China's Offshore Revival: China expects offshore production to buttress overall output target

China's offshore oil and gas exploration and production, led by China National Offshore Oil Corp., is waiting in the wings and ready to leap onto the center stage of China's petroleum industry.

China is becoming more and more reliant on offshore supplies of crude oil, given rising demand and bleak prospects for higher onshore production.

The country expects offshore oil production by 2005 to more than double last year's level to 392 million bbl/year of oil equivalent (40 million tonnes/year of oil equivalent), including 221 million bbl of crude oil (30.28 million tonnes) and 10.9 billion cu m of natural gas. More than 50% of total oil and gas production will be based on production sharing contracts with foreign companies that operate off China.

CNOOC Ltd. is to produce 176 million boe in 2005, compared with the company's 2001 estimate of 95 million boe.

CNOOC Ltd. is 70.6%-owned by China National Offshore Oil Corp. The subsidiary was listed on the Hong Kong and New York stock exchanges in February 2001. Before its initial public offering, CNOOC slashed 15,000 jobs, sidelining the retrenched to noncore businesses, and kept only 1,000 workers. It is now China's most efficient and competitive E&P company.

CNOOC holds net proved reserves of 1.8 billion boe, comprised of 1.3 billion bbl of crude and condensate and 3.3 tcf of natural gas. It is now producing oil from 25 fields and gas from three fields offshore.

China's deepwater areas are scarcely touched. The producing field in the deepest water is Liuhua in 300 m of water in the Pearl River Mouth basin.

Production goal

China's offshore oil production target, if achieved, will mean that offshore fields will become the second-largest source of China's crude, after supergiant Daqing field in northeastern China. Daqing has been producing above 365 million bbl/year for more than 20 years.

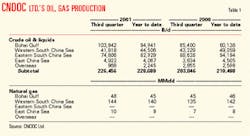

Obtaining more supplies from offshore is essential for China because onshore production has been leveling off (Table 1). Total production has remained largely unchanged, 1.022 billion bbl/year for the last five years. Total output is expected to rise by small margin if not level off between now and 2005.

In 2000, China's crude oil consumption totaled 1.68 billion bbl, of which 496 million bbl was imported. By 2005, demand is forecast at 1.79 billion bbl, of which 548 million bbl will likely have to be imported, assuming CNOOC achieves its production target.

To achieve its production goal, CNOOC and its PSC partners are developing five fields, including three in Bohai Gulf and two in the South China Sea. The company has brought on line two of the five this year. The three still under development are giant Penglai 19-3 in Bohai and Wenchang 13-1/13-2 and Dongfang 1-1 in the South China Sea. The five fields will ultimately convert 726.7 million boe of undeveloped hydrocarbon reserves into production.

In the next 3-5 years, CNOOC will drill wells independently at a rate of 15-20/year, replacing existing wells with new ones to maintain production growth.

The company has earmarked $4.7 billion for E&P during 2001-03, including $1.046 billion in 2001, $1.681 billion for 2002, and $1.935 billion for 2003. Of the total 2001 expenditure, $600 million is for exploration.

The company will keep its total production expenses, or lifting costs, below $10/bbl for the next 8-10 years. Its 2000 total production expense was $8.22/bbl.

Legal framework, PSCs

The government has reaffirmed CNOOC's legal status by allowing it exclusive rights to sign production sharing contracts with foreign contractors following a revision of regulations by the State Council in October 2001.

The government has also revised rules to remove restrictions on technology transfer and requirements on domestic components for procurement. The aim is to provide a level playing ground for all oil field service contractors, domestic and international, after China joins the World Trade Organization.

This is expected to benefit CNOOC's exploration and production operations. China needs foreign capital and technology for sustained offshore oil development.

CNOOC's current PSC model calls for foreign companies to cover the cost of exploring the offshore oil and gas blocks licensed to them. If and when they discover economic hydrocarbon reserves, CNOOC has the option to take a 51% stake in the field development and production and inject 51% of the development capital.

The number of China's PSCs is declining in the last few years. Only two involving a total of $25 million were signed in 2001, compared with six in 2000. No licensing round has been announced since 1999.

A recent trend calls for CNOOC to offer "reverse PSCs," in which foreign companies join in developing oil and gas reserves discovered by CNOOC. This is because the company needs foreign capital to quickly bring commercial reserves into production.

In the latest licensing round, CNOOC in 1999 offered six offshore blocks in the East China Sea basin, the Pearl River Mouth basin, the Beibu Gulf basin, and the Yingge Sea. The six blocks covered 13,450 sq km. This followed offers in 1998 when CNOOC delineated 20 blocks for foreign participation in the Yellow Sea and the Beibu Gulf area of the western South China Sea.

CNOOC plans to offer few offshore blocks in the next a few years because in Bohai Gulf and the South China Sea most of the prospective blocks are under exploration or development. In the East China Sea, CNOOC and China Petroleum & Chemical Corp. (Sinopec) will soon tie up with units of Royal Dutch/Shell Group and Unocal Corp. to explore the Xihu trough.

By the end of October 2001, CNOOC had entered into 148 PSCs and agreements with 70 foreign oil and gas companies from 18 countries and regions. Those contracts were valued more than $7 billion. Of these, 35 are still valid (Table 2). The others have expired.

To date, through Sino-foreign joint effort, CNOOC has sunk more than 400 exploratory wells and discovered nearly 100 oil and gas-bearing structures.

Drilling in 2001

CNOOC originally planned to drill 20 marine exploration wells in 2001, and its foreign partners were to have drilled 27 to 38 wells off China. The company also planned to conduct 10,000 line km of 2D and 1,200 sq km of 3D seismic surveys in 2001. Foreign operators were to conduct 1,800 line km of 2D and 2,000 sq km of 3D seismic surveys in 2001.

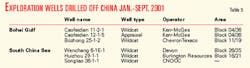

Five exploratory wells were being drilled on Sept. 30 (Table 3). By the end of the third quarter CNOOC had completed the drilling of nine of the 20 wells, and foreign companies completed 24 of the exploration and appraisal wells planned for this year. CNOOC struck hydrocarbons in four out of the nine, and foreign companies were successful in 17 of the 24 wells drilled.

Devon Energy Corp., Oklahoma City, made a discovery on Block 16/02 of the eastern South China Sea. The Huizhou 9-2 discovery well flowed 1,602 b/d of oil and 2.1 MMcfd of gas.

Also in the South China Sea, the CACT Group had an initial flow of 4,700 b/d of oil from the Huizhou 19-2 well. CACT is a consortium of CNOOC Ltd., Agip China BV, a unit of Italian oil major Agip SpA, Chevron Overseas Petroleum Ltd., and Texaco China BV.

One of CNOOC's appraisal wells, Weizhou 12-1-6, flowed 5,345 b/d of crude oil and 1.97 MMcfd of gas. It is on the Yulin 35 Block in Beibu Gulf in the western part of the South China Sea.

Phillips Petroleum Co. and Kerr-McGee Corp. drilled successful appraisal wells in Bohai Gulf in northern China.

CNOOC and its foreign partners were drilling five wildcats and one appraisal well off China as of this writing in late November.

Bohai's importance

Bohai Gulf is expected to be CNOOC's key area for crude oil output growth in the next few years following recent large discoveries made by Phillips.

As of June 2001, CNOOC and its foreign partners had identified 19.7 billion bbl of proved crude oil reserves in a large number of fields in Bohai (Fig. 1).

Over the next four years, China plans to build 50 new platforms and drill 1,100 wells in Bohai Gulf at a cost of $6 billion including investments under PSCs in an effort to raise output to 146 million bbl/year from 26.3 million.

Of CNOOC's total $4.7 billion E&P expenses slated for 2001-03, $2 billion is allocated to Bohai.

Penglai 19-3, which Phillips discovered in 1999, is China's largest offshore oil discovery with crude reserves of 4.4 billion bbl.

CNOOC and Phillips signed an agreement late in 2000 to jointly develop the field, and initial development calls for a drilling platform, a floating production, storage, and offloading vessel, offloading facilities, and two offshore oil pipelines.

Penglai 19-3 covers 50 sq km in 23 m of water near the Longkou coast. Pay zone thickness averages 150 m.

The companies plan to start production at Penglai 19-3 in the first half of 2002, with initial output pegged at 35,000-40,000 b/d from 24 production wells. Production will be expanded to 100,000-130,000 b/d by 2005 when the second phase is brought on line, which at that time will account for 43% of the total crude production CNOOC expects to produce from Bohai.

Penglai ownership is CNOOC Ltd. 51% and Phillips 49%.

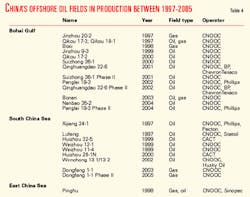

Bohai's crude output has already been boosted since September 2001 with the startup of Qinghuangdao 32-6 field and Suizhong 36-1 field (Table 4).

Qinghuangdao 32-6, 130 km east of Tianjin city, is producing an initial 25,000 b/d of oil. Production is expected to peak at 65,000 b/d when the second phase starts operation in 2002.

Discovered in 1995, Qinghuangdao has 103 million bbl of reserves. China entered into a reverse PSC with BP PLC and Texaco in 1998 to develop the field, where CNOOC initially confirmed the commerciality of the reserves. Interests are CNOOC 51% and BP and ChevronTexaco 24.5% each.

Since August, CNOOC commissioned three new platforms in the self-financed second phase of Bohai's Suizhong 36-1 field. The second phase followed the commencement of operations at three other platforms, D, E, and F, in the same field in 2000. The new platforms have brought Suizhong's oil production to 69,000 b/d.

Suizhong 36-1, discovered in 1987 in the southern part of Liaodong Bay, is 100% owned and operated by CNOOC. It is now China's largest self-financed field, but the amount of the expenditure was not available.

Other Bohai action

In the meantime, CNOOC has raised its crude reserve portfolio with a new discovery at its Nanbao field in the southern part of Bohai. The Nanbao 35-2-7 appraisal well is expected to increase the reserve size at the Nanbao 35-2 field by 25%. The well flowed 432 b/d of 16° gravity oil when drilling reached a depth of 1,473 m. It encountered a 64 m pay zone.

Nanbao 35-2-7 is 1.4 km northeast of an earlier wildcat well, Nanbao 35-2-1, which led to the discovery of Nanbao 35-2 in 1996. The initial appraisal allowed CNOOC to place the field's reserves at 65 million bbl. CNOOC, which wholly owns the field, is drilling another appraisal well. It plans to bring Nanbao on line in 2004.

CNOOC and Shell Exploration China Ltd. will soon start examining options and plans for developing oil and gas reserves on the Bonan Block in southeastern Bohai. The block contains several oil and gas fields 65 miles north of Longkou in 330 ft of water that hold a combined 1 tcf of gas and 600-700 million bbl of oil in place.

Two key structures, Bozhong 26-2 and Bozhong 28-1, and the other three fields hold a combined reserve of more than 160 million bbl of liquids and around 300 bcf of associated gas.

The block is close to several metropolitan areas of Shangdong Province. The initiative contemplates a subsea pipeline with landfall at Longkou and continuing east to Yantai and south to Qingdao on the Yellow Sea coast.

Late in the year, Sinopec's Shengli Oil & Gas Co. unit began construction of one drilling and one production platform for the Zhao Dong Block 11/19 in western Bohai just offshore from the Dagang fields. Apache Corp., Houston, ordered the platforms for production of oil in 4.5 m of water on the 49,000 acre block starting in 2002 or 2003.

Noble Affiliates Inc., Houston, is to start production next year from Cheng Dao Xi Block A field in 25 ft of water in southwestern Bohai. The $101 million development plan called for 16 wells, including injectors, to feed facilities with a capacity of 10,000 b/d connected to a 5-mile pipeline to shore infrastructure in the Shengli fields.

South China Sea

The Pearl River Mouth basin in the South China Sea is the mainstay of China's offshore oil production for now.

Four fields, Huizhou, Liuhua, Lufeng, and Xijiang, produce a combined 210,000 b/d of oil (Fig. 2). Huizhou is the biggest at 94,000 b/d.

Huizhou 32-5, which started up in 1999 on Block 16/08, is latest field to be brought on line. Operated by CACT, it is the first project in the South China Sea to use production technology allowing subsea links to an existing platform, Huihzou 26-1. Three wells at Huihzou 32-5 are tied to Huihzou 26-1, 3.5 km northwest. The crude oil is then processed through the surface facilities on the Huizhou 26-1 platform.

Husky Oil China Ltd., a unit of Husky Energy Inc., Calgary, will soon emerge as a major foreign player in South China Sea, where it is working several PSCs. Along with CNOOC, it is developing the Wenchang 13-1/13-2 blocks in the western South China Sea 136 km east of Hainan Island (Fig. 3). CNOOC licensed the two blocks to Husky in a reverse PSC. The two blocks have 60.6 million bbl of oil reserves, with CNOOC holding a 60% of the working interest and Husky holding the remainder.

Wenchang is expected to come on line in the first half of 2002 with a maximum design production capacity of more than 50,000 b/d.

Also with Husky, CNOOC signed in July 2001 a PSC to explore Block 39/05. The 5,700 sq km block is 100 km east of Hainan Island. Under PSC terms, Husky committed to drill a minimum of three exploration wells during seven years.

CNOOC signed another PSC in 2001 with Santa Fe Energy Resources Corp., now part of Devon Energy, to explore and develop Block 27/10. The block covers 6,546 sq km.

The contract was the eighth between Santa Fe and CNOOC, of which six are under execution. Santa Fe's major discoveries in Pearl River Mouth basin are Panyu 4-2 and Panyu 5-1.

One of the few oil finds in the South China Sea in 2001 is Liuhua 19-3 about 220 km south of Hong Kong. CNOOC struck oil at the Liuhua 19-3-1 well, TD 1,500 m. The well flowed 49,000 cu m/day of gas through a 44/64-in. choke. CNOOC plans to drill a few more wells around the discovery well.

CNOOC also made a discovery this year at the Wenchang structure of Qiongdongnan basin southeast of Hainan island. The CNOOC-financed Wenchang 15-1 well flowed 4,760 b/d of 35° gravity oil and 330 Mcfd of gas on a 16 mm choke from 1,250 m. The pay zone is 40 ft thick, and the structure covers 18.5 sq km. The company will appraise the find in 2002.

It was also drilling the Songtao 36-1-1 wildcat late in the year in the Qiongdongnan basin 60 km southeast of Hainan Island.

In addition to the Wenchang oil fields that CNOOC is developing with Husky, CNOOC is also in the midst of developing Dongfang 1-1, a gas prone field west of Hainan Island.

CNOOC is injecting 5 billion yuan to build 1.6 billion cu m/year of gas production capacity at Dongfang by September 2003, expandable to 2.4 billion cu m/year by 2005.

By then, Dongfang will be China's second largest offshore gasfield in the South China Sea after Yacheng 13-1, operated by CNOOC and BP. Dongfang 1-1 traps 90 billion cu m of gas reserves.

For Dongfang gas production, CNOOC has signed a package contract for developing a few downstream projects in Hainan Province, committing about 10 billion yuan to building a chemical plant and gas pipeline grid and retrofitting a Hainan power plant with gas.

Overall gas strategy

CNOOC has an ambitious plan to build distribution networks to feed gas into households and industries in China's eastern and southern coastal provinces in the next 10 years.

The company is on track to raise its natural gas production to 10.9 billion cu m/year by 2005, up from 4.6 billion cu m last year. An initial plan calls for the company to verify between 370 billion and 600 billion cu m of gas by 2005.

CNOOC's gas production is being transported to users in Hong Kong, Tianjin, Liaoning, and Shanghai.

The company is now involved with Shell to conduct a feasibility study regarding construction of a 2,000 km gas pipeline along China's southern and eastern coasts. While the government has discounted CNOOC's ability to have enough gas resources to make the pipeline viable, CNOOC has taken a different approach, that of building the pipeline piecemeal, province by province.

It has recently struck a deal to form a joint venture with Zhejiang local companies to build a distribution network and has signed agreements with Fujian and Shandong provincial governments to build gas facilities including terminals to import LNG.

To Zhejiang, the company will supply gas to be produced from the Xihu trough in the East China Sea. CNOOC and Sinopec expect to raise gas reserves at Xihu to 150 billion to 200 billion cu m by 2003 from 54 billion cu m.

CNOOC will supply part of the gas produced from Bohai to Shandong, and CNOOC and the Shandong government will build an LNG terminal in the province to supplement the Bohai gas.

The central government is unlikely to approve CNOOC's gas expansion plan until its flagship LNG project in southern China's Guangdong province becomes viable.

CNOOC is spearheading a consortium made of BP and local Guangdong and Hong Kong businesses to conduct a feasibility study to build a 3 million tonnes/year LNG receiving terminal at Shenzhen in Guangdong province.

The project has government approval, and CNOOC has begun an international tender for LNG supply contracts. CNOOC has issued bidding documents to Australia, Indonesia, Russia, Qatar, Malaysia, and Yemen.

The Guangdong terminal is estimated to cost $616 million. Expected to come on stream in 2005, it also involves building a 300 km pipeline.

In a bid to secure enough LNG supplies for the terminal, CNOOC signed a memorandum of understanding with Chevron Australia Pty. Ltd. to explore the feasibility of acquiring an equity stake in the Gorgon area off Western Australia.

Gorgon field is the largest natural gas field discovered in Australia with confirmed hydrocarbon reserves in excess of 9.6 tcf.