OGJ Newsletter

Market Movement

Will winter rescue natural gas prices?

Withdrawal of natural gas from storage has started. Will it have come in time to rescue gas prices from the cellar before the end of the year?

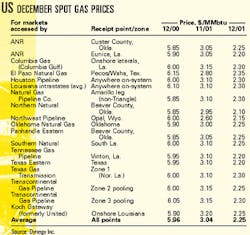

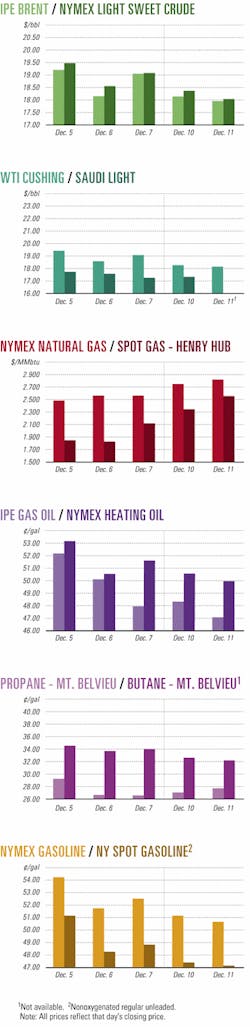

US natural gas spot prices have plunged to an average $2.25/MMbtu this month, down almost 80¢ from a month ago and not much more than a third of where they were a year ago (see table).

If, as expected, warmer-than-normal weather prevails across much of the US in the coming days, spot gas prices are likely to slip through the $2.00/MMbtu floor that is such an important psychological watershed for idling rigs.

But market fundamentals are already beginning to set the stage for an upward correction. The extent of that rebound will largely be dictated by the kind of weather seen across North America this winter. In the long run, however, industry fundamentals still support upward pressure on prices more than they do downward pressure.

First withdrawal

The American Gas Association reported a withdrawal of 16 bcf from storage, a bit larger than was expected, for the week ended Nov. 30.

But New York Mercantile Exchange gas futures prices scarcely blinked, even slipping a few cents on the day the AGA storage report was released. It's evident that continued mild weather, the lingering storage surplus overhang, and a comparison with strong withdrawal rates a year ago at this time are putting downward pressure on gas futures prices.

Since the beginning of the heating season Nov. 1, the US has seen temperatures 26% higher than normal and 32% higher than the same time a year ago. Con- sequently, lagging seasonal demand has prompted unusually late injections into storage, record stock levels at 3.128 tcf, and a jump in the year-to-year storage surplus to 699 bcf. Working gas in storage at the first of the month stood at 95% compared with less than 74% a year ago at this time.

Canada's situation offers little relief, with the storage picture there comparable. The Canadian Gas Association reported a boost in gas inventories for the week ended Nov. 23 of 3.9 bcf to a total of almost 471 bcf, another indicator of the lateness of the injection season even north of the border. Canadian gas stocks were 34.5 bcf above year-ago levels, reaching almost 83% of capacity compared with 76.5% a year ago.

Growing surplus

Given the latest data on storage and a forecast of warmer-than-normal weather across the eastern half of the US, the year-on-year storage surplus is likely to grow.

Ron Barone, in a UBS Warburg research note, has said, "The industry could easily face a 1 tcf surplus heading into January, given that the following three [year-ago] withdrawal comparisons are 158, 175, and 209 bcf," he said. "Depending on 1Q02 temperatures, this storage overhang could place tremendous pressure on the spot market in the early part of the year."

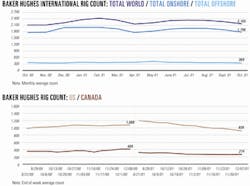

Barone sees little respite in the near term for North American gas markets, given the persistently strong drilling activity. The count of US active rigs drilling for natural gas fell sharply the week ended Nov. 30-by 29 units to 785-but it still remains well above last year's count at this time: 954 vs. 708. Canadian drilling activity also remains strong, rising 13 units to 309 for the week ended Dec. 4.

Industry Scoreboard

null

null

null

Industry Trends

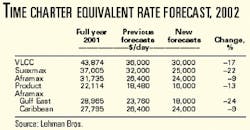

TANKER CHARTER HIRE rates are likely to yield weaker earnings through 2002. Lehman Bros. has lowered its fourth quarter 2001 and the full year 2002 time charter equivalent rate forecast.

The lower rate outlook for the various types of tankers represents a 14-18% year-over-year decline (see table).

"The weak outlook for oil demand next year makes significant increases in production unlikely. Seen against an estimated 5% in- crease in the global crude tanker fleet, a near-term catalyst for higher charter hire rates is lacking," said Lehman analyst Daniel L. Barcelo.

Without significant OPEC-led production increases, vessel demand for 2002 is likely to be outpaced by new vessel deliveries, resulting in an increase in the global crude oil tanker fleet of 5%. This trend means tanker rates will see little improvement during the next year, he said.

"The global oil market is currently receiving more oil than necessary. Any further increases in production in the current environment are unlikely without a noticeable increase in oil demand," said Barcelo. "The reduced outlook is expected to increase scrapping rates however, which will help to provide a floor to tanker rates."

THE POLYSTYRENE MARKET continued its down cycle this year, with only a little relief in sight.

Chemical Market Associates Inc., in a new report, blames 2 consecutive years of global demand declines for polystryene's sad state today. CMAI's consultants Alex Lidback, Vince Sinclair, and John Bonarius compiled the report.

The demand setback in 2001 means the polystyrene industry is in need of rationalization, they said.

"World demand fell by 2.5% in 2001 after a decline of 0.1% in 2000. China is the only large market to grow in 2001, with an increase of 3.6%, while the rest of the world fell by 4.0%," the report said.

Demand growth is expected to resume in 2002, although at a subdued rate. "CMAI is discounting any speculative inventory surge that would artificially inflate demand. On the basis of very depressed operating rates for polystyrene and styrene monomer, there is very little chance that a perception of short supply could develop any time soon," the consultants said.

The world average capacity utilization rate of 75% in 2001 is significantly lower than in previous market troughs.

"A year ago, the market was poised for reasonable recovery and an improvement in industry fortunes. However, the legacy of the 900,000 tonne imbalance between capacity and demand growth in 2001 holds operating rates down throughout the forecast period to 2006," the report said.

Government Developments

PETROBRAS'S MONOPOLY over oil products imports will end Dec. 31 with a new fuels market opening to competition on Jan. 1, 2002.

Brazil's Senate approved a constitutional change that adjusted the taxation system for oil and fuel companies. The opening of the fuel market had been postponed since August 2001 while lawmakers debated the tax change.

Meanwhile, US financial services firm Morgan Stanley Dean Witter predicts Brazil's gasoline prices will drop by 13% as of January with the introduction of competition.

On the other hand, Morgan Stanley said Brazilian diesel and natural gas prices will increase by 27% because they are subsidized. Morgan Stanley predicted import tariffs would hover around 8%.

Christian Audi, a Morgan Stanley analyst, said that overall oil products prices will drop because gasoline is the most important product imported.

Petrobras still owns a 14,000 km pipeline network and most port terminals in Brazil. Some foreign companies already are building their own port terminals. Dutch company Oiltanking is negotiating a partnership with Petrobras to build a port terminal in Pecem, in the northern state of Ceara.

Italian company ICD, in partnership with Vitoil, is building a $15 million port terminal with storage capacity of 110 million l. of oil products. And Decal is planning to build a terminal in Suape, Pernambuco state.

Petrobras has a combined total of 10.1 million cu m of storage capacity of oil products in its terminals.

Meanwhile, Brazil's Senate has approved the appointment of Sebastiao Rego Barros as new executive director of the National Petroleum Agency (ANP), which regulates Brazil's petroleum sector.

He replaced former ANP Executive Director David Zylbersztajn, who resigned from his post in September.

ANP has played a major role in reducing Petrobras's monopoly over many aspects of Brazil's oil industry and has battled to create a pro-market competitive environment, now that Petrobras lost its monopoly.

FERC Chairman Pat Wood III said federal legislation is not needed to accelerate construction of a pipeline to deliver Alaskan gas to the Lower 48 states.

Speaking late last month to the Energy Bar Association, Wood said an existing interagency task force would be able to accelerate the permitting process, when and if an application is filed at FERC.

Wood acknowledged that a decline in natural gas prices may have curbed enthusiasm for the project, but said, "The country needs this without question. We can't get to [supplying] a 32 tcf/year market without arctic gas and liquefied natural gas."

The US Energy Information Administration has estimated that US demand for natural gas will grow faster than that of any other major fuel source, reaching 32 tcf by 2015.

Wood said the gas pipeline is a key element of national energy strategy, but the companies building the line should determine the route, not government.

Quick Takes

Royal Dutch/Shell found what is likely to be the Philippines' first commercially viable oil deposits in a deep well drilled through its existing Malampaya gas reservoir, the company said.

Initial well tests from the thin oil rim beneath the gas zone yielded 8,000 b/d of 30° gravity crude-the highest single-well oil production rate in the country since the 1970s.

The well test, performed at 850 m subsea by the Atwood Falcon rig and Stena Natalita floating storage unit, is believed to be the world's deepest horizontal subsea well test.

Development could lead to a $600 million investment to bring the oil ashore via a floating production, storage, and offloading vessel. Project partners include operator Shell 45%, ChevronTexaco 45%, and Philippine National Oil Co. 10%. The oil accumulation is under the complex gas-producing area in a narrow stratum, into which a 1,000 m horizontal well was drilled, Shell said. The M10 hole was suspended several months ago to allow completion of five gas wells. The oil well is 5 km west of the gas wells.

Shell said another well would be needed to bring the reservoir into production. Reserves are estimated at 50 million bbl.

Malampaya oil is high in hydrogen sulfide and would require treatment on an FPSO. Associated gas would be tied into the Malampaya production platform and then transported by the existing 504 km pipeline to Batangas.

Malampaya field, which is 50 km northwest of Palawan Island and 600 km southwest of Manila, holds 3 tcf of gas reserves. Production is sent via pipeline from a subsea manifold in 850 m of water to the production platform in 43 m of water.

In other exploration action, Canadian Superior Energy began drilling the first of three wells in a deep gas program in northeastern British Columbia. Drilling began on the company's wholly owned, 5,120-acre Farmington prospect 25 miles southeast of Fort St. John. The other two wells will be in the Umbach and Altares areas. The $1.5 million (Can.) Farmington test will target the Kiskatinaw at 2,500 m. The company postulates individual well reserves potential at 20 bcf and deliverability at 8-10 MMcfd. The 1,160 m test in the Umbach area, 80 miles northwest of Fort St. John, will target the lower Cretaceous Cadomin and Gething. It follows a recent Canadian Superior discovery at 45-F/94-H-3, which began producing 1.5 MMcfd in November. Canadian Superior operates the Umbach prospect with 62.5% interest. The Altares test, 45 miles west of Fort St. John, will target the Mississippian at 2,525 m. Canadian Superior recently acquired a 50% working interest in the foothills overthrust prospect. Kobes field, on trend to the northwest, is a 250 bcf field developed on a similar Mississippian overthrust play.

Separately, Canadian Superior said its recently acquired Mayflower block off eastern Canada has structures analogous to some fields with reserves of as much as 500 million bbl of oil or 5 tcf of natural gas. At the Canada-Nova Scotia Offshore Petroleum Board lease sale held last month, Canadian Superior offered a work expenditure pledge of $41.3 million (Can.) for License 2406, now dubbed Mayflower (OGJ Online, Nov. 2, 2001). It also pledged $15.5 million for License 2409, now Mariner. Seismic data on the Mayflower prospect, 285 miles east of Boston, has identified three large, deepwater turbidite structures analogous to some in the Gulf of Mexico, off Angola, and off Brazil, the firm said. Seismic on the Mariner prospect has identified a large Cretaceous structure in shallow water near existing Sable Island infrastructure. Similar structures nearby, the firm said, are producing 500 MMcfd of gas. Canadian Superior plans to drill a well on its Marquis prospect, also off eastern Canada, next year (OGJ, Dec. 3, 2001, p. 47).

Indonesia has awarded a consortium of TotalFinaElf and Japan's Inpex the Donggala block north of the Makassar Straits. The 3,820 sq km block is in 1,800-2,500 m of water 75 km from TotalFinaElf's Tunu field. The companies expect to begin drilling next year. Block operator TotalFinaElf said the acquisition is part of a strategy to strengthen its position in the deep offshore. The consortium produces more than 500,000 boe/d in Indonesia, supplying 60% of the gas requirements of the 22.25 million tonne/year capacity Bontang LNG plant. F Saudi Aramco has a discovery in eastern Saudi Arabia at Jefin No. 1, said Saudi Minister of Petroleum and Mineral Resources Ali al-Naimi. The well flowed 1,100 b/d of oil and 1.6 MMcfd of sweet gas. Al-Naimi said this is the ninth commercial field near supergiant Ghawar field.

THE PETROCHEMICALS BUSINESS continues to suffer amid economic doldrums.

Chemical joint venture Chevron Phillips Chemical said it will fully decommission the 400 million lb/year ethylene cracker at its Sweeny, Tex., chemical facility and will continue to idle its 650 million lb/year cracker at Sweeny "for the foreseeable future."

The smaller cracker, called Unit 12, has not operated since December 2000 because of a slump in ethylene and ethylene-derivatives demand.

The primary drivers behind the decision, the JV said, were "a combination of the difficult market environment and pending capital requirements for environmental upgrades." Chevron Phillips Chemical added, "Unit 22 is a very competitive cracker, and we expect it to return to service when the market situation improves."

The JV will reassign its employees working at the two units and will decrease contract manpower. After Unit 12 is decommissioned, the JV will have an ethylene production capacity of 7.6 billion lb/year, with 4.1 billion lb/year at Sweeny, and the remaining 3.5 billion lb/year equally divided between its Cedar Bayou and Port Arthur manufacturing sites.

This announcement follows Chevron Phillips Chemical's postponement of the reopening of its Puerto Rican benzene and cyclohexane manufacturing operations indefinitely. The JV, which idled all its manufacturing operations in Puerto Rico in March, cites economic conditions as the reason behind the restart delay.

It will continue to review options to eventually restart paraxylene and orthoxylene manufacturing but will not restart them in early 2002 as previously planned. The JV has been working to reconfigure the plant, "negotiating for appropriate feedstocks in order to make this a viable operation long-term," it said.

"Unfortunately, general economic conditions, and particularly the economics of manufacturing benzene and subsequently cyclohexane in Puerto Rico, have not improved and have in fact worsened," the JV added. Chevron Phillips Chemical said it would meet its contractual obligations through other production and alternate supply agreements.

But the petrochemical boom in China continues apace.

BP, Sinopec, and Shanghai Petrochemical have revealed more details of their ethylene cracker and chemicals derivative complex planned near Shanghai (OGJ Online, Sept. 4, 2001).

The $2.7 billion project is expected to begin operations in 2005 at Shanghai Chemical Industry Park, Caojing. The companies earlier this month officially formed a JV, Shanghai Secco Petrochemical. China approved a feasibility study for the project (OGJ Online, Aug. 30, 2001).

The main downstream and derivatives plants are planned to produce polyethylene (600,000 tonnes/year), propylene (590,000 tonnes/year), polypropylene (250,000 tonnes/year), styrene (500,000 tonnes/year), polystyrene (300,000 tonnes/ year), acrylonitrile (260,000 tonnes/year), aromatics (500,000 tonnes/year), and butadiene (150,000 tonnes/year).

"Following China's accession to the World Trade Organization, this project, as the central pillar of the Shanghai chemical zone, will promote and lead economic development in Shanghai and eastern China and help bring China's petrochemical industry to a new level of performance," Sinopec said.

Secco will tender for design and construction contracts with the aim of breaking ground in first half 2002.

Shenzhen Liaohe Tongda Chemicals (Liaotong) has selected Halliburton KBR to revamp its ammonia plant at Panjin, Liaoning province, China.

KBR will use a proprietary reforming exchanger system to reduce the plant's natural gas consumption.

The unit will supply synthesis gas to produce 1,070 tonnes/day of ammonia. A similar unit has been operating at a Canadian ammonia plant since 1994, KBR said.

Halliburton KBR will provide basic engineering services from its Houston office. Liaotong's domestic contractor, China Huanqiu Chemical Engineering, will execute detailed engineering, and Liaotong's project team will handle procurement activities and construction work. Halliburton KBR will provide procurement assistance services and technical advisory services during erection and commissioning phases. The schedule calls for mechanical completion in fourth quarter 2002.

The Iran-Turkey gas pipeline will be operational by yearend, said Turkish Commercial Counselor Osman Bakaroglu, quoted by OPEC News Agency.

International inspectors still are examining the line, a process that began in July, he said. As soon as the inspection is completed, the line would be inaugurated.

In 1997, the two countries agreed that Iran would export 10 billion cu m (bcm)/year of gas to Turkey for 25 years. Under the contract, Turkey would import 225 bcm of gas.

The line will initially supply 3 bcm/year to Turkey, increasing deliveries gradually to 10 bcm/year in 2007.

The line extends 2,557 km into Turkey and is expected to supply 57 villages by 2003.

Reports earlier in the year said the two sides had agreed to start trading during the second half of September; however, Turkey had not implemented the deal. Some analysts said they believe Turkish officials delayed the opening of the pipeline until they were sure they would need the gas.

Topping off other pipeline activity, El Paso Corp. has begun engineering studies for its proposed $1.6 billion Blue Atlantic pipeline, which will carry gas from fields off Nova Scotia to markets in eastern Canada and the northeastern US (OGJ, Oct. 8, 2001, Newsletter, p. 8). It has selected several companies to work on the 750 mile, 36-in., 1 bcfd line. Willbros Engineers will provide overall project management services, including siting and design of the line and related facilities. Other alliance companies are Trow Consulting Engineers, Accent Engineering Consultants, and Project Consulting Services. Blue Atlantic will extend from fields near Sable Island to the southern coast of Nova Scotia then continue subsea to landing points in New York and New Jersey. The companies expect gas demand in the northeastern US to increase to 2 bcfd by 2005, up 685 MMcfd from current demand. The group expects to complete preliminary engineering studies by yearend 2002. El Paso said the project could be in service by fourth quarter 2005.

ExxonMobil began first production from a satellite fields development project, which it said is the first of its kind off Malaysia.

Seligi H-the first of five satellite platforms being used to develop six fields-has come on stream. Seligi H is 50 miles off Terengganu in the South China Sea. The other platforms are Raya B, Lawang A, Serudon A, and Irong Barat B.

About 90 million bbl will be produced from the $240 million satellite platform project. Peak production from all five generic, minimum facility platforms is expected to total 40,000 b/d of oil and 50 MMcfd of gas. Production will be brought on stream in stages between the second quarter of 2002 and early 2003.

"By simultaneously constructing these satellite platforms, sequentially installing them, and then using the same drilling rig, we are able to capitalize on time efficiencies and economies of scale," ExxonMobil said.

Under various production sharing contracts, ExxonMobil has a working interest of 78-80% in the fields, with the remaining interest held by Petronas Carigali.

LNG ACTION continues to heat up in the US and China.

Cheniere Energy acquired an option to buy a site near Sabine Pass, Tex., to build an LNG receiving terminal.

Cheniere previously acquired options for LNG terminal sites at Freeport and Brownsville, Tex. It announced the intent to acquire three such options earlier this year (OGJ Online, June 12, 2001).

"All the work we have done continues to support our conclusion that Texas is well situated to develop LNG receiving terminals because of its extensive infrastructure for transportation and the large industrial demand in the state," Cheniere said. The firm signed several memoranda of understanding for the offtake of 350 MMcfd from the Freeport location. "We believe that LNG will become a critical component of supply of gas within the current decade," the company said. Cheniere has begun permitting and engineering work at the Freeport site, where it added 100 MMcfd of capacity to its proposal.

A consortium led by CNOOC selected Halliburton and JGC to perform front-end engineering design for the $600 million Guangdong LNG project in southern China.

The project will include a 3 million tonne/year LNG receiving terminal and a 300 km gas distribution pipeline system.

JGC and Halliburton KBR expect to complete the FEED contract by first quarter 2002. The project could be commissioned in 2005 (OGJ Online, Apr. 26, 2001).