Worldwide oil demand to increase again in 2001

Continued growth in the global economy will push up worldwide demand for oil again this year.

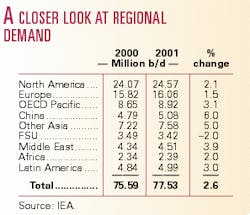

Recent data from the International Energy Agency project demand increases in all major regions except the former Soviet Union (see tables). Biggest percentage increases will be in China 6%, other Asia 5%, and the Middle East 4%.

IEA expects demand worldwide to grow by 2.6% in 2001 to an average of 77.5 million b/d. The increase follows gains of 1.1% in 2000 and 1.6% in 1999.

Production increases in North America and the FSU will raise supply from outside the Organization of Petroleum Exporting Countries to an average for the year of 46.7 million b/d, compared with 45.9 million b/d last year.

Oil & Gas Journal assumes that OPEC output of crude oil will average 28.7 million b/d for the year, which implies an average stock build of 800,000 b/d, most of it occurring in the second quarter.

In the first quarter, OGJ expects OPEC to lower output of crude oil to an average 29 million b/d. With demand at the 77.7 million b/d expected by IEA and non-OPEC production nearly unchanged, OPEC output at that level implies a first-quarter stock build of 1.1 million b/d.

IEA forecasts that second quarter demand will dip by 2 million b/d and non-OPEC output by 300,000 b/d. OGJ assumes that OPEC production will slide to 28.1 million b/d in the quarter, which implies a large stock build of 2 million b/d.

Third quarter demand will climb back to 77 million b/d, according to IEA's projection. Non-OPEC production will remain at the second-quarter level. If OPEC produces 28.5 million b/d of oil during the period, stocks will grow by 1 million b/d.

IEA expects fourth quarter worldwide demand to be very strong at 79.8 million b/d, with non-OPEC production jumping to 47.2 million b/d. The implied stock change then swings to a 600,000 b/d average withdrawal.

Review of 2000

The increase in worldwide oil demand in 2000 came despite a run-up in prices of crude oil and products.

But average demand for the year of 75.6 million b/d didn't meet expectations of a year ago. At the end of 1999, EIA was projecting demand for all of 2000 at 77.1 million b/d.

OPEC production averaged 31 million b/d in 2000, compared with 29.4 million b/d in 1999. Non-OPEC production increased to 45.9 million b/d from 44.5 million b/d.

Inventories rose at the rate of 1.3 million b/d in 2000 after falling at a comparable rate in 1999.

At this time last year, OGJ projected that inventories would drop again in 2000-if the oil was available in storage and price patterns continued to encourage withdrawals. The predicted drawdown rate was what was necessary to balance supply and demand at projected levels. But there were doubts that enough oil remained in inventory to sustain it. By that time, stocks in industrialized countries were already low by historic standards. For other parts of the world, inventory data are sketchy or nonexistent.

As it turned out, the below-forecast demand and above-forecast production by OPEC balanced the market and allowed the restocking that began in the year's second quarter.

After a quota adjustment, OPEC's production increased to 30.7 million b/d in the second quarter of 2000 from 29.3 million b/d in the first quarter. Subsequent quota increases took the group's average output to 31.5 million b/d in the third quarter and 32.2 million b/d in the fourth quarter.

The average price of the OPEC basket of crudes increased through most of the year despite the quota adjustments. The monthly averages were $24.77/bbl for January, $29.17/bbl for June, and $31.80/bbl for September. Prices began to subside in the fourth quarter.