CASPIAN PRODUCTION POTENTIAL-2: Risks temper Caspian rewards potential

Last of a series.

In Part 1 of this series (OGJ, Dec. 17, 2001, p. 18), Wood Mackenzie estimated the reserves and production potential of the five countries surrounding the Caspian Sea-Kazakhstan, Azerbaijan, Turkmenistan, and the Caspian offshore sectors of Russia and Iran-and ranked those companies active in the region's upstream industry.

In this concluding section of the analysis, which updates another two-part analysis (OGJ, July 24, 2000, p. 38, and Aug. 21, 2000, p. 52), Wood Mackenzie assesses the foreign oil company investment in the region since 1990 and looks at the potential level of investment required to meet the optimistic production potential profiles to 2020.

Due to a number of factors-the complex geopolitics of the Caspian region, the distance to international markets, the relatively high levels of risk, and the amount of financing available-the production potential profiles indicated in Part 1 of the series are unlikely to be achieved in the time frame specified. By applying risk factors to the main parameters for each project, more-realistic (risked) production and investment forecasts for the region are possible.

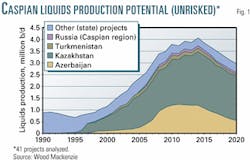

Unrisked production

Wood Mackenzie analysis suggests that the five Caspian littoral countries have the potential to produce about 4 million b/d of liquids by 2014 (Fig. 1). Although still unofficial, reports that Agip KCO's Kashagan structure is now expected to hold at least 10 billion bbl of liquids reserves boosted Kazakhstan's reported share of regional reserves to over 60%.

In addition, production start-up at Kashagan and ramp-up at Tengiz have both been brought forward in line with operators' expectations. Peak production could easily be delayed, as these timetables have a significant political dimension and account for two of the three largest portions of regional production-the Azeri-Chirag-Gunesh* (ACG) complex being the third.

Similarly, Azerbaijan's liquids production potential is highly dependent upon three key areas (ACG, the developed shallow-water portion of Guneshli, and Shah Daniz) and is likely to become even more so, as exploration results indicated that the South Caspian basin appears to be more gas-prone. Shah Daniz condensate production will also depend on the volumes of gas that can be contracted-another task that has proved notoriously difficult for the region's producers.

Given these uncertainties and the transportation, exploration, political, and financing risks inherent in the Caspian region, the profile developed in Part 1 of this Caspian series is an optimistic scenario.

Wood Mackenzie analyzed 39 Caspian E&P projects and 2 pipeline projects (see table) to create a risked production profile that takes into account project uncertainty. While it is beyond the scope of this analysis to assess all projects that form the basis for the optimistic Caspian oil profile, future production from the chosen projects represents more than 85% of production. The liquids production profile, then, highlights the significance of the key projects relative to overall Caspian liquids potential.

Investment potential

Using Wood Mac- kenzie's portfolio of Caspian project cash flows generated with its global economic model, it has been possible to assess the level of investment required to meet the unrisked production profile for the key projects.

The two pipeline projects, considered separately, are the Caspian Pipeline Consortium (CPC) system in Kazakhstan and the Baku-Tbilisi-Ceyhan (BTC) line extending from Azerbaijan to Turkey. Azerbaijan's Western Export Pipeline is considered an integral part of the ACG upstream development and has been included in the field cash flow. Early production from the Russian Caspian is likely to be by barge, so no major new Russian oil pipelines will be required in the short term.

It has been assumed that the gas production potential of the region is not restricted by export capacity and that all costs relating to maintenance of new gas pipelines are incorporated through future tariff receipts.

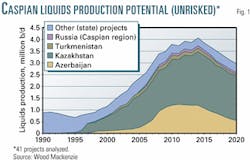

Capital expenditures

Based on Wood Mackenzie's estimate of the costs and timings associated with each project-as of Jan. 1, 2002-capital expenditures (capex) are expected to be $110 billion. Kazakhstan, with 23 projects, has 55% of the capex, and Azerbaijan, with 8 projects, has 20%. Turkmenistan, with 6 projects, has 1%; the Caspian area of Russia has 1% (2 projects); and the 2 pipeline projects represent 7%. Other (state) projects have 16% of the capex.

Total capex for the 41 key projects amount to a forecast $92.5 billion during 1990-2020 (projected monetary values are in 2002 dollars), and the estimated capex on state projects would be $17 billion over the same period.

During the next 20 years, spending on four fairly well- defined projects will drive regional capex -Kashagan, Tengiz, and Karachaganak in Kazakhstan and the ACG complex in Azerbaijan (20%, 18%, 6%, and 12% of the regional total, respectively). There are two other significant Caspian projects, Shah Daniz field and the Severnyi block, but these are less well defined.

Wood Mackenzie's estimate of the capital costs to develop Shah Daniz gas field is low, because only 22% of the field's reserves have been contracted to date. However, as additional gas contracts are negotiated, Shah Daniz capex requirements will undoubtedly increase.

There is no approved development plan for the Severnyi block in the Russian sector, because it is still under early appraisal.

Capex outlook

Capex investment is expected to peak in 2006 at over $7.6 billion and remain above $4.0 billion/year until 2013 at least (Fig 2).

As the Caspian province matures and the states undertake more exploration work funded from the early revenue of current projects, a number of smaller projects are likely to replace giant field and complex developments such as Tengiz, Kashagan, ACG, and Shah Daniz. Given the levels of exploration work in the Azeri sector of the Caspian and the number of large undrilled structures identified off Kazakhstan, even two medium-sized discoveries could extend the capex plateau of $6-7 billion/year for an additional 5 years.

The capital investment associated with the larger number of smaller fields may extend the capex plateau but over the longer term is unlikely to match the huge investments associated with the early development of the giant fields.

The main constraint on Caspian oil projects historically has been export pipeline capacity. Operation of the new CPC Tengiz-Novorossiysk line will enable Kazakh oil production to take a major step forward, while Azeri production from ACG awaits progress on the BTC line. The latter is not expected to be complete before 2005.

Although these two pipe- lines will add as much as 2.3 million b/d to current export capacity, smaller projects may still experience difficulty accessing export routes and may be delayed accordingly. Any significant delays to Tengiz or ACG could be especially problematic, as plateau production could then coincide with peak production from Kashagan, resulting in increased competition for export capacity.

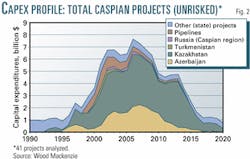

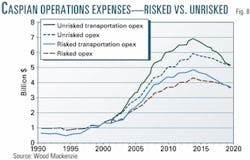

Operating expenses

Total operating expenses-field operating expenses and transportation tariffs-during 1990-2020 are expected to total $204 billion. Kazakhstan's foreign-led E&P projects account for 54% of the total operating expenditures (opex), Azerbaijan 21%, Turkmenistan 10%, and Russia's Caspian region 2%. State spending will account for the remaining 14% of opex in that time frame.

As with capex, export capacity limitations are likely to pose the biggest threat to the future opex profile presented in Fig. 3. The lack of pipeline infrastructure and the large distances to world markets make regional transportation costs high, and as a result, they form a significant part of any project investment. This is clearly illustrated in the 39 E&P projects analyzed. Of the projected 1990-2020 opex, 52%, or $107 billion, will be spent on transportation tariff payments.

Tengiz, Kashagan, ACG, and Karachaganak dominate the opex profile as they do the capex. The four projects combined account for 51% ($103 billion) of the potential Caspian opex. Tengiz operating costs are expected to total $34 billion (17% of the total opex) by 2020. The opex profile closely resembles the unrisked production profile, as expected, with maximum operating costs of $12.8 billion for the region, coinciding with peak oil in 2014.

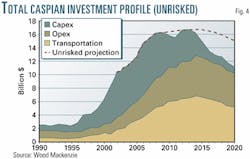

Total investment

The combined, unrisked capex and opex for the Caspian region amount to almost $314 billion during 1990-2020. Peak investment is anticipated in 2013 at almost $17 billion and is split surprisingly evenly between capex, field opex, and transportation opex (28%, 33%, and 39%, respectively) given the advanced stage of most of the projects by that date.

The key factor in the total investment profile is Agip KCO's Kashagan development, which is expected to hit peak production in 2014. This also explains the rapid decline in capex after 2013, as Kashagan is the last of the projects analyzed to hit peak production.

If, as expected, significant exploration projects are under way by 2005-10 in a bid to maintain production after the major projects come off peak, capex would not contract as sharply as shown in Fig. 4. In this case, investment could be maintained almost at peak levels for an additional 5-6 years and would be in excess of $15 billion each year during 2007-20 (see unrisked projection in Fig. 4).

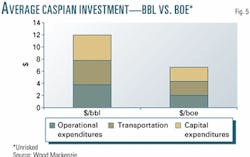

Based on the Caspian's potential production of almost 26 billion bbl of liquids over the 30-year period, capex averages $4.20/bbl, field opex averages $3.80/ bbl, and average transportation opex (tariff) is $4/bbl (total average cost of more than $12/bbl).

This high calculated cost per barrel is due to the large volumes of gas associated with the key liquids-led projects. When gas reserves are included, the average cost drops significantly to $6.40/boe (Fig. 5).

Risking

The highlighted production and investment profiles are based on Wood Mackenzie's current understanding of the individual projects and the region as a whole. Although the unrisked profiles provide a useful guide to the levels of potential production and investment in the region, the previously mentioned factors make these unrisked profiles unlikely to be achieved in the time frame indicated.

A clear example of delays in the region is provided by the ACG project, which is currently expected to reach peak production of 850,000 b/d in 2010. In 1997, AIOC projected that peak production would occur in 2005, but expansion has been continually constrained by a lack of progress on the BTC export pipeline. In the future, securing sufficient and timely export capacity similarly will be vital to the development timetable for the major Kashagan project.

To generate more-realistic production and investment profiles that take into account the possibility of delays or project failure, Wood Mackenzie has estimated an overall risk for each project that is based on the likelihood of the project developing according to the existing plan. The overall project risk comprises individual risk values placed on each of the following parameters:

- Exploration risk-For projects at the exploration stage, the chance of economic success has been estimated.

- Transportation-markets risk-A risk factor is applied to each project, based on available transportation infrastructure (pipeline, rail, or tanker) and the location of the project in relation to the market.

- Development risk-A risk placed on the likelihood of development delays either through technical, logistical (e.g., rig availability), or economic-financing difficulties.

The three risk factors are multiplied to give an overall risk for each project. The overall risk for each project is then applied to annual production and investment (capex, opex) profiles to provide risked profiles. While the risking process is subjective by nature, the resulting risked production and investment profiles represent a more realistic projection of the Caspian region in the future.

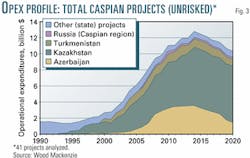

Risked production

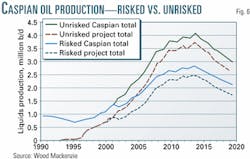

The risked production profile for the 39 E&P projects suggests a peak production of almost 2.5 million b/d in 2010-15 compared with the unrisked peak of 3.7 million b/d in 2015.

Wood Mackenzie has assumed that all remaining production-mostly from those projects that remain under state control-generally has a very low level of risk, primarily associated with the national governments' need to fund their ongoing development.

Hence, total risked Caspian production over the 30-year period is estimated to be almost 20 billion bbl compared with the unrisked total of almost 26 billion bbl. The overall Caspian profile has a projected risked peak production of 2.8 million b/d in 2014 compared with 4.1 million b/d in the unrisked case (Fig. 6).

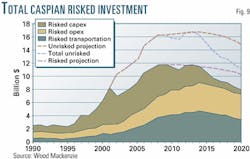

Risked investment

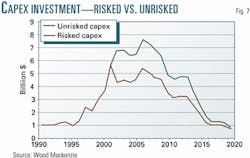

The level of investment required to meet the new risked production profile will clearly be significantly less than that required for the unrisked production (Fig. 7). The capex, field opex, and transportation opex profiles have been risked by project-using the same methodology applied in the production section-to generate more-realistic investment profiles.

During 1990-2020, risked capex is estimated to account for $83 billion of regional investment compared with the unrisked value of $110 billion. Risked field opex and transportation opex are expected to amount to $75 billion and $79 billion, respectively, over the same 30-year period.

The total risked opex is $154 billion, which compares with an unrisked figure of $204 billion. These risked capex and opex figures combine to produce an overall Caspian investment during 1990-2020 of almost $237 billion compared with unrisked figures of $314 billion (Fig. 8).

The risked investment profiles provide a more realistic projected future investment, and consequently, Wood Mackenzie believes that total Caspian investment is likely to build up to reach a plateau of almost $12 billion/year from 2007, compared with $8 billion in 2001 (Fig. 9).

Summary

To recap Woodmac's findings in this analysis:

- The Caspian region has the potential to produce almost 4 million b/d of liquids by 2014. Risking the production profile to account for transportation-market risk, project delays, and exploration failure generates a more realistic scenario and results in a production plateau of 2.8 million b/d of liquids.

- Gas will play an increasingly significant part of Caspian production in the future, contributing about 44% in 2014. However, in order to realize the full value from the region, major new gas markets and export routes will need to be secured soon.

- In addition to the liquids, 12 bcfd of gas could be produced, resulting in a total risked production of 5.0 million boe/d (Fig. 10).

- The overall profile is highly dependent on six key projects-Kashagan, Tengiz, Karachaganak, ACG, Shah-Daniz, and Russia's Severnyi block-so any delays or deviations from these plans could have a huge impact on both production and investment profiles in the region.

- The single most important factor, which will dictate future oil production in the Caspian, is the availability of export capacity. The progress of Tengiz, ACG, Shah Daniz, and Kashagan remains dependent on the timely construction and commissioning of their respective pipelines.

- Total unrisked investment for the Caspian during 1990-2020 is estimated at almost $314 billion, with a corresponding risked investment of $237 billion for the same 30-year period. The risked investment comprises $83 billion for capex, $75 billion for field opex, and $79 billion for transportation opex (tariff payments).

- Average investment over the period is $12.10/bbl or $6.40/boe.

- Total (risked) Caspian investment is likely to build to almost $12 billion/year after 2008 from $8 billion in 2001.

- The importance of key projects to the region is highlighted by the fact that just three projects (ACG, Kashagan, and Tengiz) account for nearly half of all investment to 2020.

- The risks associated with a number of key projects in the Caspian are significantly lower than they were 12-18 months ago. Kashagan is now a discovery under appraisal; CPC is operational; significant progress has been made on the commercial framework of BTC; and a gas contract and transit terms with Georgia have been approved for Shah Daniz gas.

- The overall potential of the Caspian region is not in doubt. However, the rate of investment will be determined primarily by the perceived risk in the region. If the host governments can genuinely and perceptibly reduce those risks, e.g., improve fiscal and political stability, lenders likely would be more willing to finance upstream projects in those countries.

The authors

Hilary McCutcheon has worked at Wood Mackenzie for 5 years since graduating with an MA in Russian interpreting and translating. She has been involved in coverage of various parts of the former Soviet Union (Central Asia, Caucasus, and Timan-Pechora) and now focuses on commercial analysis of Central Asia.

Richard Osbon has a BS in geochemistry from the University of Manchester and an MS in basin evolution and dynamics from the University of London. He worked for ARCO British Ltd. as an exploration geologist focused on the UK North Sea before joining Wood Mackenzie in January 2000, where he now is a research consultant on the Former Soviet Union team.