Market Movement

US power demand continues to drain natural gas supplies

The recent decline in natural gas prices in the US is not a harbinger of return to low gas prices.

If anything, the outlook for burgeoning US electric power demand for natural gas instead suggests a sturdy foundation for gas prices for the foreseeable future.

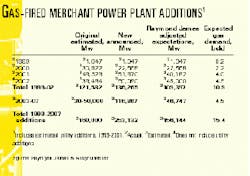

The drop of almost $3.70/MMbtu from the final close of the January 2001 NYMEX futures contract (nearly $10/MMbtu) to the final close of the February contract last week reflects mainly the recent warming trend. US heating degree-days were 10% higher than last year and at near-normal levels for the week ended Jan. 27. The near-term trend, say weather forecasters, is for continued warmer-than-normal weather, presaging further modest declines in gas prices.

But the outlook for the year overall is for natural gas prices to average $5-6/MMbtu, judging from a sampling of analysts' forecasts. UBS Warburg, for one, pegs natural gas prices at an average $5.75/MMbtu for 2001.

Much of the year's outlook for natural gas prices hinges on the level of storage withdrawals for the next 8 weeks or so. The warmer weather in recent weeks has diminished the urge to pull down more gas from inventory-although another cold spell in the US Northeast last week resulted in a larger than expected drawdown. Even though the year-to-year storage deficit has been trimmed by about 300 bcf in January-and expected to shrink a bit more last week-storage levels nevertheless are still running about 500 bcf below year-ago levels. At this rate, natural gas storage is likely to end the heating season at about 478 bcf, UBS Warburg projects.

That leaves the gas industry facing a very tight year-dangerously so, if it proves to be a hot summer. And that continuing tension between power demand for cooling and heating demand is the more likely scenario for natural gas markets in the years to come.

Power building boom

This situation has been building for a long time, so that means the current natural gas supply dilemma (some would still call it a crisis) will not be resolved quickly.

That's the view of St. Petersburg, Fla., analyst Raymond James & Associates.

"For 20 years, there has been an energy-supply bubble (oil, US natural gas, and electricity) that has finally been eaten away by increasing demand and dwindling energy infrastructure reinvestment," RJA said. "This 20-year trend will not be fixed in 1 year."

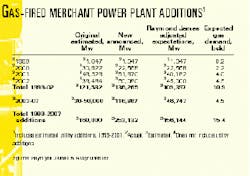

The best evidence of that pronouncement is a look at the number of natural gas-fired electric power plants that are slated to be built over the next several years (see table).

Last year, RJA surveyed power plant operators with this result: 120,000 Mw of gas-fired power would be added to the US power grid by the end of 2002. In a recent update of that survey, RJA found that those plans were ratcheted up to 136,000 Mw. Even a conservative view assumes at least 100,000 Mw of added capacity in that time frame.

Because every 10,000 Mw of capacity translates to an incremental 1 bcfd of gas demand, it is reasonable to assume that US gas demand will increase by almost 11 bcfd by yearend 2002 from the power sector alone. Looking in the 5-year period beyond that, a conservative projection of added gas-fired power capacity calls for a further increment of 4.5 bcfd, for a total increase in power demand for gas of 15.4 bcfd to 2007.

For the near term, RJA doesn't place much faith in natural gas supplies coming to the rescue to meet this demand challenge. Given that another 20,000 Mw of power capacity is expected to come on line before this summer-on top of the 22,000 Mw added in 2000-at least 3-4 bcfd of incremental gas supply will be needed to meet the increased requirements of electric power producers this summer. RJA sees little prospect for that much new gas supply coming on stream any time soon.

The analyst contends, instead, that the real answer to this dilemma lies in natural gas demand-that high natural gas prices will eventually crimp demand for natural gas from the industrial sector.

null

null

null

Industry Trends

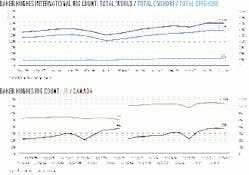

Over the next 12 months, oil field service stocks will likely outperform the market.

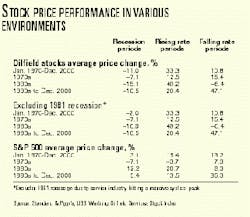

Most of the gain will take place by midyear (see related story, p. 22), according to financial analyst UBS Warburg, which also states that, during past US recessions, oil field service stocks declined by 11% on average, while the S&P 500 index rose by 3.1%.

However, if stock price performance during the 1981 recession period is excluded from the analysis, then the average decline in oil field stocks during recessions is 2% (see table). "The oil field service stocks are generally insensitive to the trends in interest rates and over the past 30 years have averaged gains in both rising and falling interest rate environments," UBS Warburg said. "Since 1970, oil field stocks have gained an average of 10.8% during falling rate periods and slightly underperformed the S&P 500ellipse However, this relationship is inconsistent over the decades, as oil field stocks posted strong gains and significantly outperformed the S&P 500 during the 1970s and the 1990s."

Worldwide 4th QUARTER E&P earnings for US integrated companies POSTED AN INCREASE OF 74% to $8.6 billion.

According to UBS Warburg, the increase in earnings for the group of US integrated firms it tracks was the result of higher US oil and natural gas prices and strong refining margins. "These factors should more than offset the generally weaker marketing margin conditions and our expectations for dramatically lower chemical earnings. In total, we forecast an 86% improvement in fourth quarter 2000 earnings (see related story, p. 31)."

The analyst predicts that this sharp rise in upstream profitability was supported by respective increases in benchmark prices for US crude oil and natural gas of 30% and 131%. The analyst also stated that worldwide 4th quarter downstream earnings were up 623% vs. a year ago to $1.5 billion, as strong refining margins offset weaker retail marketing margins.

"Despite continued relatively healthy refining margin conditions, we expect downstream profits to fall 17% on a sequential basis," the analyst said. "Finally, we expect chemical earnings to drop by 88% vs. the prior yearellipseand be down 81% from third quarter levels."

Government Developments

US President George W. Bush named a cabinet task force to develop a national energy policy. Vice-Pres. Dick Cheney will head the study.

Also on the task force are Treasury Sec. Paul O'Neill, Energy Sec. Spencer Abraham, Commerce Sec. Donald Evans, Agriculture Sec. Ann Veneman, Transportation Sec. Norman Mineta, Interior Sec. Gale Norton, and EPA Administrator Christie Whitman.

Last week, the US Senate judiciary committee approved the nomination of Norton with a 75-24 vote. Whitman received unanimous approval, and Abraham was approved early last month.

Meanwhile, members of the Senate energy and natural resources committee are expected to offer a slate of energy policy proposals this week. That package will expand on legislation that Sen. Frank Murkowski (R-Alas.) proposed last year.

Bush said, "It's becoming very clear to the country that demand is outstripping supply, that there are more users of electricity and natural gas than there are new units [of energy sources] being found, and we've got to do something about that.

Bush said the task force would focus on issues such as high energy prices, reliance on foreign oil imports, and development of pipelines and power-generation capacity.

Florida Gov. Jeb Bush has urged MMS not to hold Eastern Gulf of Mexico Lease Sale 181, although the tracts would be more than 100 miles from his state's shore.

The December sale would offer 1,033 blocks covering 5.949 million acres in the western portion of the eastern gulf. MMS estimates the sale area could contain up to 370 million bbl of oil and 3.2 tcf of gas. Water depths are 108-10,980 ft.

If held, the sale would be the first in the eastern gulf since 1988. The next eastern gulf sale is proposed for 2012 (OGJ Online, Dec. 7, 2000).

Gov. Bush protested the sale in a letter to acting Interior Sec. Tom Slonaker on Jan. 23. Florida consistently has opposed leasing within 100 miles of its coastline, stating that potential environmental damage could threaten its tourist industry.

National Ocean Industries Association said, "We think that the sale as proposed by the MMS takes those objections into account, and further objections are really outweighed by the extreme importance of Sale 181 to our country's energy future. We are faced with a surge in natural gas demand, and Florida specifically is faced with a growing population and surging energy demand within the state."

In a recent television interview, Vice- Pres. Cheney hinted that acreage off Florida-and California-might be drop- ped from the lease sale schedule.

Quick Takes

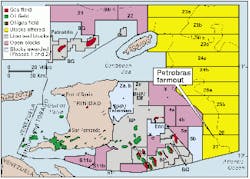

Petrobras Trinidad inked a farmout agreement with Norsk Hydro for exploration Block 27 off Trinidad and Tobago.

Under the deal, Norsko Hydro will acquire half of Petrobras's 38% stake in the deepwater acreage, where water depths are 700-1,200 m.

The first of two exploration wells on the block, awarded in 1998, is scheduled to be spudded in August-September. A 3D seismic survey has been conducted, and two exploration wells are planned. The block covers 1,220 sq km, about the size of two North Sea blocks.

The farmout is subject to approval by the Trinidad and Tobago government and the block's other partners, BP (57%), Petrobras (19%), and state-owned Petrotrin (5%).

Elsewhere on the exploration scene, Petro-Canada this month will spud the first natural gas exploration well drilled in the Mackenzie Delta region in more than a decade, the company said. Petro-Canada has a 60% interest in the well, which will test Tertiary sands on the Kurk Block at 9,186 ft. The well is to wrap up in April. Seismic is planned on four other Mackenzie Delta blocks this winter.

Harken Energy has spudded its second exploratory well, Manantial No. 1, on the 41,000 acre Cambulos association contract block in the Middle Magdalena Valley of Colombia. The well, programmed to 3,500 ft TD, is designed to test the Hoyon formation and will take up to 30 days to drill. F Statoil has found hydrocarbons with well 30/3-8, drilled from the Veslefrikk A platform on License 52 in the Norwegian North Sea. The well reached 6,208 m and found hydrocarbons in several Middle Jurassic sandstone intervals. The company is considering production-testing the well.

Equistar plans to shut down its Port Arthur polyethylene plant.

Equistar Chemicals will discontinue operations at its polyethylene plant at Port Arthur, Tex., by Feb. 28, the company said.

It plans to permanently shut down the facility. The plant includes a 240 million lb/year high density polyethylene (HDPE) reactor and a 160 million lb/year low density polyethylene reactor, as well as a 300 million lb/year HDPE reactor shut in 2 years ago.

Equistar Chemicals is a JV of Lyondell Chemical, Millennium Chemicals, and Occidental Petroleum.

In other petrochemical news, Thai Olefins has selected Chiyoda Corp. and Kellogg Brown & Root to design and build its proposed 300,000 tonne/year ethylene plant in the Map Ta Phut industrial complex at Rayong, Thailand. The plant, based on ethane and LPG feedstock, will be designed to use KBR's proprietary ethylene process. The lump sum, turnkey contract includes license, basic design, engineering, procurement, construction, and commissioning services. The facility will expand production at existing ethylene facilities in Map Ta Phut.

Chevron Niugini's papua new guinea-Queensland gas pipeline project has hit a ROADBLOCK.

Chevron Niugini said that, despite political problems in Papua New Guinea and in Queensland, the proposed $6.5 billion (Aus.), 3,500-km gas pipeline project is likely to proceed.

In Papua New Guinea, Moran oil field-one of those that will contribute gas to the project-was shut down for several days last month following landowner protests at the field's helipad. Apparently, one participant group contends there are 27 groups that claim title to lands in the Moran field area, rather than just the 14 groups previously identified. Although the row is among landholder groups, Chevron has been forced to shut in production.

The second annoyance for the project progress comes from political events in Queensland, including the resignation of a former deputy premier and the minister who played a key role in the project development-Jim Elder-over electoral issues. The embattled Queensland premier, Peter Beattie, has called a state election for Feb. 17, and this is likely to delay decisions on the project once again.

In other pipeline action, Duke Energy is planning to build a $250 million (Aus.) natural gas pipeline from western Victoria to South Australia. The plans include acquiring the gas from BHP Petroleum's yet-to-be-developed Minerva field-about 15 km off the coast near Port Campbell in western Victoria-along with other smaller Victorian fields in the Otway basin. The company said the line would supply a minimum demand of 76.4 MMcfd. Capacity more likely would be up to 153 MMcfd. Completion would be in 2003.

Iraq and Syria plan to build a 1.4 million b/d oil pipeline to replace an old, corroded one, a senior Iraqi official said. Iraqi Oil Minister Amer Mohammed Rasheed told government newspaper Al-Jumhouriya that the old pipeline was no longer economical. The pipeline, which is at least 20 years old, has leakage and corrosion problems. Its capacity is unknown, but it recently was transporting 200,000 b/d (OGJ Online, Jan. 1, 2001). Syria plans to issue a tender soon for construction of the section within its borders, while the tender for the Iraqi section will be issued after Iraq's financial situation improves, Al-Jumhouriya said. Iraq is under UN sanctions that block it from freely exporting oil and making oil sector investments. Rasheed said another oil pipeline is planned through Jordan. The Jordanian government has issued a tender for a section extending from the Iraqi border to the 90,400 b/d refinery at Zerka. Iraq would build another section, from Haditha, 260 km northwest of Baghdad, to the Syrian border.

A proposal by Talisman Energy to build a sour gas pipeline in the Alberta foothills region is opposed by environmental groups that have called for hearings on the project. The pipeline would be located just outside the 1,544-sq-mile Bighorn Wildland Recreation area. Talisman has applied for regulatory approval to build 25 miles of sour gas pipelines and associated facilities near Nordegg, Alta. Environmentalists say the pipeline, drilling, and logging are a threat to the area. Talisman says the project would be outside the area and would tie together natural gas wells already drilled. The Alberta Energy and Utilities Board said objections to the project are being considered, and a decision will be made on a possible public hearing.

Fort Union Gas Gathering plans to expand its gas gathering system in Wyoming to increase capacity to 634 MMcfd of gas from 434 MMcfd. The company said the system would accommodate the increase in production from the Powder River basin. The Fort Union gas gathering system extends 106 miles from near Gillette, Wyo., south to Glenrock, Wyo. Norsk Hydro awarded two orders for manufacture and delivery of steel pipe for the 217-km, 28-in. oil export pipeline that will link the Grane field platform on Block 25/11 in the Norwegian North Sea to the Sture terminal. Due to "limited capacity" in the steel market, Hydro said it has had to divide the order between Europipe GMBH and Mitsui & Co. Norway. The two contracts, individually valued at some $30 million, each are for 50,000 tonnes of steel. Hydro said the line pipe is scheduled for delivery to a coating yard in either Scotland or Norway between September and December.

NPRA plans to challenge EPA's final diesel sulfur rule in US federal court.

The rule, among other provisions, calls for a 97% reduction in the sulfur content of highway diesel fuel to 15 ppm from 500 ppm.

The association said that it believes EPA, under outgoing Administrator Carol Browner, exceeded its authority in issuing the rule.

NPRA said the rule would create diesel shortages. It pointed to a Charles River Associates study that said the rule would lead to a 12% shortfall in US diesel supplies starting in 2006 (OGJ Online, Dec. 21, 2000).

It also said the impact would be felt across the national economy, because diesel trucks transport the vast majority of American products.

The NPRA spokesman said the group "welcomes the decision of the Bush administration to review the diesel rule, and we hope that necessary revisions in the rule can be achieved. But we must pursue every possible remedy, including legal actions."

NPRA noted that, a year ago, it had advocated a "more reasonable and balanced" approach that would have cut sulfur content by 90%.

TOPPING DRILLING NEWS THIS WEEK, Maersk Contractors exercised an option for a second ultraharsh-environment jack up from Hyundai Heavy Industries.

Delivery of this second rig will occur at yearend 2002. The first rig, ordered in April 2000, is due for delivery in the summer of 2002. The rigs are designed for the harsh environments of the northern North Sea and other harsh-weather conditions.

The units will be able to work in these areas in 150 m of water. The rigs will be able to drill subsea wells in addition to traditional surface-completed wells.

Elsewhere on the drilling front, Mike Mullen Energy Equipment Resources acquired the Bohai 6 jack up from China Offshore Oil Northern Drilling for an undisclosed sum. Officials said this is the first time China has sold an offshore drilling rig. The jack up, which can drill in 250 ft of water, will be renamed the Odin Spirit. For the time being, the new owner will hot stack the rig at the Dalian New Shipyard.

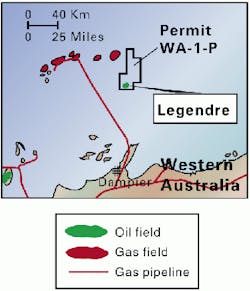

Woodside Energy is making final preparations for first oil from its Legendre oil fields off Western Australia.

The Ocean Legend, a mobile production unit converted from a jack up, arrived in Dampier last month. Three tugs will tow the unit to position on Block WA-1-P, containing Legen- dre North and Legendre South fields.

Three horizontal production wells are planned in Legendre North and one in Legendre South. Production from the $110 million (Aus.) project should begin in April. Peak production is expected at 50,000 b/d of oil. Gas produced will be used to power production facilities; the rest will be reinjected.

Woodside Energy estimates that the fields contain 44 million bbl of oil reserves.

The Ocean Legend will export produced oil via a 10-in. pipeline to a mooring system, then to a floating storage and offloading vessel. From that vessel, the oil will be transferred to tankers.

In other production work, Petro-Canada drilled and completed three of six preproduction wells at Terra Nova oil field on the Grand Banks off eastern Canada, with the remaining wells scheduled to be completed prior to start-up. Onshore testing and commissioning of a Terra Nova offshore production vessel is under way, and the Terra Nova project is 90% complete.

THAI SHELL E&P EXPECTS TO RAISE OIL PRODUCTION FROM ITS S1 TRACT IN NORTHERN THAILAND THIS YEAR TO 24,500 B/D, UP 2.7% FROM LAST YEAR.

The company plans to maintain gas production at last year's level of 55 MMcfd, plus 300 tonnes/ day of LPG processed from the associated gas.

Thai Shell said development wells drilled last year are being put on stream this year, augmenting output from 100 older wells.

This year, Thai Shell plans 28 development wells and four exploratory wells, as well as a 200 sq km 3D seismic survey, on the S1 acreage.