, "The inclusion of Wood in [this] initiative is an attempt by BP to engage the creativity of the marketplace to develop a field that has to date proved difficult to make economic."

Wood is the first of five undeveloped UK North Sea discoveries earmarked last August to be brought to market under the LOGIC scheme. The other four are Solan, Strathmore, Kestrel, and Kessog.

Total reserves for the five fields-found by BP, Amerada Hess, and Shell UK E&P-are estimated at more than 200 million boe and could lead, according to LOGIC, to "as much as £500 million of new development investment."

Quick Takes

Singapore has inked a 20-year, $9 billion contract with Indonesia to buy 2.27 tcf of South Sumatra Natural gas.

The agreement came just weeks after Singapore and Indonesia started up their joint multibillion-dollar gas supply initiative, the West Natuna gas transportation system.

Singapore will import as much as 350 MMcfd through the 300-mile pipeline, about half of which will be offshore, from south Sumatra to the islands of Batam and Singapore. Deliveries of 150 MMcfd will begin in 2003.

Indonesian state gas distribution firm PT Perusahaan Gas Negra owns the Indonesian section of the line, while Singapore Power subsidiary PowerGas owns the remainder. Once fully operational by July 2003, Indonesia expects the project to generate at least $7 billion in revenues.

Elsewhere in pipeline news, a trio of major Alaska North Slope producers, the North American Natural Gas Pipeline Group, is taking preliminary steps to construct a 48-in. gas pipeline through Alaska and Canada to markets in the US, industry officials told Alaskan legislators this month. The group's three-member management committee-Joe Marushak of Phillips Alaska; Ken Konrad, BP Exploration (Alaska); and Robbie Shilhab, ExxonMobil-outlined preliminary plans for the proposed system to separate Alaska state Senate and House committees. Initial construction is expected to cost at least $75 million, officials said. The proposed line, which will be designed to operate at 2,500 psi of pressure or greater, would be made of 1-in. thick, high-strength steel. The group's management doesn't yet have complete estimates for all technical, permitting, and logistics costs for either of two competing pipeline routes currently proposed: A northern route would loop offshore from Alaska's North Slope to Canada's Mackenzie Delta and down the Mackenzie Valley to northern Alberta, while the proposed southern route would parallel the existing North Slope-Fairbanks oil pipeline, then follow the Alaska Highway into northern Alberta.

Explorer Pipeline plans to expand its 1,400-mile products mainline between Houston and Chicago by at least 100,000 b/d before late 2002. Explorer said the line has been at capacity for 2 years. The system currently moves 560,000 b/d of gasoline, diesel fuel, and jet fuel through a 28-in. line from Houston to Tulsa and then 350,000 b/d through to Chicago via a 24-in. line. Explorer will add 9-15 intermediate pumping stations rather than any new pipelaying. Detailed engineering design to determine the size of the expansion is under way.

Thai Olefins Co. (TOC) PLANS to build A $210 million, 300,000 tonne/year ethylene glycol plant IN THAILAND.

TOC will integrate the plant with its existing Map Ta Phut petrochemical complex at Rayong, Thailand.

To build the facility, TOC will form a JV firm with international companies. The company recently awarded Chiyoda Corp. and Halliburton a $140 million contract to build a 300,000 tonne/year ethylene plant, also at Map Ta Phut (OGJ Online, Jan. 29, 2001).

Meanwhile, TOC expects a new capital injection from the Petroleum Authority of Thailand, which holds 49% of the company, to finance the expansion of the ethylene complex.

In other petrochemical news, German technology group Lurgi is in development stages to build a test plant for converting methanol into propylene at Statoil's Tjeldbergodden facility in western Norway. The Tjeldber godden plant currently produces more than 2,400 tonnes/day of methanol. "The contract will enable us to gain first-hand experience of this technology and help us to develop a new market for methanol," said Sjur Haugen, manager, business de vel opment, for Statoil's methanol unit. The plant is slated to come on stream before the summer.

ENI has Stepped up its presence in Iran.

ENI has taken a 38.25% interest in a JV that will spend a projected $300 million to develop Balal oil field in the Persian Gulf off Iran.

The field, which is in 70 m of water, has an estimated 100 million bbl of reserves and is expected to produce 40,000 b/d (OGJ Online, Oct. 19, 2000).

Work is under way and production will begin by late 2002. Under terms of the buy-back contract, the JV partners-which include operator TotalFinaElf with 46.75% and Bow Valley of Canada holding 15%-will recover their investment with partial ownership in the field's production. ENI estimated it would receive about 9,000 b/d of oil.

ENI already serves as operator and holds 60% interest in phases 4 and 5 of a project to developing the offshore South Pars gas field. The Italian firm also holds a 45% stake in the development of Dorood offshore oil field; TotalFinaElf holds 55% interest.

Elsewhere on the development front, Stolt Offshore Services awarded J. Ray McDermott Middle East a subcontract to build three decks for platforms to be installed in EA field-operated by Shell Petroleum Development of Nigeria-43 miles off Forcados in the Niger Delta. JRM, which also will be responsible for loadout and transportation of the structures, started fabrication work at its yard in Jebel Ali Free Zone in Dubai. The decks will be transported in December. Shell and its partners expect to spend $1 billion to develop EA field, which holds an estimated 350 million boe in reserves. When fully developed, the field is expected to yield 120,000 b/d and 100 MMcfd of gas (OGJ, Nov. 1, 1999, p. 34). EA field is due on stream in the second half of 2002.

A unit of Ivanhoe Energy signed agreements with PetroChina for JV development of reserves in the Sichuan basin. The agreements give Sunwing Energy exclusive rights to develop and exploit oil and gas reserves on three blocks in the basin. The Zitongxi, Zitongdong, and Yudong blocks cover more than 2.2 million acres near Chongqing, 932 miles southwest of Beijing. Chinese estimates place the blocks' proven and probable reserves at 20 tcf of gas.

A "Major discovery" was made near crazy horse field in the deepwater gulf of mexico, say field developers BP and ExxonMobil.

The oil majors said they made the discovery in Crazy Horse North on Mississippi Canyon Block 776. The discovery is 5 miles northwest of Crazy Horse field.

BP and ExxonMobil hold a respective 75% and 25% in both fields. The companies said that Crazy Horse would produce 1 billion bbl, making it the largest ever opened in the gulf.

Crazy Horse North, which is on a separate structure than Crazy Horse, will rank as one of the five largest fields in the gulf, the companies say.

Plans are under way for a phased development of Crazy Horse. Initial production is expected by 2005 from a 250,000 b/d floating production unit.

Elsewhere on the exploration front, Noble Affiliates made its first operated deepwater discovery in the Gulf of Mexico with a well at Lost Ark prospect on East Breaks Block 421 in 2,700 ft of water. The OCS-G-17255 No. 1 well was drilled to 7,770 ft TD. Noble said it found a pay section with high porosity and permeability at 6,695-7,770 ft. No details of production tests were released, but the operator said the discovery is commercial. Noble plans to develop the well via a subsea completion tied back to an existing host platform. F CMS Oil & Gas made a discovery at its Estrella-1 well off Equatorial Guinea. The well is in 200 ft of water, 22 miles northwest of Bioko Island. Estrella was drilled to 10,324 ft and flowed at a combined rate of 47.3 MMcfd of gas and 6,780 b/d of condensate from two intervals at 6,950-7,200 ft. Flowing tubing bottomhole pressure was 4,802 psi through a 48/64-in. choke. The shut-in bottomhole pressure measured at 4,920 psi.

Murphy Oil made a natural gas discovery in northeastern British Columbia that flowed up to 100 MMcfd on test. The A-97-H exploratory well, about 62 miles north of Fort St. John, BC, was drilled to 9,153 ft TD and flowed at 100 MMcfd under test conditions in June. Harvey Doerr, president of Murphy Oil's Canadian unit, said gas flow was restricted by government regulations that set a ceiling of 46 MMcfd. Doerr said Murphy is drilling more wells, but field production will depend on what is found and how much pipeline capacity is available to move the gas. By Mar. 15, the companies want to complete a 10-mile connection to the TransCanada PipeLines system. The National Energy Board is reviewing the application.

Norwegian project delays take center stage this week in production news.

Statoil delayed production from Smørbukk in the Åsgard field in the Norwegian Sea because it found weaknesses in 80 welds on hubs that connect gas pipelines.

The lines affected were those from Midgard and Smørbukk to Åsgard B platform. The weaknesses were found while Smørbukk was being readied for production start up. ABB Vetco Gray, part of the ABB Lummus Global Group, supplied the hubs.

The ABB unit estimates it will take 6-8 weeks to get equipment to the field to start repairs. Work will first begin on valves on the Midgard lines, 400 m from the Åsgard B platform.

Meanwhile, Norsk Hydro reported that its Njord oil field in the Norwegian Sea resumed normal operations as production at many of the operator's other Norwegian Continental Shelf installations was ramped back up after "drastic" output reductions related to recent extreme cold in the region. Hydro said Njord, where production had been cut to only 7,000 b/d due to frosting problems in the installation's gas compressors, was now back to full production of 75,000 b/d. The operator's North Sea Snorre and Vigdis fields were back producing at a rate of 275,000 b/d. Production from the Snorre tension leg platform, and Vigdis subsea installation tied back to Snorre, had earlier been reduced to a combined 45,000 b/d. The operator's Oseberg field center-where output was cut to just 30,000 b/d from the usual 200,000 b/d due to the closure of the onshore Sture wet gas terminal-returned its output to normal levels. Meanwhile, Norske Shell said that its Draugen field in the Norwegian Sea would remain shut in until the temperature climbed above freezing.

Topping refining news this week, Pak-Arab Refinery's $886 million, 100,000 b/d refinery at Mehmood Kot, near Multan, Punjab province, began trial production at 50% capacity.

Petroleum Secretary Abdullah Yousaf said the plant not only would nearly double the country's indigenous refinery capability but also would ensure availability of petroleum products to the central and northern regions of the country, which account for more than 60% of the country's demand.

He said Pakistan would save about $75 million/year in foreign exchange because products imports would drop.

In other refining news, Sonangol is seeking strategic partners to build a refinery, said Halliburton affiliate Kellogg Brown & Root, which recently completed a feasibility study for the project. The 200,000 b/d grassroots refinery would be built in Lobito, about 400 km south of Luanda. Interested companies are expected to respond in early 2001.

The Sincor JV opened an oil production processing station in eastern Venezuela as part of a network to produce, upgrade, and export heavy crude from Venezuela's Orinoco Oil Belt. Sincor is a $4 billion venture of TotalFinaElf, 47%, PDVSA, 47%, and Statoil, 15%. The facility mixes 8 degrees gravity heavy crude with a lighter, 30 degrees gravity Mesa crude, creating a more marketable 16 degrees gravity crude known as Zuata 16. The plant in San Diego de Cabrutica, 325 miles east of Caracas in Anzoa tegui state, can handle 210,000 b/d of extra heavy crude and up to 300,000 b/d of diluted crude. When an upgrading plant at Jose in Anzoategui state is completed-by yearend or in early 2002-Sincor will further upgrade the crude to produce a 32 degrees gravity synthetic crude, dubbed Zuata Sweet, for export. Once the network of production facilities, upgrader, and pipelines is completed by yearend, the Sincor venture expects to produce 200,000 b/d of heavy crude.