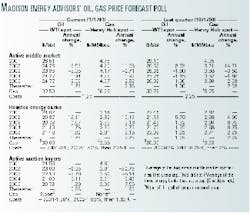

Oil & Gas Journal has introduced a recurring quarterly oil and naural gas price forecast feature developed by Madison Energy Advisors Inc., Houston (see table).

The price forecasts of those polled suggest a consensus that US benchmark oil and gas prices will retreat somewhat from 2000's lofty levels but remain comfortably above $20/bbl and $2.50/MMbtu, respectively, for at least the next 5 years.

Madison is an exploration and producing property transaction advisor. In October 2000, PennNet, the online subsidiary of OGJ parent company PennWell, acquired Madison and added the firm to its online vertically integrated energy services group Oil & Gas Journal Exchange.

For a number of years, Madison has offered a quarterly oil and gas price forecast poll that featured in-house price forecasts by Houston energy banks and by companies active in the middle range of acquiring and divesting producing oil and gas properties.

Referring to the latter, Madison said, "Over the past several years, more than 90% of all reported properties have been within these companies' target range of $10-500 million."

The banks reflected in the pricing poll are the four largest reserves-based energy lenders in Houston, leading US energy lending for more than 15 years, according to Madison.

With the newest quarterly pricing poll, Madison introduces its "active auction buyers" pricing poll. The four companies it polls were selected because of their history of actively purchasing producing assets through auctions. In subsequent presentations of this category, prior-quarter poll results will also be shown.