Return on resid processes depends on product differentials

Depending upon market demand, any of the three dominant resid-conversion processes-coking, resid fluid catalytic cracking (RFCC), or hydrocracking-can be a profitable option for using refinery resids.

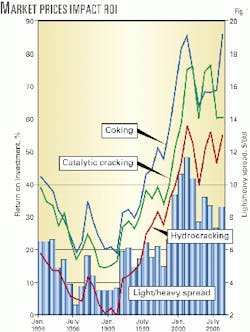

In 1998, when the light and heavy product differentials were small, the profitability of these resid-conversion processes was dismal. In 1999 and 2000, however, differentials recovered, which allowed refineries with these resid-processing units to enjoy a good return on investment (ROI).

This article reviews the developments for delayed coking, hydrocracking, and RFCC technologies and their economics. Because of the complexity of the combinations, SRI Consulting has examined the economics for each process individually.

For a US Gulf Coast location, total fixed cost for these processes increases in the following order: delayed coking < RFCC < resid hydrocracking.

Plant profitability is a strong function of product values. The ROI for these processes ranged from a low of 0-20% in 1998 and 1999 to more than 50% in 2000.

Changes or differences in product value between regions in market prices have a strong effect on the ROI of each individual process. When selecting a resid conversion process, refineries should consider the profitability of the whole refinery employing a new or expanded conversion process integrated with other existing or planned processes.

Combinations of processes, attractive for large volume applications, can maximize the production of liquids and gases at the expense of coke. Hydrocracking followed by delayed coking is one combination.

Gasification and solvent extraction, although not covered in this article, are alternative resid-conversion processes.

Resid, fuel demand

Refinery resid-upgrading processes are increasingly important in today's refinery because of the continuing increase in production of heavier crude oils and the decline in the demand for fuel oil.

Residual fuel as a percentage of crude supply (including net imports), based on data from DOE,1 will decline from 5.9% in 1997 to 5.3% in 2000 to 4.9% in 2020.

At the same time, demand for motor fuels is increasing and will continue to do so during the next 2 decades. The DOE predicts motor fuel demand will increase by 1.8 %/year initially then decline to a growth rate of 1.1%/year from 2010 to 2020.

These trends, coupled with the increasing demand for cleaner burning, lower-sulfur fuels, ensure the need for additional and better resid-upgrading processes.

The growth in upgrading of heavy oils and refinery resids depends on the general supply and demand trends for crude oil and heavy fuel oil, environmental issues, and the quality of products required in the marketplace.

Perhaps the most important and volatile issue facing the refining industry at the start of the new millennium is what fuel requirements, especially regarding sulfur content and the use of oxygenates, will be in effect in 5-10 years for automobiles and light trucks.

Global process capacities

Global coking capacity has increased more than 70% during the past 15 years. Coking units are found in about 17% of the world's refineries; about 35% of US refineries have a coking unit.

Of the world's coking feedstock capacity 55% is in the US, as is 70% of the delayed coke production. Total global delayed coker capacity was 3.1 million b/cd as of Jan. 1, 2000 (OGJ, Dec. 20, 1999, p. 45). The coking refineries are typically more complex than other refineries; 80% also have at least a catalytic cracker, and 90% have some product hydrotreating.

About 25% of non-North American refineries also have hydrocrackers, predominantly for cracking gas oil. About half of North American coking refineries have hydrocrackers.

Global hydroprocessing (hydrotreating and hydrocracking) capacity for distillate and resid feedstocks grew in the latter half of the 1990s by 2.2%/year and is projected to reach 3.50 million b/d in 2000.

Growth in resid capacity during the same period continued strong at 5.4%/year, for a total of 2.25 million b/d. In 2000, resid hydroprocessing capacity will equal 39% of total distillate and resid capacity. Resid hydrocracking capacity in 20 refineries worldwide totaled 589,000 b/cd. Resid hydrocracking is generally found in the more complex refineries.

Worldwide, an estimated 30 fluidized catalytic crackers (FCCs) were specifically designed to crack all resid feedstock. RFCC capacity exceeds 1.0 million b/d.

At least 25% of world FCC capacity cracks some resid along with gas oil. Most new FCCUs are being designed to process at least some resid.

Coking technology

Coking is the leading resid conversion process.

It can handle heavy, highly heteroatomic feedstocks that are not economic for cracking or hydrocracking. The process can treat the heaviest oils as well as oils containing high levels of heteroatoms since there is no catalyst to poison.

Developments in delayed coking processes and equipment by Foster Wheeler Corp., Conoco Inc., and others have significantly improved the technology. Technology has reduced cycle times from 24 hr to 18 hr or less, thus expanding the capacity of existing coke drums (although at the potential expense of reduced drum life).

Automation of the unheading, heading, and cooling steps of decoking the drum improves safety and helps shorten cycle time. Newer designs increase liquid yields and minimize coke yields by coking at low pressure (15 psig) without external recycle of heavy oil.

Recycling distillate instead of recycling heavy oil reduces the yield of coke and extends the run time between maintenance turnarounds. Newer double-burner furnace designs and improved tube metallurgy allow hotter coking furnace temperatures.

The maximum delayed coker drum size has increased since the early 1990s. Currently, a diameter of 27-28 ft is standard, and some 30 ft diameter drums are in service. Coker liquids require further processing to remove sulfur and stabilize or remove olefins before blending into salable products.

Delayed coking is technically advantageous when a market for the fuel coke exists. The total liquids yielded from delayed coking is about 57% of the fresh feed for a vacuum resid.

RFCC, hydrocracking technologies

RFCC is advantageous when the prime products are motor fuels, especially gasoline. The feedstock is generally limited by economics to about 10 wt % Conradson carbon residue. For an atmospheric resid, the total liquids are about 70 wt % of the fresh feed (without slurry oil recycle) and the metals content is limited by gas-processor capacity and catalyst-replacement costs.

If we include C3 and C4 olefins and isobutane for alkylation or polymer gas production, the RFCC liquid products increase to 83% of the fresh feed. This is a level comparable to the 87% obtained in resid hydrocracking of vacuum resid under conditions maximizing middle distillate production, which makes some isobutane but no light olefins.

Continued improvements in bottoms cracking catalysts and the commercialization of magnetic separation of aged, metals-containing catalyst particles have improved RFCC processes.

Riser, feedstock atomization, and catalyst-oil mixing design improvements are commercially well demonstrated. Advanced millisecond catalytic-cracking technology that breaks from traditional cracker designs has been successfully commercialized at Coastal Corp.'s Eagle Point refinery, Westville, NJ, with an improvement obtained in product yields.

In hydroprocessing, feedstock flexibility is the current emphasis. Automated catalyst replacement is allowing higher metal-containing oils to be processed. Chevron's Onstream Catalyst Replacement (OCR), Shell's Hycon bunker system, and IFP's Hyvahl swing reactors are examples.

Ebullating bed hydrocracking is becoming prominent-LC Fining by ABB Lummus Crest and BP (formerly Amoco Oil Co.), H-Oil by Institut Fran

Slurry-phase hydrocracking is promising for high-metals feeds in small (5,000 b/sd) commercial-scale operations (CANMET's and Veba Oel's Combicracking).

The desire is to lower hydrocracking temperatures to minimize catalyst coking and lower pressure to reduce capital and operating costs.

Economic aspects

The SRI process economics program (PEP) study evaluated processing 40,000 b/sd of residual refinery oil by delayed coking, hydrocracking, and RFCC processes.

The delayed coking and hydrocracking processes are based on vacuum resid obtained from a blend of Arabian Heavy and Light crude oils. Because the RFCC process cannot process very high-carbon resid oil economically, its feedstock is atmospheric resid distilled from Arabian Light crude oil.

The hydrocracker is operated for maximum middle-distillate production. This economic analysis is based on a US Gulf Coast location.

The total fixed cost increases in the following relative order: delayed coking (base or 1.0), RFCC (1.3), and resid hydrocracking (2.1).

The two-stage hydrocracker is the most complex unit; the RFCC, the least complex in terms of the number of major pieces of equipment. In all three processes, the largest capital items are the reactors, main fractionators, and gas compressors.

Costs of production for all of these processes highly depend on the spread between light product (gasoline and distillates) and heavy product (residual fuel oil) prices. The feedstock costs per barrel for the coker and the hydrocracker are identical since they process the same feedstock. The RFCC, however, processes a higher-cost feedstock.

Natural gas feedstock for the hydrogen plant associated with the hydrocracker is a significant portion of the production cost. The hydrocracker also has the highest net utility costs due to the energy consumed by the high-pressure compressors.

In contrast, the RFCC has the lowest net utility costs, since the catalyst coolers generate a significant amount of 600-psig steam.

SRI Consulting measured the overall profitability of each process and compared the processes by their annual rate of ROI. Fig. 1 shows the impact the changes in market prices during the past several years has had on the potential returns associated with each of these processes.

Returns were marginal to poor during 1998 when crude oil and refinery margins were depressed. As crude oil prices began rising during 1999, however, so did the spread between light and heavy refined products. This widening of the light and heavy differential resulted in a sharp improvement in the returns on each of these processes, which continued through 2000.

As a result of differences in products, the return on the coker and the RFCC crossed during the first half of 2000.

These economic results demonstrate the strong effect that changes or differences in product value between regions in market prices can have on the ROI of each individual process.

Reference

- DOE/EIA-0383 (2000) report.

The author

Richard H. Nielsen is a senior consultant in the process economics program of SRI Consulting. He has more than 20 years of industrial experience in refining and petrochemical process research, development, conceptual design, and economics. Previously, he was a director of Particulate Solid Research Inc. and a team leader at Ashland Petroleum Co.

Nielsen has also worked for 13 years at Phillips Petroleum Co., where he developed heavy oil processes. He holds BS, MS, and PhD degrees in chemical engineering from Iowa State University, Ames.