Most of the 900 industry representatives attending the annual 2-day Arthur Andersen LLP energy symposium expect increased demand for oil and natural gas, with lower, more volatile crude prices, and less investment capital available over the next 3 years.

Yet, most of those surveyed also projected increased spending for exploration and development during the same period, particularly outside of North America, Andersen executives reported Dec. 5.

For years, Andersen officials have polled industry executives' outlook weeks in advance of the accounting and consulting company's annual energy symposium. "But by the time we got around to announcing the results at the meeting, the situation had moved on," said Victor Burk, managing partner of Andersen's energy and utility practice in Houston.

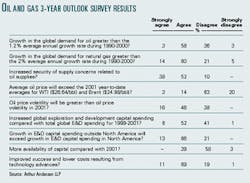

This year, the firm abandoned that approach in favor of a 2-page questionnaire distributed to attendees at the symposium's opening session Dec. 4. The full results and analysis of that poll will be released in January. However, Burk revealed some highlights during a plenary session and at a news conference following that session (see table).

Poll results

Of those polled, 61% said global demand for oil during the next 3 years will exceed the 1.2% average annual growth rate during 1990-2000. An even greater majority, 74%, said global demand for natural gas would surpass a 2% average annual growth rate during the same period.

"That implies expectations that the economies of many countries will recover relatively early in the next 3 years," Burk said.

The biggest majority, 90% of the respondents, expressed increased concerns over the security of future oil supplies. "We can probably associate security concerns with worries about spreading tension in the Middle East, with talk of potential [US] action against Iraq and with the growing conflict between Israel and the Palestinians," Burk said.

However, he said 61% of those polled at the Houston meeting indicated they do not expect any shortage of energy supplies to result from the lack of an US energy policy.

Apparently no major increase in energy prices is expected, either. A whopping 83% of the respondents predicted oil prices would not exceed averages so far this year of $26.64/bbl for benchmark US crudes or $24.98/bbl for North Sea Brent oil, while 62% said price swings would be more volatile during the next 3 years.

Only 39% of those polled said more capital would be available to the industry during that period. Yet 58% forecast global spending for exploration and development will increase from 1999-2001 levels, with 79% agreeing that growth of capital spending in other markets would exceed that of North America.

Although Andersen officials could not explain the apparent paradox of projections of less capital and more spending, Burk noted that 80% of the respondents expect greater success and lower costs because of technology advances.

"I believe we are entering a period in which we will see fundamental and structural changes in the energy industry," he said.

Similar surveys conducted by Andersen officials in London and Buenos Aires in mid-October drew similar responses to "three quarters of the questions," said Burk. "So there are a lot of similarities."

Of those polled in Houston, 79% expressed confidence that California's electric power crisis would not be repeated in other deregulated US markets. Most of the respondents also expect increases in wholesale electric power price to lag behind the rate of inflation, no resurgence in nuclear power generation, and acceleration in the trend toward unbundling vertically integrated utilities.

Andersen officials also submitted to participants a questionnaire about future structural changes in the oil and gas industry.

It's the first step in a new joint study by Andersen, HSBC Investment Bank PLC, and the Oxford Institute for Energy Changes of evolving corporate structural changes within the energy industry, Burk said.