Deregulation will change Taiwan's petroleum product market

Deregulation is taking Taiwan into a new age of energy competition. The monopoly of state-owned Chinese Petroleum Corp. (CPC) in all phases of imports, refining, and product distribution is over.

And a new "Petroleum Law," passed by the parliament in late September 2001, and Taiwan's entry into the World Trade Organization (WTO), promise to open the oil industry further.

Formosa Petrochemical Corp. (FPC), a subsidiary of Formosa Plastics Corp., in September 2000 began delivering its first petroleum products to market.

FPC's moves ended the 50-year monopoly enjoyed by state-owned CPC in oil and petroleum product importing, refining, and distribution.

The impact of the entry into Taiwan's oil industry and markets by FPC has only begun to be fully felt by CPC, other oil retailers, and Taiwanese consumers. Because of the increase in crude runs and refinery output, Taiwan is on its way to becoming a net refined-product exporter after 2001.

In the meantime, the new petroleum law further liberalizing the trade and marketing of all petroleum products, is due to take effect soon.

Refining update

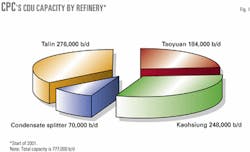

Before the trial runs of FPC's first 140,000-b/d crude distillation unit (CDU) started in early 2000, CPC was the sole producer of petroleum products in Taiwan. CPC has three refineries, at Talin and Kaohsiung in southwestern Taiwan and at Taoyuan in the north, near Taipei.

Until 1996, the Talin and Kaohsiung refineries formed an integrated subsidiary of CPC. Talin was later separated from the Kaohisung refinery.

Also, CPC has a large condensate splitter at Kaohsiung. Together, CPC's three refineries, plus the condensate splitter, now have a capacity of 777,000 b/d (Fig. 1).

Secondary units include catalytic cracking, hydro cracking, catalytic reforming, distillate treating, resid desulfurization, coking, lubes, asphalt, and other units. Over the next couple of years, CPC plans several upgrades but no new refineries.

FPC's first 140,000-b/d CDU came on stream in July 2000, and the first batch of gasoline and diesel reached market in September 2000. The second 140,000-b/d CDU is now complete and going through trial production and normal shakedown.

Because of weak domestic and international demand, however, the second unit is not yet fully commissioned. Accompanying these CDUs are several secondary units, including a resid fluid cat cracking unit, a vacuum-gas oil (VGO) desulfurization unit, and an atmospheric resid desulfurization unit.

These units should have their full impact on the market during the second half of 2001. Start-up of the third 140,000-b/d CDU is uncertain.

Although technically the third unit could be fully operational before the end of 2001, given the current market condition in Taiwan, it will not be commissioned until third quarter 2002. FPC is a highly market-oriented company and will only run the refinery if economics justify it. As such, poor margins or high inventories could lead to not only a delayed start-up of the third unit, but also the possibility for other units to be taken out of service.

FPC is not only Taiwan's first private refiner, but also the first private producer of ethylene. In fact, one of FPC's main reasons for building the refineries was to provide feedstock to its two olefin plants, which have a combined ethylene producing capacity of 1.35 million tonnes per year (tpy).

The first FPC 450,000-tpy ethylene plant became operational in February 1999, and the second 900,000-tpy ethylene plant was commissioned at the end of 2000. In comparison, CPC's four olefin plants have a total ethylene capacity of 1 million tpy.

CPC's condensate splitter (or naphtha fractionation facility) at Kaohsiung was slated to provide feedstock to the olefin plants.

Petroleum product supply

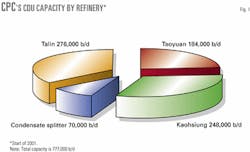

Because Taiwan only has a small amount of domestic crude oil production, it relies on imports to feed its refineries. In 2000, because of the commissioning of FPC's Phase I project, overall crude imports to Taiwan increased by 6.6%, reaching 743,000 b/d (Fig. 2). In the meantime, crude runs were 729,000 b/d in 2000, up from 708,000 b/d in 1999.

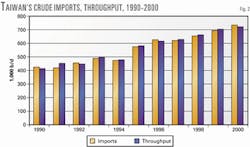

Taiwan's overall petroleum product output reached 739,000 b/d in 2000, of which nearly 100,000 b/d was naphtha production.

The situation for naphtha is unique. Because of growing ethylene production in Taiwan, demand for naphtha has been steadily increasing. This has affected the production pattern of refined products, as both FPC and CPC are trying to maximize naphtha production while competing in the supply of other products.

Taiwan is one of the few countries in the Asia-Pacific region where refining and upstream petrochemical production are deeply integrated. Although there are many players in the downstream petrochemical sector, CPC and FPC are the only ethylene producers in Taiwan.

Crude imports as well as crude runs will be higher in 2001 and rise continuously thereafter. As a result, overall petroleum product output in Taiwan will be higher in 2001 and increase steadily between 2001 and 2003, when all FPC refineries and secondary units become fully operational.

Including the naphtha produced from the condensate splitter, the overall refinery output in Taiwan will reach more than 1.1 million b/d in 2005 (Fig. 3).

Oil market developments

Deregulation of Taiwan's oil industry and markets began in 1987, when the government opened up retail gas business to the private sector. That ended decades of monopoly by CPC.

In June 1996, to accommodate FPC's refining and petrochemical investment, the government formally ended CPC's monopoly in the refining business for production, imports, exports, and distribution by refineries.

A complete opening of the import business for fuel oil, jet fuel, and LPG started in January 1999. Since start-up of its first ethylene plant in 1999 and the first refinery in 2000, FPC has been a competitor to CPC. The recently passed new law, which will be implemented at the beginning of 2002, will liberalize further the import of all petroleum products.

Taiwan's road to change has not been smooth. For one thing, it took a fairly long time for the Legislative Yuan finally to pass the new Petroleum Law after years of debate. For another, CPC's privatization plan has been postponed by the government many times during the past several years and is still up in the air.

Initially, CPC was going to be a holding company with subsidiaries to be privatized. Then the government decided to sell pieces of CPC stock at 10% or so, every year from 2000.

After that plan was aborted, the new plan called for privatization of 51% of CPC after June 2003. It is widely believed that the privatization will not start until the new petroleum law takes effect.

It may take years to complete the process even if it begins now. On an overall basis, we see little chance of privatization by the designated date of June 2003 and expect further major delays.

Since FPC entered the domestic oil market in September 2000, its market share has quickly increased to about 25%. Taiwan currently has about 2,000 retail gas stations, of which CPC owns about 600.

The market shares of CPC and FPC are determined through business alliances with retail stations. FPC actually owns only 3 stations (with a plan to increase the number to 7) but supplies 400 stations through business alliances. CPC supplies products to 1,600 stations. FPC believes that its share could eventually be more than 50% when all three of its CDUs and downstream units are online.

FPC has recently announced that the number of gas stations supplied with its products would increase to 750 by yearend 2001. On the other hand, CPC is striving to maintain its share at a minimum level of 65%. This means fierce competition ahead.

It remains to be seen what the ultimate outcome will be, but one thing is clear: Both FPC and CPC will have to find external outlets for their excess products. In the end, a business alliance to a certain degree between the two will be necessary.

Foreign investment in Taiwan's retail market is still limited. Currently, only ExxonMobil Corp. (with one station under the Mobil brand) operates in Taiwan, through joint ventures with local Taiwanese companies.

The situation is poised to change after Taiwan's official World Trade Organization (WTO) membership becomes effective at the start of 2002, following the footsteps of China. ExxonMobil plans to increase the number of stations to about a dozen in the near future. Other oil majors may also join the battle after Taiwan relaxes its control of the 35% maximum share of foreign capital in joint ventures.

Petroleum product demand

The overall petroleum demand growth in Taiwan has been significantly affected by naphtha consumption. Naphtha is used mainly as feedstock to ethylene production and, to a lesser extent, BTX production in Taiwan.

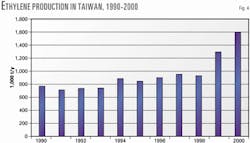

In 1999, after FPC's first ethylene plant came online, ethylene output increased 38%. It then increased another 23% in 2000, reaching 1.59 million tpy (Fig. 4). As a result, naphtha consumption in Taiwan has also increased rapidly in recent years.

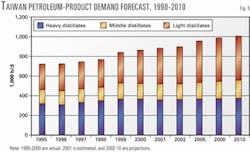

In 2000, Taiwan's overall consumption reached 865,000 b/d, 3.1% higher than 873,000 b/d in 1999 (Fig. 5). However, if naphtha is excluded, the growth would have been 0.3%, significantly lower than the growth of 6.4% in 1999.

Taiwan's demand is dominated by fuel oil (including bunker fuel), accounting for 35% of total oil demand in 2000. The second largest fuel used is gasoline (19%), followed by naphtha (15%), and diesel (13%). Associated with gasoline use, Taiwan is also a major consumer of MTBE and other oxygenates.

Although more use of naphtha is expected to 2005, the overall petroleum-product demand outlook for Taiwan is weak. The demand for fuel over the long term is expected to be flat. The likely increase in natural gas use for power and the eventual construction of Taiwan's fourth nuclear power plant have contributed to the forecast slow growth in fuel oil consumption.

Among other factors, a slowdown of economic growth will lead to lower demand for energy as a whole, further depressing oil demand.

According to Taiwan's Ministry of Economic Affairs, the overall gross domestic product (GDP) will be down by 2.1% in 2001, the first decline in many years. As a result, the overall growth of petroleum-product demand in Taiwan for the next 10 years will be considerably lower than the growth of the past decade.

Petroleum product balance

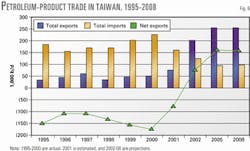

Taiwan's imports of refined products were higher in 2000 than in 1999, mainly because of the jump in naphtha imports. Also in 2000, Taiwan exported every type of product. With the exception of diesel, however, the volumes were not large.

Fundamental change is expected for 2001 and beyond. With FPC's first refinery fully on stream and construction of the second one started, overall production of petroleum products will be higher.

Taiwan is likely to end its status as a net oil product importer after 2001 for the first time in decades (Fig. 6), although it is expected to continue importing LPG, naphtha, and fuel oil, while exporting gas oil, kerosine, and jet fuel (kero-jet). With the start-up of the third refinery by FPC after mid-2002, a bigger impact will be felt in the years ahead.

Gas oil and, to a lesser extent, kero-jet, are likely to dominate the future export pool of Taiwan, followed by gasoline and fuel oil. On the import side, naphtha will be the single largest fuel imported.

Despite the increase in domestic naphtha production and continuous imports of condensate for the splitter, Taiwan wiil be short of naphtha throughout the forecast period.

Overall, by 2005, Taiwan's net product exports will rise to 159,000 b/d (Fig. 6). Because of the stagnated growth of overall oil demand, the volume of net exports will remain the same until 2008, assuming no further new refineries are built.

The authors

Kang Wu is a fellow at the East-West Center in Honolulu and the head of the center's China Energy Project. Wu's research interests and studies include energy economics, energy policies, energy market developments, downstream oil sector issues, and environmental impacts of fossil energy consuption with particular emphasis on oil and gas. He specializes in oil and gas sector issues in China and other countries in the Asia-Pacific region.Wu holds a PhD and is the author or coauthor of many project reports, journal articles, conference papers, and other publications.

Fereidun Fesharaki is president and founder of FACTS Inc. Born in Iran, he received his PhD in economics from the University of Surrey in England. He then completed a visiting fellowship at Harvard University's Center for Middle Eastern studies. In the late 1970s, he attended the Organization of Petroleum Exporting Countries' ministerial conferences in his capacity as energy advisor to the prime minister of Iran. He joined the East-West Center in 1979 and currently is a senior fellow and head of the Energy Project at the East-West Center.