NW Peru NGL-GTL venture has exploration component

Syntroleum Corp., Tulsa, Okla., and BPZ Energy, Houston, revealed the framework of the wide-ranging development of two integrated natural gas liquids and gas-to-liquids projects in northwestern Peru.

Exploitation of undeveloped discoveries and new exploratory drilling on Block Z-1 from off Mancora to Peru's border with Ecuador is contemplated in a later phase, Syntroleum said.

The projects will have three phases. The companies noted that the commencement and completion of each phase are subject to specific requirements. These include determining cost estimates, site acquisition, permitting, commitments from participants and possibly lenders, and front-end engineering design.

However, they said the project offers the prospect to book and monetize stranded gas, cut greenhouse emissions by a reduction in flaring-venting, attract other participants, add exploration activity, and demonstrate gas-to-liquids technology.

Syntroleum will hold 95% interest in the overall project and in Block Z-1, and BPZ Energy will have 5%. Syntroleum said it is discussing participation with other companies.

Talara gas utilization

Operators of oil fields around Talara send in excess of 30 MMcfd of associated gas to an aging gas processing plant operated by the local power company, Empresa Electrica de Piura SA (EEPSA).

EEPSA uses some of the lean residue gas in its 96 MW Talara electric generator and sells the rest to Perupetro SA's 62,000 b/d Talara refinery and oil producer Petro-Tech Peruana SA.

In Phase I, Syntroleum will build a larger, conventional cryogenic gas processing plant capable of extracting 2,000 b/d of NGL. That plant could be completed in 2002.

Syntroleum is negotiating with EEPSA and the producers for the assignment to Syntroleum of EEPSA's gas supply contracts. The gas will come from fields producing now or that have gas behind pipe that can be economically delivered with minimal additional capital requirements.

Syntroleum will also buy associated gas that companies are not producing from their fields, including the Peruvian oil companies Petro-Tech Peruana and Graña Montero Petrolera, Argentina's Perez Companc, Canadian company Mercantile Peru, and China's Sapet Development.

Gas to liquids

Phase II of the project would involve increasing the capacity of the cryogenic plant to handle 100 MMcfd of gas, all from the Talara area, and extract 10,000-11,000 b/d of gas liquids.

Syntroleum in Phase II would expand the conventional gas processing plant and construct a 5,000 b/d gas-to-liquids plant. The GTL plant would convert part of the lean residue gas from the expanded gas processing plant into "ultraclean synthetic fuels."

Any remaining residue gas would be sold to existing gas consumers or reinjected for reservoir pressure maintenance.

Offshore development

In the last phase, Syntroleum will expand the GTL facility by 20,000-40,000 b/d as more gas is developed nearby. This would involve a corresponding incremental gas supply of 200-400 MMcfd.

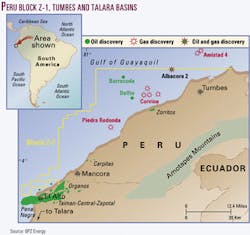

The 1,155 sq mile Z-1 block is in 30 ft to more than 500 ft of water in the Tumbes and Talara basins. The license is for 40 years with a 7-year exploration phase.

Previous exploration on five structures led to four gas and condensate discoveries that contain a combined 540 bcf of gas on the block, said Perupetro. BPZ has mapped 10 more prospective targets on the block.

Oil and-or gas are produced south and east of Z-1 in Peru and to the north off Ecuador.

The Z-1 exploration stage calls for drilling of at least three exploratory wells, complete field studies, reprocessing at least 1,000 km of 2D seismic lines, and processing and interpretation of at least 250 km of seismic. Perupetro estimates the cost of the minimum program at $26 million.

Other aspects

Syntroleum will maintain the gas supply to the Talara generator and refinery.

In another letter of intent, Perupetro expressed interest in assisting the project by offering its support in such matters as making available a potential plant site and evaluating possible purchases for local distribution by Perupetro of certain products produced by the project.

The Talara project may be a candidate to qualify for carbon credits as a result of using flared and vented gas as feedstock.

BPZ has considerable experience with Talara reservoirs and production. Other energy companies are sought to take equity in the project, assist with development plans and drilling of wells, and participate in any subsequent field development.